Exam 20: Incremental Analysis

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

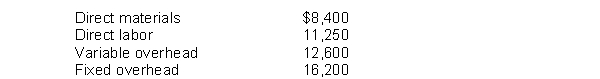

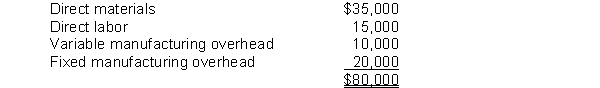

Martin Company incurred the following costs for 70,000 units:  Martin has received a special order from a foreign company for 3,000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $6,300 for shipping.

If Martin wants to earn $6,000 on the order, what should the unit price be?

Martin has received a special order from a foreign company for 3,000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $6,300 for shipping.

If Martin wants to earn $6,000 on the order, what should the unit price be?

(Multiple Choice)

4.8/5  (35)

(35)

Use the following information for questions .

Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent:  An outside supplier has offered to sell Clemente the subcomponent for $2.85 a unit.

-If Clemente accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3,600. The increase (decrease) in net income from accepting the offer would be

An outside supplier has offered to sell Clemente the subcomponent for $2.85 a unit.

-If Clemente accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3,600. The increase (decrease) in net income from accepting the offer would be

(Multiple Choice)

4.8/5  (37)

(37)

The source of data to serve as inputs in incremental analysis is generated by

(Multiple Choice)

5.0/5  (44)

(44)

Use the following information for questions .

Hi-Tech Inc. has several outdated computers that cost a total of $17,800 and could be sold as scrap for $4,600. They could be updated for an additional $2,400 and sold. If Hi-Tech updates the computers and sells them, net income will increase by $9,000.

-What amount would be considered sunk costs?

(Multiple Choice)

4.9/5  (42)

(42)

In the analysis concerning the acceptance or rejection of a special order, which items are relevant?

(Multiple Choice)

4.8/5  (33)

(33)

Use the following information for questions .

Hi-Tech Inc. has several outdated computers that cost a total of $17,800 and could be sold as scrap for $4,600. They could be updated for an additional $2,400 and sold. If Hi-Tech updates the computers and sells them, net income will increase by $9,000.

-At what price were the updated versions sold?

(Multiple Choice)

4.9/5  (35)

(35)

If a company must expand capacity to accept a special order, it is likely that there will be

(Multiple Choice)

4.7/5  (37)

(37)

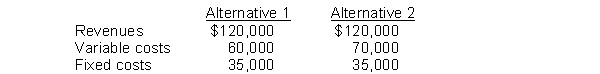

A company is considering the following alternatives:  Which of the following are relevant in choosing between the alternatives?

Which of the following are relevant in choosing between the alternatives?

(Multiple Choice)

4.7/5  (30)

(30)

The elimination of an unprofitable product line may adversely affect the remaining product lines.

(True/False)

4.7/5  (39)

(39)

In making decisions, management ordinarily considers both financial and nonfinancial information.

(True/False)

4.9/5  (28)

(28)

Define the term "opportunity cost." How may this cost be relevant in a make-or-buy decision?

(Essay)

4.7/5  (36)

(36)

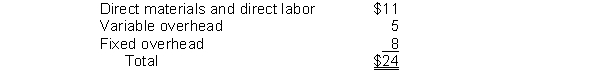

Use the following information for questions.

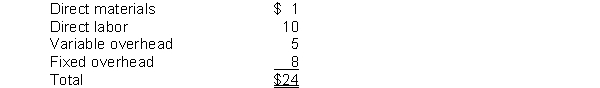

Truckel, Inc. currently manufactures a wicket as its main product. The costs per unit are as follows:  -Saran Company has contacted Truckel with an offer to sell it 5,000 of the wickets for $18 each. If Truckel makes the wickets, variable costs are $16 per unit. Fixed costs are $8 per unit; however, $5 per unit is unavoidable. Should Truckel make or buy the wickets?

-Saran Company has contacted Truckel with an offer to sell it 5,000 of the wickets for $18 each. If Truckel makes the wickets, variable costs are $16 per unit. Fixed costs are $8 per unit; however, $5 per unit is unavoidable. Should Truckel make or buy the wickets?

(Multiple Choice)

4.8/5  (34)

(34)

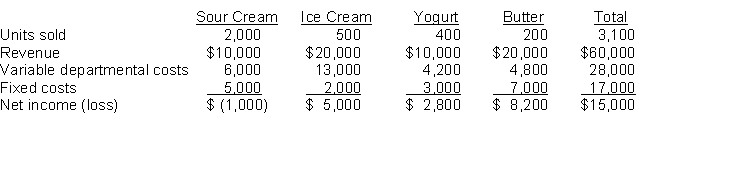

Keith Inc. has 4 product lines: sour cream, ice cream, yogurt, and butter. Demand of individual products is not affected by changes in other product lines. 30% of the fixed costs are direct, and the other 70% are allocated. Results of June follow:  Instructions

Prepare an incremental analysis of the effect of dropping the sour cream product line.

Instructions

Prepare an incremental analysis of the effect of dropping the sour cream product line.

(Essay)

4.8/5  (44)

(44)

Coyle Company manufactured 6,000 units of a component part that is used in its product and incurred the following costs:  Another company has offered to sell the same component part to the company for $13 per unit. The fixed manufacturing overhead consists mainly of depreciation on the equipment used to manufacture the part and would not be reduced if the component part was purchased from the outside firm. If the component part is purchased from the outside firm, Coyle Company has the opportunity to use the factory equipment to produce another product which is estimated to have a contribution margin of $22,000.

Instructions

Prepare an incremental analysis report for Coyle Company which can serve as informational input into this make or buy decision.

Another company has offered to sell the same component part to the company for $13 per unit. The fixed manufacturing overhead consists mainly of depreciation on the equipment used to manufacture the part and would not be reduced if the component part was purchased from the outside firm. If the component part is purchased from the outside firm, Coyle Company has the opportunity to use the factory equipment to produce another product which is estimated to have a contribution margin of $22,000.

Instructions

Prepare an incremental analysis report for Coyle Company which can serve as informational input into this make or buy decision.

(Essay)

4.9/5  (35)

(35)

Agler Corporation currently manufactures a subassembly for its main product. The costs per unit are as follows:  Funkhouser Company has contacted Agler with an offer to sell it 4,000 of the subassemblies for $17 each. If Agler buys the subassemblies, $2 of the fixed overhead per unit will be allocated to other products.

Instructions

Should Agler make or buy the subassemblies? Explain your answer.

Funkhouser Company has contacted Agler with an offer to sell it 4,000 of the subassemblies for $17 each. If Agler buys the subassemblies, $2 of the fixed overhead per unit will be allocated to other products.

Instructions

Should Agler make or buy the subassemblies? Explain your answer.

(Essay)

4.7/5  (37)

(37)

A company is deciding on whether to replace some old equipment with new equipment. Which of the following is not a relevant cost for incremental analysis?

(Multiple Choice)

4.9/5  (40)

(40)

The ______________ value of old equipment is irrelevant in a decision to replace that equipment and is often referred to as a _____________ cost.

(Short Answer)

5.0/5  (27)

(27)

Costs that will differ between alternatives and influence the outcome of a decision are

(Multiple Choice)

4.8/5  (33)

(33)

Showing 161 - 180 of 203

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)