Exam 6: Differential Analysis: the Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

Wallen Corporation is considering eliminating a department that has an annual contribution margin of $80,000 and $160,000 in annual fixed costs. Of the fixed costs, $90,000 cannot be avoided. The annual financial advantage (disadvantage) for the company of eliminating this department would be:

(Multiple Choice)

4.8/5  (35)

(35)

One way to increase the effective utilization of a bottleneck is to reduce the number of defective units.

(True/False)

4.9/5  (27)

(27)

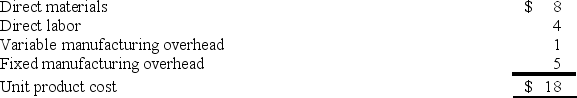

Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $18, computed as follows:  An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

(Multiple Choice)

4.8/5  (37)

(37)

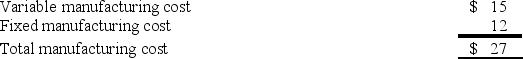

Gordon Corporation produces 1,000 units of a part per year which are used in the assembly of one of its products. The unit cost of producing these parts is:  The part can be purchased from an outside supplier at $20 per unit. If the part is purchased from the outside supplier, two thirds of the total fixed costs incurred in producing the part can be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

The part can be purchased from an outside supplier at $20 per unit. If the part is purchased from the outside supplier, two thirds of the total fixed costs incurred in producing the part can be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

(Multiple Choice)

4.9/5  (40)

(40)

A vertically integrated company is less dependent on its suppliers than a company that is not vertically integrated.

(True/False)

4.9/5  (35)

(35)

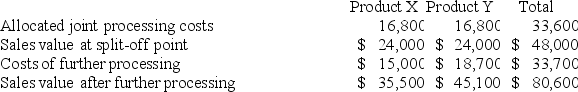

Dock Corporation makes two products from a common input. Joint processing costs up to the split-off point total $33,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:  What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

(Multiple Choice)

4.9/5  (32)

(32)

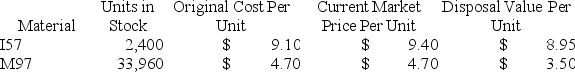

Munafo Corporation is a specialty component manufacturer with idle capacity. Management would like to use its extra capacity to generate additional profits. A potential customer has offered to buy 6,500 units of component VGI. Each unit of VGI requires 1 unit of material I57 and 5 units of material M97. Data concerning these two materials follow:  Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?

Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?

(Multiple Choice)

4.8/5  (31)

(31)

Paine Corporation processes sugar beets in batches that it purchases from farmers for $72 a batch. A batch of sugar beets costs $11 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $27 or processed further for $16 to make the end product industrial fiber that is sold for $40. The beet juice can be sold as is for $43 or processed further for $28 to make the end product refined sugar that is sold for $100. Which of the intermediate products should be processed further?

(Multiple Choice)

4.9/5  (45)

(45)

Elly Industries is a multi-product company that currently manufactures 30,000 units of part MR24 each month for use in production of its products. The facilities now being used to produce part MR24 have a fixed monthly cost of $150,000 and a capacity to produce 35,000 units per month. If Elly were to buy part MR24 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40% of their present amount. The variable production costs of Part MR24 are $11 per unit. If Elly industries is able to obtain part MR24 from an outside supplier at a purchase price of $10 per unit, the monthly financial advantage (disadvantage) of buying the part rather than making it would be:

(Multiple Choice)

4.9/5  (37)

(37)

When a company has a production constraint, total contribution margin will be maximized by emphasizing the products with the highest contribution margin per unit of the constrained resource.

(True/False)

4.7/5  (32)

(32)

Elly Industries is a multi-product company that currently manufactures 30,000 units of part MR24 each month for use in production of its products. The facilities now being used to produce part MR24 have a fixed monthly cost of $150,000 and a capacity to produce 35,000 units per month. If Elly were to buy part MR24 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40% of their present amount. The variable production costs of Part MR24 are $11 per unit. If Elly Industries continues to use 30,000 units of part MR24 each month, it would realize a financial advantage by purchasing this part from an outside supplier only if the supplier's unit price is less than:

(Multiple Choice)

4.8/5  (22)

(22)

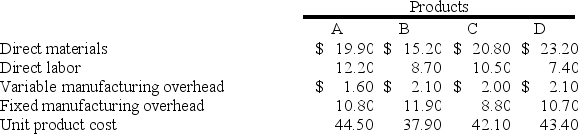

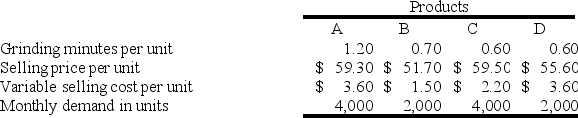

Bruce Corporation makes four products in a single facility. These products have the following unit product costs:  Additional data concerning these products are listed below.

Additional data concerning these products are listed below.

The grinding machines are potentially the constraint in the production facility. A total of 9,000 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Which product makes the LEAST profitable use of the grinding machines? (Round your intermediate calculations to 2 decimal places.)

The grinding machines are potentially the constraint in the production facility. A total of 9,000 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Which product makes the LEAST profitable use of the grinding machines? (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (39)

(39)

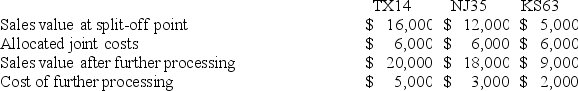

Faustina Chemical Corporation manufactures three chemicals (TX14, NJ35, and KS63) from a joint process. The three chemicals are in industrial grade form at the split-off point. They can either be sold at that point or processed further into premium grade. Costs related to each batch of this chemical process is as follows:  For which product(s) above would it be more profitable for Faustina to sell at the split-off point rather than process further?

For which product(s) above would it be more profitable for Faustina to sell at the split-off point rather than process further?

(Multiple Choice)

4.7/5  (35)

(35)

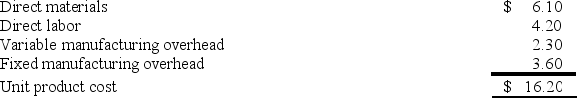

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each. Product A90's unit product cost is $16.20, determined as follows:  Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

(Multiple Choice)

4.9/5  (44)

(44)

The Freed Corporation produces three products, X, Y, Z, from a single raw material input. Product Y can be sold at the split-off point for total annual revenues of $50,000, or it can be processed further at a total annual cost of $16,000 and then sold for $68,000. Which of the following statements is true concerning Product Y?

(Multiple Choice)

4.9/5  (42)

(42)

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products. The company is presently producing Part X internally at a total cost of $100,000, computed as follows:

Direct materials \ 15,000 Direct labor 30,000 Variable manufacturing overhead 10,000 Fixed manufacturing overhead 45,000 Total costs \ 100,000 An outside supplier has offered to provide Part X at a price of $18 per unit. If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated. Assume that direct labor is a variable cost.

Required:

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

(Essay)

4.9/5  (39)

(39)

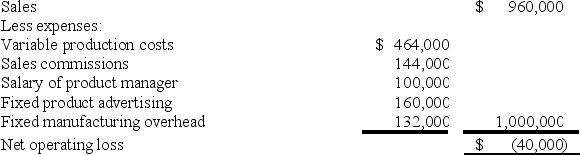

Balser Corporation manufactures and sells a number of products, including a product called JYMP. Results for last year for the manufacture and sale of JYMPs are as follows:  Balser is trying to decide whether to discontinue the manufacture and sale of JYMPs. All expenses other than fixed manufacturing overhead are avoidable if the product is dropped. None of the fixed manufacturing overhead is avoidable.

Assume that dropping Product JYMP would result in a $90,000 increase in the contribution margin of other products. If Balser chooses to discontinue JYMP, the annual financial advantage (disadvantage) of eliminating this product should be:

Balser is trying to decide whether to discontinue the manufacture and sale of JYMPs. All expenses other than fixed manufacturing overhead are avoidable if the product is dropped. None of the fixed manufacturing overhead is avoidable.

Assume that dropping Product JYMP would result in a $90,000 increase in the contribution margin of other products. If Balser chooses to discontinue JYMP, the annual financial advantage (disadvantage) of eliminating this product should be:

(Multiple Choice)

4.8/5  (41)

(41)

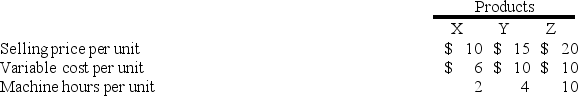

Marley Corporation makes three products (X, Y, & Z) with the following characteristics:  The company has a capacity of 2,000 machine hours, but there is virtually unlimited demand for each product. In order to maximize total contribution margin, how many units of each product should the company produce?

The company has a capacity of 2,000 machine hours, but there is virtually unlimited demand for each product. In order to maximize total contribution margin, how many units of each product should the company produce?

(Multiple Choice)

4.8/5  (39)

(39)

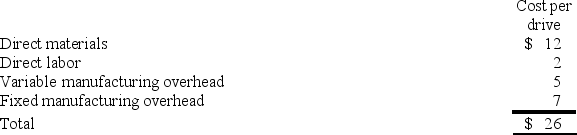

Zouar Computer Corporation currently manufactures the disk drives that it uses in its computers. The costs to produce 5,000 of these disk drives last year were as follows:  Kidal Electronics has offered to provide Zouar with all of its disk drive needs for $27 per drive. If Zouar accepts this offer, Zouar will be able to use the freed up space to generate an additional $40,000 of income each year to produce more of its computer keyboards. Only $3 per drive of the fixed manufacturing overhead cost above could be avoided. Direct labor is an avoidable cost in this decision. Based on this information, would Zouar be financially better off making the drives or buying the drives and by how much?

Kidal Electronics has offered to provide Zouar with all of its disk drive needs for $27 per drive. If Zouar accepts this offer, Zouar will be able to use the freed up space to generate an additional $40,000 of income each year to produce more of its computer keyboards. Only $3 per drive of the fixed manufacturing overhead cost above could be avoided. Direct labor is an avoidable cost in this decision. Based on this information, would Zouar be financially better off making the drives or buying the drives and by how much?

(Multiple Choice)

4.9/5  (37)

(37)

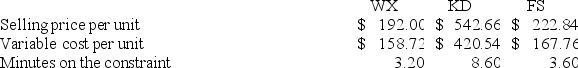

The constraint at Rauchwerger Corporation is time on a particular machine. The company makes three products that use this machine. Data concerning those products appear below:  Assume that sufficient time is available on the constrained machine to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource? (Round your intermediate calculations to 2 decimal places.)

Assume that sufficient time is available on the constrained machine to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource? (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

5.0/5  (38)

(38)

Showing 61 - 80 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)