Exam 20: Incremental Analysis

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

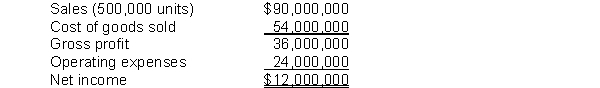

Carney Company manufactures cappuccino makers. For the first eight months of 2013, the company reported the following operating results while operating at 80% of plant capacity:  An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit.

In September, Carney Company receives a special order for 40,000 machines at $135 each from a major coffee shop franchise. Acceptance of the order would result in $10,000 of shipping costs but no increase in fixed expenses.

Instructions

(a) Prepare an incremental analysis for the special order.

(b) Should Carney Company accept the special order? Justify your answer.

An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit.

In September, Carney Company receives a special order for 40,000 machines at $135 each from a major coffee shop franchise. Acceptance of the order would result in $10,000 of shipping costs but no increase in fixed expenses.

Instructions

(a) Prepare an incremental analysis for the special order.

(b) Should Carney Company accept the special order? Justify your answer.

(Essay)

4.7/5  (29)

(29)

Use the following information for questions .

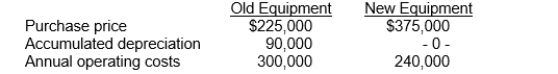

Chung Inc. is considering the replacement of a piece of equipment with a newer model. The following data has been collected:  If the old equipment is replaced now, it can be sold for $60,000. Both the old equipment's remaining useful life and the new equipment's useful life is 5 years.

-Which of the following amounts is irrelevant to the replacement decision?

If the old equipment is replaced now, it can be sold for $60,000. Both the old equipment's remaining useful life and the new equipment's useful life is 5 years.

-Which of the following amounts is irrelevant to the replacement decision?

(Multiple Choice)

4.7/5  (33)

(33)

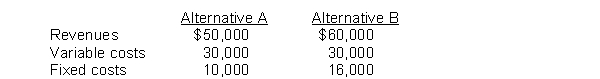

Alvarez Company is considering the following alternatives:  What is the incremental profit?

What is the incremental profit?

(Multiple Choice)

4.9/5  (27)

(27)

In an equipment replacement decision, the cost of the old equipment is a(n)

(Multiple Choice)

4.7/5  (32)

(32)

What will most likely occur if a company eliminates an unprofitable segment when a portion of fixed costs are unavoidable?

(Multiple Choice)

4.9/5  (34)

(34)

A special one-time order should never be accepted if the unit sales price is less than the unit variable cost.

(True/False)

4.9/5  (44)

(44)

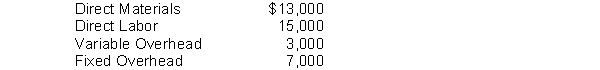

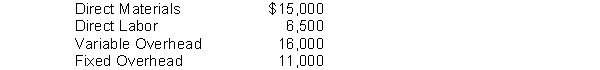

Crigui Music produces 60,000 CDs on which to record music. The CDs have the following costs:  None of Crigui's fixed overhead costs can be reduced, but another product could be made that would increase profit contribution by $4,000 if the CDs were acquired externally. If cost minimization is the major consideration and the company would prefer to buy the CDs, what is the maximum external price that Crigui would be willing to accept to acquire the 60,000 units externally?

None of Crigui's fixed overhead costs can be reduced, but another product could be made that would increase profit contribution by $4,000 if the CDs were acquired externally. If cost minimization is the major consideration and the company would prefer to buy the CDs, what is the maximum external price that Crigui would be willing to accept to acquire the 60,000 units externally?

(Multiple Choice)

4.7/5  (40)

(40)

If a company is operating at full capacity, the incremental costs of a special order will likely include fixed manufacturing costs.

(True/False)

4.9/5  (41)

(41)

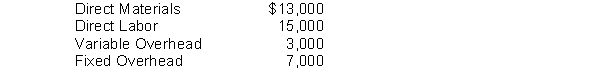

Fornelli, Inc. can produce 100 units of a component part with the following costs:  If Fornelli, Inc. can purchase the units externally for $40,000, by what amount will its total costs change?

If Fornelli, Inc. can purchase the units externally for $40,000, by what amount will its total costs change?

(Multiple Choice)

4.8/5  (37)

(37)

Eddy Company is starting business and is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $60 and Eddy Company would sell it for $135. The cost to assemble the product is estimated at $27 per unit and Eddy Company believes the market would support a price of $174 on the assembled unit. What is the correct decision using the sell or process further decision rule?

(Multiple Choice)

4.9/5  (43)

(43)

Crigui Music produces 60,000 CDs on which to record music. The CDs have the following costs:  Crigui could avoid $4,000 in fixed overhead costs if it acquires the CDs externally. If cost minimization is the major consideration and the company would prefer to buy the 60,000 units externally, what is the maximum external price that Crigui would expect to pay for the units?

Crigui could avoid $4,000 in fixed overhead costs if it acquires the CDs externally. If cost minimization is the major consideration and the company would prefer to buy the 60,000 units externally, what is the maximum external price that Crigui would expect to pay for the units?

(Multiple Choice)

4.8/5  (40)

(40)

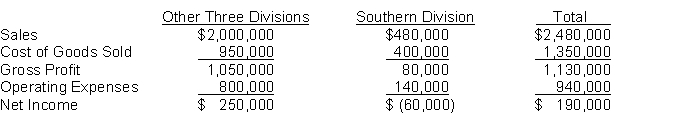

A recent accounting graduate from Marvel State University evaluated the operating performance of Fanning Company's four divisions. The following presentation was made to Fanning's Board of Directors. During the presentation, the accountant made the recommendation to eliminate the Southern Division stating that total net income would increase by $60,000. (See analysis below.)  For the other divisions, cost of goods sold is 80% variable and operating expenses are 70% variable. The cost of goods sold for the Southern Division is 30% fixed, and its operating expenses are 75% fixed. If the division is eliminated, only $15,000 of the fixed operating costs will be eliminated.

Instructions

Do you concur with the new accountant's recommendation? Present a schedule to support your answer.

For the other divisions, cost of goods sold is 80% variable and operating expenses are 70% variable. The cost of goods sold for the Southern Division is 30% fixed, and its operating expenses are 75% fixed. If the division is eliminated, only $15,000 of the fixed operating costs will be eliminated.

Instructions

Do you concur with the new accountant's recommendation? Present a schedule to support your answer.

(Essay)

4.9/5  (39)

(39)

It costs Garner Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 3,000 scales at $15 each. Garner would incur special shipping costs of $1 per scale if the order were accepted. Garner has sufficient unused capacity to produce the 3,000 scales. If the special order is accepted, what will be the effect on net income?

(Multiple Choice)

4.8/5  (31)

(31)

The process used to identify the financial data that change under alternative courses of action is called allocation of limited resources.

(True/False)

4.8/5  (45)

(45)

A company is considering replacing old equipment with new equipment. Which of the following is a relevant cost for incremental analysis?

(Multiple Choice)

4.7/5  (42)

(42)

In deciding on the future status of an unprofitable segment, management should recognize that net income could decrease by eliminating the unprofitable segment.

(True/False)

4.8/5  (30)

(30)

The opportunity cost of an alternate course of action that is relevant to a make-or-buy decision is

(Multiple Choice)

4.9/5  (29)

(29)

Showing 121 - 140 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)