Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

For financial reporting to the IRS and other external users, manufacturing overhead costs are

(Multiple Choice)

4.9/5  (33)

(33)

Why is variable costing not in accordance with generally accepted accounting principles?

(Multiple Choice)

4.9/5  (39)

(39)

Variable costing has an advantage over absorption costing for which of the following purposes?

(Multiple Choice)

4.8/5  (37)

(37)

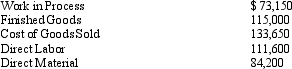

Denver Corporation The records of Denver Corporation revealed the following data for the current year.

Refer to Denver Corporation. Assume, for this question only, actual overhead is $98,700 and applied overhead is $93,250. Manufacturing overhead is:

Refer to Denver Corporation. Assume, for this question only, actual overhead is $98,700 and applied overhead is $93,250. Manufacturing overhead is:

(Multiple Choice)

4.7/5  (37)

(37)

When a relationship between one independent variable and one dependent variable is analyzed, the regression is referred to as ____________________.

(Short Answer)

4.8/5  (41)

(41)

Wilder Corporation wishes to develop a single predetermined overhead rate. The company's expected annual fixed overhead is $340,000 and its variable overhead cost per machine hour is $2. The company's relevant range is from 200,000 to 600,000 machine hours. Walton expects to operate at 425,000 machine hours for the coming year. The plant's theoretical capacity is 850,000. The predetermined overhead rate per machine hour should be

(Multiple Choice)

4.9/5  (28)

(28)

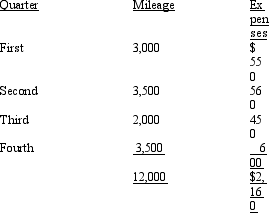

Wyman Company owns two luxury automobiles that are used by employees on company business. Mileage and expenses, excluding depreciation, by quarters for the most recent year are presented below:

Required: Determine the variable cost per mile (nearest tenth of a cent) and the fixed costs per quarter, using the method of least squares.

Required: Determine the variable cost per mile (nearest tenth of a cent) and the fixed costs per quarter, using the method of least squares.

(Essay)

4.9/5  (42)

(42)

The regression equation y = a+ bX assumes that the function is curvilinear in nature.

(True/False)

4.7/5  (42)

(42)

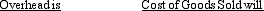

Actual overhead exceeds applied overhead and the amount is immaterial. Which of the following will be true? Upon closing,

(Multiple Choice)

4.8/5  (39)

(39)

What are the major differences between variable and absorption costing?

(Essay)

4.7/5  (34)

(34)

Bush Corporation The following information has been extracted from the financial records of Bush Corporation for its first year of operations:

Refer to Bush Corporation. Based on absorption costing, what amount of period costs will Bush Corporation deduct?

Refer to Bush Corporation. Based on absorption costing, what amount of period costs will Bush Corporation deduct?

(Multiple Choice)

4.8/5  (36)

(36)

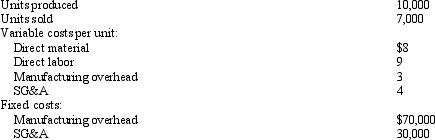

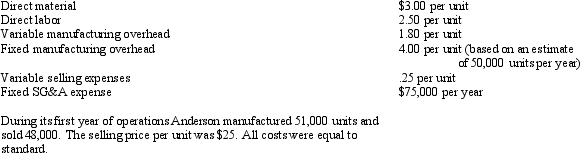

Anderson Corporation Anderson Corporation has the following standard costs associated with the manufacture and sale of one of its products:

Refer to Anderson Corporation. Based on variable costing, the income before income taxes for the year was

Refer to Anderson Corporation. Based on variable costing, the income before income taxes for the year was

(Multiple Choice)

4.7/5  (32)

(32)

A credit to the Factory Overhead account represents actual overhead costs.

(True/False)

4.8/5  (26)

(26)

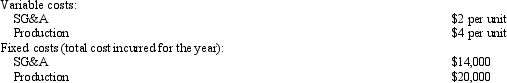

Oakwood Corporation Oakwood Corporation produces a single product. The following cost structure applied to its first year of operations:

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year. If Oakwood uses absorption costing, it would deduct period costs of

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year. If Oakwood uses absorption costing, it would deduct period costs of

(Multiple Choice)

4.9/5  (40)

(40)

Consider the following three product costing alternatives: process costing, job order costing, and standard costing. Which of these can be used in conjunction with absorption costing?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 141 - 160 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)