Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

Drew Corporation is relocating its facilities. The company estimates that it will take three trucks to move office contents. If the per truck rental charge is $1,000 plus 25 cents per mile, what is the expected cost to move 800 miles?

(Multiple Choice)

4.9/5  (36)

(36)

Consider the regression equation y = a + bX. The portion of the equation that represents the activity base is __________.

(Short Answer)

4.8/5  (34)

(34)

The estimated maximum potential activity for a specified time is:

(Multiple Choice)

4.8/5  (33)

(33)

Practical capacity is the capacity that can be achieved during normal working hours.

(True/False)

4.7/5  (40)

(40)

Awesome Athletics, Inc. has developed a new design to produce hurdles that are used in track and field competition. The company's hurdle design is innovative in that the hurdle yields when hit by a runner and its height is extraordinarily easy to adjust. Management estimates expected annual capacity to be 90,000 units; overhead is applied using expected annual capacity. The company's cost accountant predicts the following current year activities and related costs:

Other than any possible under- or overapplied fixed overhead, management expects no variances from the previous manufacturing costs. Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Required:

Other than any possible under- or overapplied fixed overhead, management expects no variances from the previous manufacturing costs. Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Required:

(Essay)

4.7/5  (39)

(39)

Plantwide overhead rates provide a more accurate computation of factory overhead than departmental overhead rates

(Short Answer)

4.7/5  (43)

(43)

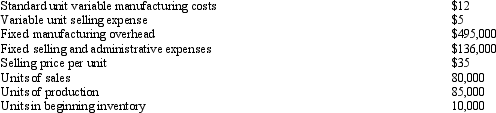

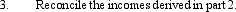

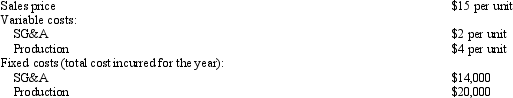

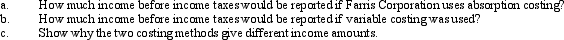

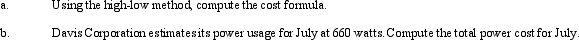

Farris Corporation produces a single product. The following is a cost structure applied to its first year of operations.

During the first year, Farris Corporation manufactured 5,000 units and sold 3,800. There was no beginning or ending work-in-process inventory.

During the first year, Farris Corporation manufactured 5,000 units and sold 3,800. There was no beginning or ending work-in-process inventory.

(Essay)

4.8/5  (38)

(38)

A master budget is a planning document that presents expected variable and fixed overhead costs at different activity levels.

(True/False)

4.8/5  (44)

(44)

The costing technique that treats fixed manufacturing overhead as a period cost is referred to as ______________ or ____________ costing.

or

(Short Answer)

4.9/5  (25)

(25)

A performance measure that is short-run in nature and represents a firm's anticipated activity level for the upcoming period is ____________________ capacity.

(Short Answer)

4.9/5  (36)

(36)

In an income statement prepared as an internal report using the variable costing method, fixed manufacturing overhead would

(Multiple Choice)

4.8/5  (29)

(29)

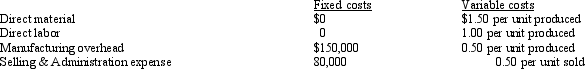

Oakwood Corporation Oakwood Corporation produces a single product. The following cost structure applied to its first year of operations:

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation manufactured 5,000 units and sold 4,000 in the current year. If Oakwood employs a costing system based on variable costs, the company would end the current year with a finished goods inventory of

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation manufactured 5,000 units and sold 4,000 in the current year. If Oakwood employs a costing system based on variable costs, the company would end the current year with a finished goods inventory of

(Multiple Choice)

4.9/5  (42)

(42)

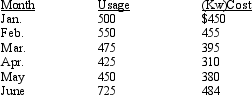

Davis Corporation has the following data relating to its power usage for the first six months of the current year.

Assume usage is within the relevant range of activity.

Required:

Assume usage is within the relevant range of activity.

Required:

(Essay)

4.8/5  (42)

(42)

Profit under absorption costing may differ from profit determined under variable costing. How is this difference calculated?

(Multiple Choice)

4.9/5  (42)

(42)

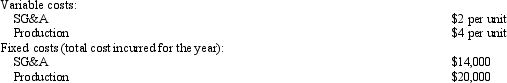

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. In presenting inventory on the balance sheet at December 31, the unit cost under absorption costing is

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. In presenting inventory on the balance sheet at December 31, the unit cost under absorption costing is

(Multiple Choice)

4.9/5  (37)

(37)

How can a company produce both variable and absorption costing information from a single accounting system?

(Essay)

4.8/5  (35)

(35)

An ending inventory valuation on an absorption costing balance sheet would

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)