Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

The market value of a corporation's stock is determined by the number of shares that the corporation has been authorized to issue.

(True/False)

4.8/5  (42)

(42)

If stock is issued for a noncash asset, the asset should be recorded on the books of the corporation at

(Multiple Choice)

4.8/5  (39)

(39)

If a stockholder cannot attend a stockholder's meeting, he may delegate his voting rights by means of

(Multiple Choice)

4.9/5  (36)

(36)

Retained earnings is affected by each of the following except

(Multiple Choice)

4.9/5  (33)

(33)

Why must a corporation have sufficient retained earnings before it may declare cash dividends?

(Essay)

4.7/5  (35)

(35)

On January 1, 2018, Dreamy Company issued 30,000 shares of $2 par value common stock for $150,000. On March 1, 2018, the company purchased 6,000 shares of its common stock for $7 per share for the treasury. On June 1, 2018, 1,500 of the treasury shares are sold for $10 per share. On September 1, 2018, 3,000 treasury shares are sold at $5 per share.

Instructions

Journalize the stock transactions of Dreamy Company in 2018.

(Essay)

4.9/5  (34)

(34)

Which of the following factors does not affect the initial market price of a stock?

(Multiple Choice)

4.7/5  (40)

(40)

Other comprehensive income items include each of the following except

(Multiple Choice)

4.8/5  (28)

(28)

Par value of stock represents the __________________ per share that must be retained in the business for the protection of corporate ___________________.

(Short Answer)

4.8/5  (37)

(37)

The cumulative effect of the declaration and payment of a cash dividend on a company's balance sheet is to

(Multiple Choice)

4.9/5  (27)

(27)

eris, Inc. has 1,000 shares of 6%, $10 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2018. What is the annual dividend on the preferred stock?

(Multiple Choice)

4.8/5  (45)

(45)

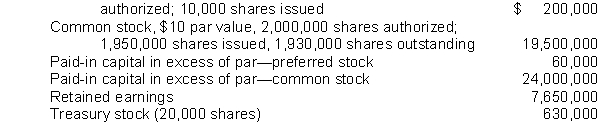

Realistic Corporation's December 31, 2018 balance sheet showed the following:

8% preferred stock, $20 par value, cumulative, 20,000 shares  Realistic's total paid-in capital was

Realistic's total paid-in capital was

(Multiple Choice)

4.9/5  (40)

(40)

Domaine Corporation is authorized to issue 1,000,000 shares of $1 par value common stock. During 2018, the company has the following stock transactions.

Jan. 15 Issued 500,000 shares of stock at $7 per share.

Sept. 5 Purchased 30,000 shares of common stock for the treasury at $9 per share.

Instructions

Journalize the transactions for Domaine Corporation.

(Essay)

4.8/5  (48)

(48)

Crawl Inc., has 1,000 shares of 6%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2017, and December 31, 2018. The board of directors declared and paid a $2,000 dividend in 2017. In 2018, $10,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 2018?

(Multiple Choice)

4.9/5  (37)

(37)

The ultimate effect of incurring an expense is to reduce stockholders' equity. The declaration of a cash dividend also reduces stockholders' equity. Explain the difference between an expense and a cash dividend and explain why they have the same effect on stockholders' equity.

(Essay)

4.7/5  (40)

(40)

Sandoz Corporation was organized on January 1, 2018, with authorized capital of 500,000 shares of $10 par value common stock. During 2018, Sandoz issued 30,000 shares at $12 per share, purchased 3,000 shares of treasury stock at $13 per share, and sold 3,000 shares of treasury stock at $14 per share. What is the amount of additional paid-in capital at December 31, 2018?

(Multiple Choice)

4.8/5  (36)

(36)

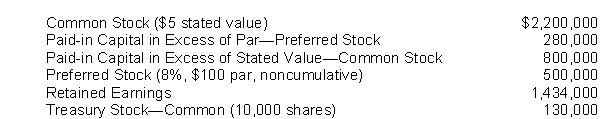

The following stockholders' equity accounts, arranged alphabetically, are in the ledger of Star Corporation at December 31, 2018.  Instructions

Prepare the stockholders' equity section of the balance sheet at December 31, 2018.

Instructions

Prepare the stockholders' equity section of the balance sheet at December 31, 2018.

(Essay)

4.7/5  (30)

(30)

The date a cash dividend becomes a binding legal obligation to a corporation is the

(Multiple Choice)

4.8/5  (39)

(39)

Showing 201 - 220 of 341

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)