Exam 6: Differential Analysis: the Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

Two products, QI and VH, emerge from a joint process. Product QI has been allocated $9,600 of the total joint costs of $12,000. A total of 9,000 units of product QI are produced from the joint process. Product QI can be sold at the split-off point for $13 per unit, or it can be processed further for an additional total cost of $54,000 and then sold for $18 per unit. If product QI is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

(Multiple Choice)

4.9/5  (45)

(45)

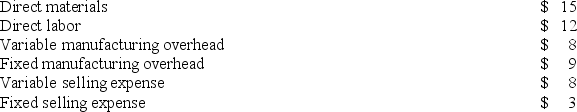

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

(Multiple Choice)

4.8/5  (33)

(33)

The split-off point in a process that produces joint products is the point in the manufacturing process at which the joint products can be recognized as separate products.

(True/False)

4.8/5  (39)

(39)

Showing 201 - 203 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)