Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

The high-low method excludes outliers from the calculation of the slope of a regression line.

(True/False)

4.9/5  (34)

(34)

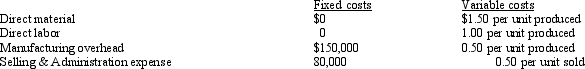

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. What is the net income under absorption costing?

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. What is the net income under absorption costing?

(Multiple Choice)

4.9/5  (42)

(42)

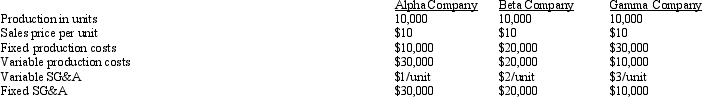

Alpha, Beta, and Gamma Companies Three new companies (Alpha, Beta, and Gamma) began operations on January 1 of the current year. Consider the following operating costs that were incurred by these companies during the complete calendar year:

Refer to Alpha, Beta, and Gamma Companies. Based on sales of 7,000 units, which company will report the greater income before income taxes if absorption costing is used?

Refer to Alpha, Beta, and Gamma Companies. Based on sales of 7,000 units, which company will report the greater income before income taxes if absorption costing is used?

(Multiple Choice)

4.8/5  (37)

(37)

In relationship to changes in activity, variable overhead changes

(Multiple Choice)

4.7/5  (45)

(45)

Under absorption costing, fixed manufacturing overhead could be found in all of the following except the

(Multiple Choice)

4.8/5  (40)

(40)

In a normal cost system, factory overhead is assigned to an overhead control account and then allocated to products and services.

(True/False)

4.9/5  (39)

(39)

A debit to the Factory Overhead account represents actual overhead costs.

(True/False)

4.8/5  (36)

(36)

A credit to the Factory Overhead account represents applied overhead costs.

(True/False)

4.9/5  (38)

(38)

An actual cost system differs from a normal cost system in that an actual cost system

(Multiple Choice)

4.8/5  (40)

(40)

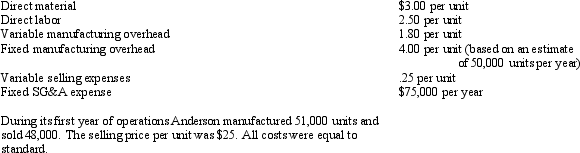

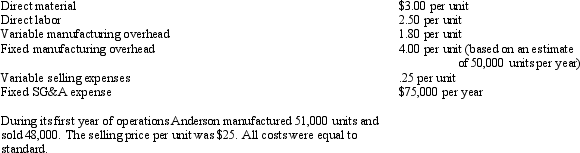

Anderson Corporation Anderson Corporation has the following standard costs associated with the manufacture and sale of one of its products:

Refer to Anderson Corporation. Under absorption costing, the standard production cost per unit for the current year was

Refer to Anderson Corporation. Under absorption costing, the standard production cost per unit for the current year was

(Multiple Choice)

4.8/5  (41)

(41)

What factor, related to manufacturing costs, causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing?

(Multiple Choice)

4.9/5  (26)

(26)

Anderson Corporation Anderson Corporation has the following standard costs associated with the manufacture and sale of one of its products:

Refer to Anderson Corporation. Under variable costing, the standard production cost per unit for the current year was

Refer to Anderson Corporation. Under variable costing, the standard production cost per unit for the current year was

(Multiple Choice)

4.8/5  (44)

(44)

The costing technique that treats all manufacturing costs as inventoriable is referred to as _________________ or ___________ costing.

or

(Short Answer)

4.8/5  (31)

(31)

The slope of a regression line is determined by dividing the change in total cost by the change in activity level.

(True/False)

4.9/5  (33)

(33)

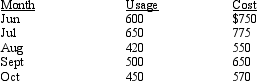

Wilson Corporation Wilson Corporation has the following data for use of its machinery

Refer to Wilson Corporation. Using the high-low method, compute the fixed cost element (to the nearest whole dollar).

Refer to Wilson Corporation. Using the high-low method, compute the fixed cost element (to the nearest whole dollar).

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following is not a reason to use predetermined overhead rates?

(Multiple Choice)

4.9/5  (36)

(36)

The variable costing format is often more useful to managers than the absorption costing format because

(Multiple Choice)

4.7/5  (31)

(31)

Showing 121 - 140 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)