Exam 22: Accounting Changes and Error Analysis

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

On January 1, 2012, Lake Co. purchased a machine for $1,320,000 and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value. On January 1, 2015, Lake determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of $120,000. An accounting change was made in 2015 to reflect these additional data. The accumulated depreciation for this machine should have a balance at December 31, 2015 of

(Multiple Choice)

4.8/5  (36)

(36)

Use the following information for questions 53 and 54.

Swift Company purchased a machine on January 1, 2012, for $600,000. At the date of acquisition, the machine had an estimated useful life of six years with no salvage. The machine is being depreciated on a straight-line basis. On January 1, 2015, Swift determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no salvage. An accounting change was made in 2015 to reflect this additional information.

-Assume that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate was 30% in 2012, 2013, 2014, and 2015. What should be reported in Swift's income statement for the year ended December 31, 2015, as the cumulative effect on prior years of changing the estimated useful life of the machine?

(Multiple Choice)

4.8/5  (27)

(27)

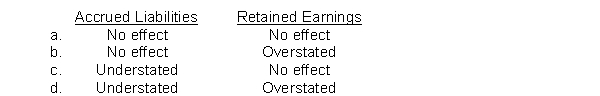

On December 31, 2015, special insurance costs, incurred but unpaid, were not recorded. If these insurance costs were related to work in process, what is the effect of the omission on accrued liabilities and retained earnings in the December 31, 2015 balance sheet?

(Short Answer)

4.7/5  (45)

(45)

Showing 101 - 103 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)