Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

The board of directors must assign a per share value to a stock dividend declared that is

(Multiple Choice)

4.7/5  (39)

(39)

On January 1, Soft Corporation had 80,000 shares of $10 par value common stock outstanding. On June 17, the company declared a 10% stock dividend to stockholders of record on June 20. Market value of the stock was $15 on June 17. The entry to record the transaction of June 17 would include a

(Multiple Choice)

4.7/5  (43)

(43)

Cooke Corporation issues 10,000 shares of $50 par value preferred stock for cash at $60 per share. In the stockholders' equity section, the effects of the transaction above will be reported

(Multiple Choice)

4.9/5  (37)

(37)

During 2018, Pink Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value.

2. Issued par value common stock for cash at an amount greater than par value.

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock.

4. Declared a small stock dividend when the market value was higher than the par value.

5. Declared a cash dividend.

6. Issued the shares of common stock required by the stock dividend declaration in 4 above.

7. Issued par value common stock for cash at par value.

8. Paid the cash dividend.

Instructions

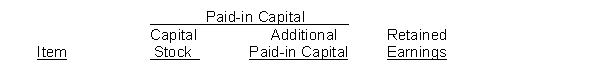

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase, (D) for decrease, and (NE) for no effect.

(Essay)

4.9/5  (39)

(39)

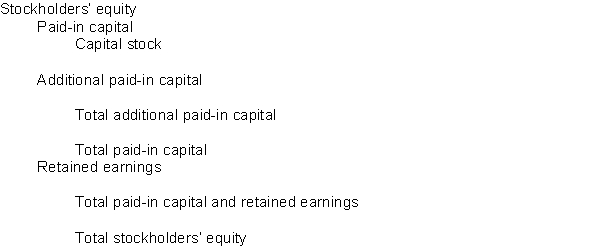

Place each of the items listed below in the appropriate subdivision of the stockholders' equity section of a balance sheet.

Common stock, $10 stated value

Retained earnings

8% Preferred stock, $100 par value

Paid-in capital in excess of par

Paid-in capital in excess of stated value

Treasury stock-Common

Paid-in capital from treasury stock

(Essay)

4.9/5  (37)

(37)

Car and Auto Sisters had retained earnings of $18,000 on the balance sheet but disclosed in the footnotes that $3,000 of retained earnings was restricted for plant expansion and $1,000 was restricted for bond repayments. Cash of $2,000 had been set aside for the plant expansion. How much of retained earnings is available for dividends?

(Multiple Choice)

4.9/5  (36)

(36)

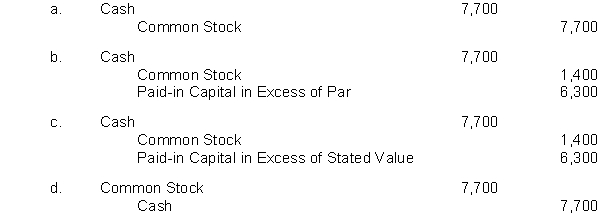

Darman Company issued 700 shares of no-par common stock for $7,700. Which of the following journal entries would be made if the stock has a stated value of $2 per share?

(Short Answer)

4.7/5  (39)

(39)

Identify which of the following items would be reported as additions (A) or deductions (D) in a Retained Earnings Statement.

1. Net Income

2. Net Loss

3. Cash Dividends

4. Stock Dividends

(Short Answer)

4.9/5  (36)

(36)

Crain Company issued 2,000 shares of its $5 par value common stock in payment of its attorney's bill of $30,000. The bill was for services performed in helping the company incorporate. Crain should record this transaction by debiting

(Multiple Choice)

4.9/5  (37)

(37)

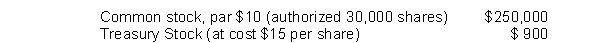

The following data is available for Blaine Corporation at December 31, 2018:  Based on the data, how many shares of common stock have been issued?

Based on the data, how many shares of common stock have been issued?

(Multiple Choice)

4.8/5  (38)

(38)

When preferred stock is cumulative, preferred dividends not declared in a period are

(Multiple Choice)

4.9/5  (40)

(40)

Net income of a corporation should be closed to retained earnings and net losses should be closed to paid-in capital accounts.

(True/False)

4.8/5  (35)

(35)

If common stock is issued for an amount greater than par value, the excess should be credited to

(Multiple Choice)

4.9/5  (26)

(26)

If the board of directors authorizes a $100,000 restriction of retained earnings for a future plant expansion, the effect of this action is to

(Multiple Choice)

4.8/5  (39)

(39)

The par value of stock issued for noncash assets is never a factor in determining the cost of the assets received.

(True/False)

4.9/5  (44)

(44)

Rex Company reported retained earnings at December 31, 2017, of $420,000. Reese had 180,000 shares of common stock outstanding throughout 2018.

The following transactions occurred during 2018.

1. Net income was $295,000.

2. A cash dividend of $0.50 per share was declared and paid.

3. A 5% stock dividend was declared and distributed when the market price per share was $15 per share.

Instructions

Prepare a retained earnings statement for 2018.

(Essay)

4.7/5  (32)

(32)

Showing 81 - 100 of 341

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)