Exam 22: Accounting Changes and Error Analysis

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

Use the following information for questions 44 and 45.

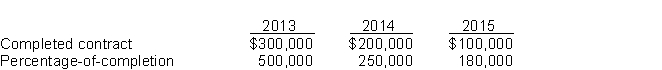

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

Income before taxes under both the methods for the past three years appears below.  -What amount will be debited to Construction in Process account, to record the change at beginning of 2015?

-What amount will be debited to Construction in Process account, to record the change at beginning of 2015?

(Multiple Choice)

4.9/5  (44)

(44)

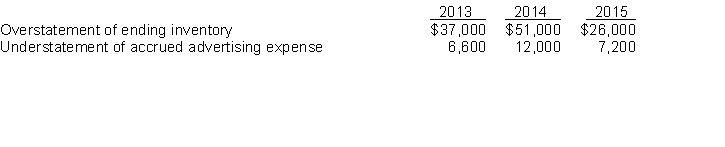

Vance Company reported net incomes for a three-year period as follows:2013, $191,000; 2014, $199,000; 2015, $180,000.In reviewing the accounts in 2016 after the books for the prior year have been closed, you find that the following errors have been made in summarizing activities:  Instructions

(a) Determine corrected net incomes for 2013, 2014, and 2015.

(b) Give the entry to bring the books of the company up to date in 2016, assuming that the books have been closed for 2015.

Instructions

(a) Determine corrected net incomes for 2013, 2014, and 2015.

(b) Give the entry to bring the books of the company up to date in 2016, assuming that the books have been closed for 2015.

(Essay)

4.8/5  (33)

(33)

Companies report changes in accounting estimates retrospectively.

(True/False)

4.9/5  (42)

(42)

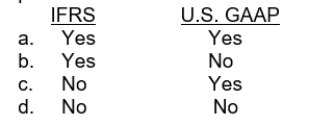

Is the following exception applicable to IFRS or U.S. GAAP?"If determining the effect of a change in accounting principle is considered impracticable, then a company should report the effect of the change in the period in which it believes it practicable to do so."

(Short Answer)

4.8/5  (37)

(37)

A company changes from percentage-of-completion to completed-contract method, which is used for tax purposes. The entry to record this change should include a

(Multiple Choice)

4.9/5  (42)

(42)

On December 31, 2015, Grantham, Inc. appropriately changed its inventory valuation method to FIFO cost from weighted-average cost for financial statement and income tax purposes. The change will result in a $2,500,000 increase in the beginning inventory at January 1, 2015. Assume a 30% income tax rate. The cumulative effect of this accounting change on beginning retained earnings is

(Multiple Choice)

4.7/5  (47)

(47)

Detailed guidance regarding the accounting and reporting for the indirect effects of changes in accounting principle is available under

(Multiple Choice)

5.0/5  (38)

(38)

Match disclosures to situations.In the blank to the left of each question, fill in the letter from the following list which best describes the presentation of the item on the financial statements of Helton Corporation for 2015.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (41)

(41)

When a company changes an accounting principle, it should report the change by reporting the cumulative effect of the change in the current year's income statement.

(True/False)

4.9/5  (43)

(43)

Adoption of a new principle in recognition of events that have occurred for the first time or that were previously immaterial is treated as an accounting change.

(True/False)

4.8/5  (37)

(37)

Use the following information for questions 64 and 65.

Link Co. purchased machinery that cost $1,800,000 on January 4, 2013. The entire cost was recorded as an expense. The machinery has a nine-year life and a $120,000 residual value. The error was discovered on December 20, 2015. Ignore income tax considerations.

-Before the correction was made, and before the books were closed on December 31, 2015, retained earnings was understated by

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following is not accounted for a change in accounting principle?

(Multiple Choice)

4.7/5  (31)

(31)

The estimated life of a building that has been depreciated for 30 years of an originally estimated life of 50 years has been revised to a remaining life of 10 years. Based on this information, the accountant should

(Multiple Choice)

4.8/5  (38)

(38)

During 2014, a textbook written by Mercer Co. personnel was sold to Roark Publishing, Inc., for royalties of 10% on sales. Royalties are receivable semiannually on March 31, for sales in July through December of the prior year, and on September 30, for sales in January through June of the same year.

Royalty income of $162,000 was accrued at 12/31/14 for the period July-December 2014.

Royalty income of $180,000 was received on 3/31/15, and $234,000 on 9/30/15.

Mercer learned from Roark that sales subject to royalty were estimated at $3,240,000 for the last half of 2015.In its income statement for 2015, Mercer should report royalty income at

(Multiple Choice)

4.8/5  (32)

(32)

Companies account for a change in depreciation methods as a change in accounting principle.

(True/False)

4.8/5  (43)

(43)

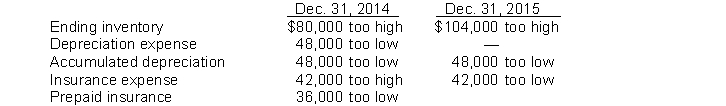

Joseph Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 contained the following errors:  In addition, on December 26, 2015 fully depreciated equipment was sold for $48,000, but the sale was not recorded until 2016. No corrections have been made for any of the errors.

InstructionsIgnoring income taxes, show your calculation of the total effect of the errors on 2015 net income.

In addition, on December 26, 2015 fully depreciated equipment was sold for $48,000, but the sale was not recorded until 2016. No corrections have been made for any of the errors.

InstructionsIgnoring income taxes, show your calculation of the total effect of the errors on 2015 net income.

(Essay)

4.9/5  (39)

(39)

Presenting consolidated financial statements this year when statements of individual companies were presented last year is

(Multiple Choice)

4.9/5  (42)

(42)

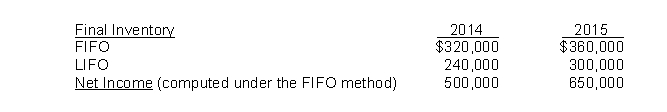

Lanier Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

(Multiple Choice)

4.8/5  (38)

(38)

Use the following information for questions 47 and 48.

On January 1, 2012, Nobel Corporation acquired machinery at a cost of $1,200,000. Nobel adopted the straight-line method of depreciation for this machine and had been recording depreciation over an estimated life of ten years, with no residual value. At the beginning of 2015, a decision was made to change to the double-declining balance method of depreciation for this machine.

-Assuming a 30% tax rate, the cumulative effect of this accounting change on beginning retained earnings, is

(Multiple Choice)

4.7/5  (32)

(32)

IFRS requires that changes in estimate be accounted for using the retrospective method.

(True/False)

5.0/5  (33)

(33)

Showing 21 - 40 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)