Exam 6: Differential Analysis: the Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

The Anaconda Mining Company currently is operating at less than 50 percent of practical capacity. The management of the company expects sales to drop below the present level of 15,000 tons of ore per month very soon. The selling price per ton of ore is $2 and the variable cost per ton is $1. Fixed costs per month total $15,000.

Management is concerned that a further drop in sales volume will generate a loss and, accordingly, is considering the temporary suspension of operations until demand in the metals markets returns to normal levels and prices rebound. Management has implemented a cost reduction program over the past year that has been successful in reducing costs. Nevertheless, suspension of operations appears to be the only viable alternative. Management estimates that suspension of operations would reduce fixed costs from $15,000 to $5,000 per month.

Required:

a. Why does management estimate that fixed costs will persist at $5,000 per month even though the mine is temporarily closed?

b. At what sales volume should management suspend operations at the mine?

(Essay)

4.8/5  (43)

(43)

Juliani Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 50,000 units per month is as follows:

Direct materials \ 32.50 Direct labor \ 7.20 Variable manufacturing overhead \ 1.30 Fixed manufacturing overhead \ 20.90 Variable selling \& administrative expense \ 1.90 Fixed selling \& administrative expense \ 7.30 The normal selling price of the product is $75.00 per unit.

An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $0.30 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

Required:

a. Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $65.60 per unit. What is the financial advantage (disadvantage) for the company next month if it accepts the special order?

b. Suppose the company is already operating at capacity when the special order is received from the overseas customer. What would be the opportunity cost of each unit delivered to the overseas customer?

c. Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1,000 units for regular customers. What would be the minimum acceptable price per unit for the special order?

(Essay)

4.8/5  (35)

(35)

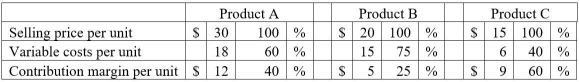

Holden Corporation produces three products, with costs and selling prices as follows:  A particular machine is the bottleneck. On that machine, 3 machine hours are required to produce each unit of Product A, 1 hour is required to produce each unit of Product B, and 2 hours are required to produce each unit of Product C. Rank the products from the most profitable to the least profitable use of the constrained resource (bottleneck). (Round your intermediate calculations to 2 decimal places.)

A particular machine is the bottleneck. On that machine, 3 machine hours are required to produce each unit of Product A, 1 hour is required to produce each unit of Product B, and 2 hours are required to produce each unit of Product C. Rank the products from the most profitable to the least profitable use of the constrained resource (bottleneck). (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (34)

(34)

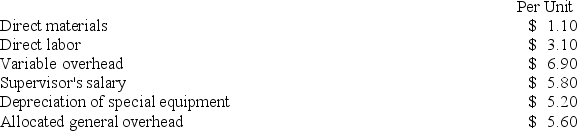

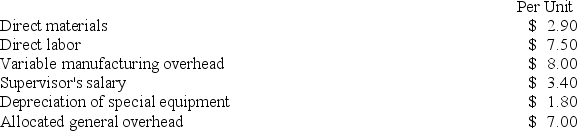

Penagos Corporation is presently making part Z43 that is used in one of its products. A total of 5,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.

In addition to the facts given above, assume that the space used to produce part Z43 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the annual financial advantage (disadvantage) of buying part Z43 from the outside supplier and using the freed space to make more of the other product?

An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.

In addition to the facts given above, assume that the space used to produce part Z43 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the annual financial advantage (disadvantage) of buying part Z43 from the outside supplier and using the freed space to make more of the other product?

(Multiple Choice)

4.9/5  (39)

(39)

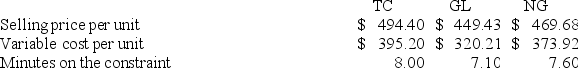

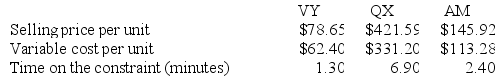

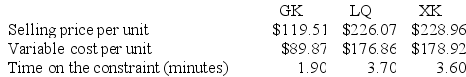

Bertucci Corporation makes three products that use the current constraint which is a particular type of machine. Data concerning those products appear below:  Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource? (Round your intermediate calculations to 2 decimal places.)

Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource? (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (41)

(41)

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 7,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

(Multiple Choice)

4.7/5  (36)

(36)

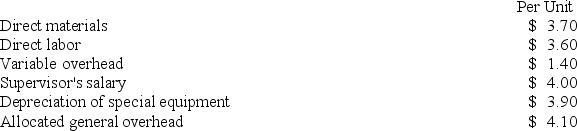

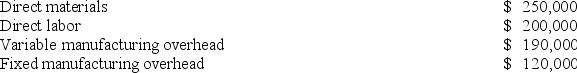

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:  Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

(Multiple Choice)

4.9/5  (34)

(34)

Mae Refiners, Inc., processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $60 to buy from farmers and $13 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for $29 or processed further for $13 to make the end product industrial fiber that is sold for $61. The cane juice can be sold as is for $40 or processed further for $28 to make the end product molasses that is sold for $67. Which of the intermediate products should be processed further?

(Multiple Choice)

4.8/5  (38)

(38)

The constraint at Dreyfus Inc. is an expensive milling machine. The three products listed below use this constrained resource.

Required:

a. Rank the products in order of their current profitability from the most profitable to the least profitable. In other words, rank the products in the order in which they should be emphasized. Show your work!

b. Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource?

Required:

a. Rank the products in order of their current profitability from the most profitable to the least profitable. In other words, rank the products in the order in which they should be emphasized. Show your work!

b. Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource?

(Essay)

4.9/5  (33)

(33)

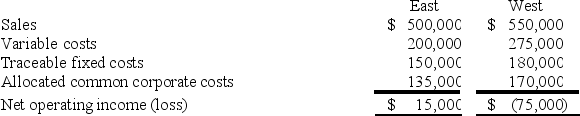

The Cook Corporation has two divisions--East and West. The divisions have the following revenues and expenses:  The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

(Multiple Choice)

4.8/5  (33)

(33)

Prosner Corp. manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $500,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:

Further Sales Value Sales Value at Processing After Further Split-Off Costs Processing Product D \ 300,000 \ 125,000 \ 534,000 Product F \ 275,000 \ 210,000 \ 450,000 Product G \ 195,000 \ 135,000 \ 360,000 Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

(Essay)

4.9/5  (36)

(36)

Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $53 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $18 to make the end product industrial fiber that is sold for $39. The beet juice can be sold as is for $32 or processed further for $28 to make the end product refined sugar that is sold for $79. What is the financial advantage (disadvantage) for the company from processing one batch of sugar beets into the end products industrial fiber and refined sugar rather than not processing that batch at all?

(Multiple Choice)

4.7/5  (31)

(31)

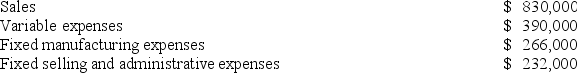

The management of Bonga Corporation is considering dropping product D74F. Data from the company's accounting system for this product for last year appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

According to the company's accounting system, what is the net operating income earned by product D74F? Include all costs in this calculation-whether relevant or not.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

According to the company's accounting system, what is the net operating income earned by product D74F? Include all costs in this calculation-whether relevant or not.

(Multiple Choice)

4.8/5  (34)

(34)

Brissett Corporation makes three products that use the current constraint, which is a particular type of machine. Data concerning those products appear below:

Required:

a. Rank the products in order of their current profitability from the most profitable to the least profitable. In other words, rank the products in the order in which they should be emphasized. Show your work!

b. Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource?

Required:

a. Rank the products in order of their current profitability from the most profitable to the least profitable. In other words, rank the products in the order in which they should be emphasized. Show your work!

b. Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource?

(Essay)

4.9/5  (35)

(35)

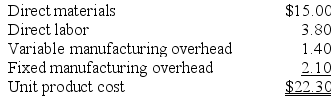

Wehrs Corporation has received a request for a special order of 6,000 units of product K19 for $32.30 each. The normal selling price of this product is $33.45 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $4.90 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $4.90 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

(Essay)

4.7/5  (41)

(41)

Kahn Corporation (a multi-product company) produces and sells 8,000 units of Product X each year. Each unit of Product X sells for $10 and has a contribution margin of $6. If Product X is discontinued, $50,000 of the $60,000 in annual fixed costs charged to Product X could be eliminated. The annual financial advantage (disadvantage) for the company of eliminating this product should be:

(Multiple Choice)

4.8/5  (37)

(37)

Part U16 is used by Mcvean Corporation to make one of its products. A total of 13,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

(Multiple Choice)

4.9/5  (37)

(37)

Vannorman Corporation processes sugar beets in batches. A batch of sugar beets costs $78 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $16 to make the end product industrial fiber that is sold for $57. The beet juice can be sold as is for $39 or processed further for $22 to make the end product refined sugar that is sold for $84. How much profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar rather than not processing that batch at all?

(Multiple Choice)

4.9/5  (41)

(41)

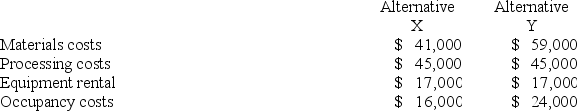

Two alternatives, code-named X and Y, are under consideration at Guyer Corporation. Costs associated with the alternatives are listed below.  What is the financial advantage (disadvantage) of Alternative Y over Alternative X?

What is the financial advantage (disadvantage) of Alternative Y over Alternative X?

(Multiple Choice)

5.0/5  (43)

(43)

Showing 81 - 100 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)