Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

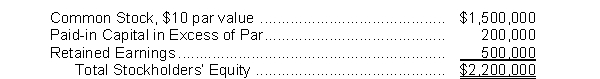

Yates Corporation has the following stockholders' equity accounts on January 1, 2018:  The company uses the cost method to account for treasury stock transactions. During 2018, the following treasury stock transactions occurred:

April 1 Purchased 10,000 shares at $19 per share.

August 1 Sold 4,000 shares at $22 per share.

October 1 Sold 2,000 shares at $15 per share.

Instructions

(a) Journalize the treasury stock transactions for 2018.

(b) Prepare the Stockholders' Equity section of the balance sheet for Yates Corporation at December 31, 2018. Assume net income was $110,000 for 2018.

The company uses the cost method to account for treasury stock transactions. During 2018, the following treasury stock transactions occurred:

April 1 Purchased 10,000 shares at $19 per share.

August 1 Sold 4,000 shares at $22 per share.

October 1 Sold 2,000 shares at $15 per share.

Instructions

(a) Journalize the treasury stock transactions for 2018.

(b) Prepare the Stockholders' Equity section of the balance sheet for Yates Corporation at December 31, 2018. Assume net income was $110,000 for 2018.

(Essay)

4.9/5  (33)

(33)

A large stock dividend and stock split can frequently have the same effect on the market price of a corporation's stock. Explain how stock dividends and stock splits affect the market price of a corporation's stock.

(Essay)

4.9/5  (42)

(42)

The amount of a cash dividend liability is recorded on the date of record because it is on that date that the persons or entities who will receive the dividend are identified.

(True/False)

4.9/5  (30)

(30)

The per share amount normally assigned by the board of directors to a large stock dividend is

(Multiple Choice)

4.8/5  (36)

(36)

Three dates are important in connection with cash dividends. Identify these dates, and explain their significance to the corporation and its stockholders.

(Essay)

4.8/5  (37)

(37)

The following selected transactions pertain to Sinclair Corporation:

Jan. 3 Issued 100,000 shares, $5 par value, common stock for $25 per share.

Feb. 10 Issued 6,000 shares, $5 par value, common stock in exchange for special purpose equipment. Sinclair Corporation's common stock has been actively traded on the stock exchange at $30 per share.

Instructions

Journalize the transactions.

(Essay)

4.8/5  (38)

(38)

Identify (by letter) each of the following characteristics as being an advantage, a disadvantage, or not applicable to the corporate form of business organization.

A = Advantage

D = Disadvantage

N = Not Applicable

Characteristics

1. Separate legal entity

2. Taxable entity resulting in additional taxes

3. Continuous life

4. Unlimited liability of owners

5. Government regulation

6. Separation of ownership and management

7. Ability to acquire capital

8. Ease of transfer of ownership

(Short Answer)

4.8/5  (31)

(31)

The concept of an "artificial being" refers to which form of business organization?

(Multiple Choice)

4.8/5  (38)

(38)

Jason Thomas has invested $200,000 in a privately held family corporation. The corporation does not do well and must declare bankruptcy. What amount does Thomas stand to lose?

(Multiple Choice)

4.9/5  (38)

(38)

Identify the effect the declaration and distribution of a stock dividend has on the par value per share.

Par Value per Share

(Multiple Choice)

4.8/5  (36)

(36)

A separate paid-in capital account is used to record each of the following except the issuance of

(Multiple Choice)

4.9/5  (40)

(40)

Additional paid-in capital includes all of the following except the amounts paid in

(Multiple Choice)

4.9/5  (34)

(34)

Organizational costs are capitalized by debiting an intangible asset entitled Organization Costs.

(True/False)

4.9/5  (31)

(31)

Each of the following decreases retained earnings except a

(Multiple Choice)

4.8/5  (37)

(37)

Morgan Company reported the following balances at December 31, 2017: common stock $500,000; paid-in capital in excess of par value $100,000; retained earnings $350,000. During 2018, the following transactions affected stockholders' equity.

1. Issued preferred stock with a par value of $150,000 for $200,000.

2. Purchased treasury stock (common) for $50,000.

3. Earned net income of $140,000.

4. Declared and paid cash dividends of $75,000.

Instructions

Prepare the stockholders' equity section of Morgan Company's December 31, 2018, balance sheet.

(Essay)

4.7/5  (45)

(45)

A statement of stockholders' equity discloses all of the following except:

(Multiple Choice)

4.9/5  (38)

(38)

On September 5, Borton Corporation acquired 2,500 shares of its own $1 par common stock for $22 per share. On October 15, 1,000 shares of the treasury stock is sold for $25 per share.

Instructions

Journalize the purchase and sale of the treasury stock assuming that the company uses the cost method.

(Essay)

4.9/5  (30)

(30)

Showing 321 - 340 of 341

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)