Exam 20: Incremental Analysis

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

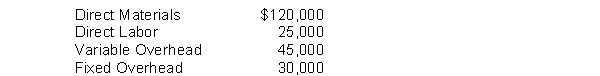

Tex's Manufacturing Company can make 100 units of a necessary component part with the following costs:  If Tex's Manufacturing Company can purchase the component externally for $190,000 and only $5,000 of the fixed costs can be avoided, what is the correct make-or-buy decision?

If Tex's Manufacturing Company can purchase the component externally for $190,000 and only $5,000 of the fixed costs can be avoided, what is the correct make-or-buy decision?

(Multiple Choice)

4.8/5  (34)

(34)

A company is within plant capacity. It is contemplating whether a special order should be accepted. The order will not impact regular sales. If the company accepts the special order, what will occur?

(Multiple Choice)

4.8/5  (35)

(35)

All of the following are relevant in deciding whether to eliminate an unprofitable segment except the segment's

(Multiple Choice)

4.8/5  (32)

(32)

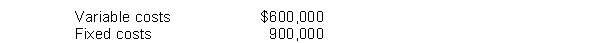

Sandusky Inc. has the following costs when producing 100,000 units:  An outside supplier is interested in producing the item for Sandusky. If the item is produced outside, Sandusky could use the released production facilities to make another item that would generate $150,000 of net income. At what unit price would Sandusky accept the outside supplier's offer if Sandusky wanted to increase net income by $120,000?

An outside supplier is interested in producing the item for Sandusky. If the item is produced outside, Sandusky could use the released production facilities to make another item that would generate $150,000 of net income. At what unit price would Sandusky accept the outside supplier's offer if Sandusky wanted to increase net income by $120,000?

(Multiple Choice)

4.9/5  (35)

(35)

Accounting's contribution to the decision-making process occurs in all of the following steps except to

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following is relevant information in a decision whether old equipment presently being used should be replaced by new equipment?

(Multiple Choice)

4.8/5  (39)

(39)

A company decided to replace an old machine with a new machine. Which of the following is considered a relevant cost?

(Multiple Choice)

4.9/5  (34)

(34)

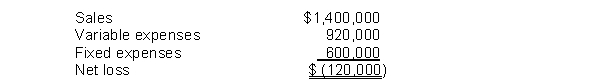

Corn Crunchers has three product lines. Its only unprofitable line is Corn Nuts, the results of which appear below for 2013:  If this product line is eliminated, 30% of the fixed expenses can be eliminated. How much are the relevant costs in the decision to eliminate this product line?

If this product line is eliminated, 30% of the fixed expenses can be eliminated. How much are the relevant costs in the decision to eliminate this product line?

(Multiple Choice)

4.9/5  (46)

(46)

Financial data are developed for a course of action under an incremental basis and then compared to data developed under a differential basis before a decision is made.

(True/False)

4.9/5  (39)

(39)

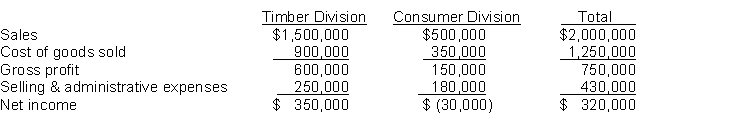

Trump Forest Corporation operates two divisions, the Timber Division and the Consumer Division. The Timber Division manufactures and sells logs to paper manufacturers. The Consumer Division operates retail lumber mills which sell a variety of products in the do-it-yourself homeowner market. The company is considering disposing of the Consumer Division since it has been consistently unprofitable for a number of years. The income statements for the two divisions for the year ended December 31, 2016 are presented below:  In the Consumer Division, 70% of the cost of goods sold are variable costs and 35% of selling and administrative expenses are variable costs. The management of the company feels it can save $45,000 of fixed cost of goods sold and $50,000 of fixed selling expenses if it discontinues operation of the Consumer Division.

Instructions

(a) Determine whether the company should discontinue operating the Consumer Division.

(b) If the company had discontinued the division for 2016, determine what net income would have been.

In the Consumer Division, 70% of the cost of goods sold are variable costs and 35% of selling and administrative expenses are variable costs. The management of the company feels it can save $45,000 of fixed cost of goods sold and $50,000 of fixed selling expenses if it discontinues operation of the Consumer Division.

Instructions

(a) Determine whether the company should discontinue operating the Consumer Division.

(b) If the company had discontinued the division for 2016, determine what net income would have been.

(Essay)

4.8/5  (26)

(26)

Decision-making involves choosing among alternative courses of action.

(True/False)

4.8/5  (38)

(38)

It is better not to replace old equipment if it is not fully depreciated.

(True/False)

4.9/5  (34)

(34)

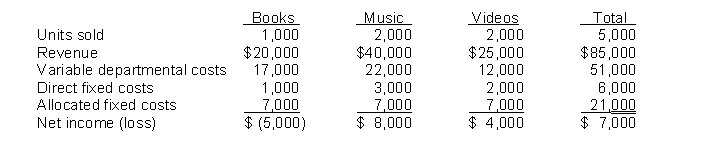

Mercer has three product lines in its retail stores: books, videos, and music. Results of the fourth quarter are presented below:  The allocated fixed costs are unavoidable. Demand of individual products are not affected by changes in other product lines.

Instructions

What will happen to profits if Mercer discontinues the Books product line?

The allocated fixed costs are unavoidable. Demand of individual products are not affected by changes in other product lines.

Instructions

What will happen to profits if Mercer discontinues the Books product line?

(Essay)

5.0/5  (39)

(39)

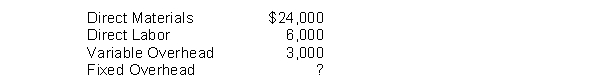

Bell's Shop can make 1,000 units of a necessary component with the following costs:  The company can purchase the 1,000 units externally for $39,000. The unavoidable fixed costs are $2,000 if the units are purchased externally. An analysis shows that at this external price, the company is indifferent between making or buying the part. What are the fixed overhead costs of making the component?

The company can purchase the 1,000 units externally for $39,000. The unavoidable fixed costs are $2,000 if the units are purchased externally. An analysis shows that at this external price, the company is indifferent between making or buying the part. What are the fixed overhead costs of making the component?

(Multiple Choice)

4.9/5  (41)

(41)

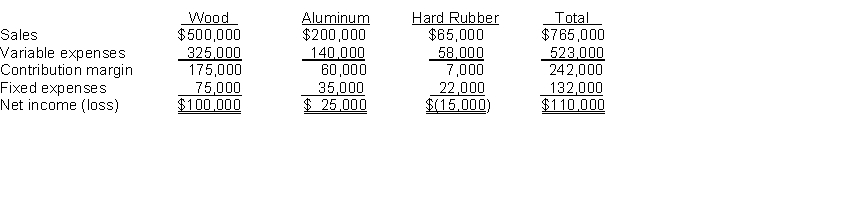

Abel Company produces three versions of baseball bats: wood, aluminum, and hard rubber. A condensed segmented income statement for a recent period follows:  Assume all of the fixed expenses for the hard rubber line are avoidable. What will be total net income if the line is dropped?

Assume all of the fixed expenses for the hard rubber line are avoidable. What will be total net income if the line is dropped?

(Multiple Choice)

4.9/5  (33)

(33)

Many of the decisions involving incremental analysis have qualitative features, but since they are not easily measured they should be ignored.

(True/False)

4.7/5  (41)

(41)

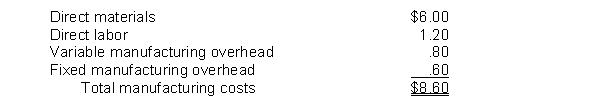

Spencer Chemical Corporation produces an oil-based chemical product which it sells to paint manufacturers. In 2016, the company incurred $344,000 of costs to produce 40,000 gallons of the chemical. The selling price of the chemical is $12.00 per gallon. The costs per unit to manufacture a gallon of the chemical are presented below:  The company is considering manufacturing the paint itself. If the company processes the chemical further and manufactures the paint itself, the following additional costs per gallon will be incurred: Direct materials $1.70, Direct labor $.60, Variable manufacturing overhead $.50. No increase in fixed manufacturing overhead is expected. The company can sell the paint at $15.50 per gallon.

Instructions

Determine the incremental per gallon increase in net income and the total increase in net income if the company manufactures the paint.

The company is considering manufacturing the paint itself. If the company processes the chemical further and manufactures the paint itself, the following additional costs per gallon will be incurred: Direct materials $1.70, Direct labor $.60, Variable manufacturing overhead $.50. No increase in fixed manufacturing overhead is expected. The company can sell the paint at $15.50 per gallon.

Instructions

Determine the incremental per gallon increase in net income and the total increase in net income if the company manufactures the paint.

(Essay)

4.9/5  (38)

(38)

If an incremental make or buy analysis indicates that it is cheaper to buy rather than make an item, management should always make the decision to choose the lowest cost alternative.

(True/False)

4.8/5  (35)

(35)

The basic decision rule in a sell or process further decision is: process further if the incremental revenue from processing exceeds the incremental processing costs.

(True/False)

4.8/5  (35)

(35)

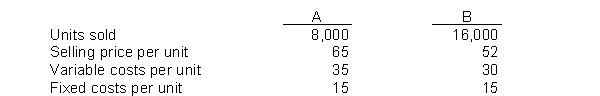

Roland Company operates a small factory in which it manufactures two products: A and B. Production and sales result for last year were as follow:  For purposes of simplicity, the firm allocates total fixed costs over the total number of units of A and B produced and sold.

The research department has developed a new product (C) as a replacement for product B. Market studies show that Roland Company could sell 11,000 units of C next year at a price of $80, the variable costs per unit of C are $39. The introduction of product C will lead to a 10% increase in demand for product A and discontinuation of product B. If the company does not introduce the new product, it expects next year's result to be the same as last year's.

Instructions

Should Roland Company introduce product C next year? Explain why or why not. Show calculations to support your decision.

For purposes of simplicity, the firm allocates total fixed costs over the total number of units of A and B produced and sold.

The research department has developed a new product (C) as a replacement for product B. Market studies show that Roland Company could sell 11,000 units of C next year at a price of $80, the variable costs per unit of C are $39. The introduction of product C will lead to a 10% increase in demand for product A and discontinuation of product B. If the company does not introduce the new product, it expects next year's result to be the same as last year's.

Instructions

Should Roland Company introduce product C next year? Explain why or why not. Show calculations to support your decision.

(Essay)

4.8/5  (32)

(32)

Showing 21 - 40 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)