Exam 3: Adjusting the Accounts

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Mother Hips Garment Company purchased equipment on June 1 for $90,000, paying $20,000 cash and signing a 9%, 2-month note for the remaining balance. The equipment is expected to depreciate $18,000 each year. Mother Hips Garment Company prepares monthly financial statements.

Instructions

(a) Prepare the general journal entry to record the acquisition of the equipment on June 1st.

(b) Prepare any adjusting journal entries that should be made on June 30th.

(c) Show how the equipment will be reflected on Mother Hips Garment Company's balance sheet on June 30th.

(Essay)

4.7/5  (43)

(43)

The expense recognition principle attempts to match ______________ with ______________.

(Short Answer)

4.8/5  (45)

(45)

An adjusting entry recording accrued salaries for a period indicates that Salaries Expense has been ________________ but has not yet been ________________ or recorded.

(Essay)

4.8/5  (40)

(40)

Management usually desires ________ financial statements and the IRS requires all businesses to file _________ tax returns.

(Multiple Choice)

4.8/5  (48)

(48)

New Slang Pest Control has the following balances in selected accounts on December 31, 2017. Accounts Receivable \ 0 Accumulated Depreciation - Equipment 0 Equipment 6,650 Interest Payable 0 Notes Payable 20,000 Prepaid Insurance 2,220 Salaries and Wages Payable 0 Supplies 2,940 Unearned Service Revenue 30,000

All of the accounts have normal balances. The information below has been gathered at December 31, 2018.

1. Depreciation on the equipment for 2018 is $1,300.

2. New Slang Pest Control borrowed $20,000 by signing a 10%, one-year note on July 1, 2018.

3. New Slang Pest Control paid $2,220 for 12 months of insurance coverage on October 1, 2018.

4. New Slang Pest Control pays its employees total salaries of $11,000 every Monday for the preceding 5-day week (Monday-Friday). On Monday, December 27, 2018, employees were paid for the week ending December 24, 2018. All employees worked the five days ending December 31, 2018.

5. New Slang Pest Control performed disinfecting services for a client in December 2018. The client will be billed $3,200.

6. On December 1, 2018, New Slang Pest Control collected $30,000 for disinfecting processes to be performed from December 1, 2018, through May 31, 2018.

7. A count of supplies on December 31, 2018, indicates that supplies of $850 are on hand.

Instructions

Prepare in journal form with explanations, the adjusting entries for the seven items listed for New Slang Pest Control.

(Essay)

4.8/5  (41)

(41)

For each of the following oversights, state whether total assets will be understated (U), overstated (O), or no affect (NA).

_____ 1. Failure to record revenue recognized but not yet received.

_____ 2. Failure to record expired prepaid rent.

_____ 3. Failure to record accrued interest on the bank savings account.

_____ 4. Failure to record depreciation.

_____ 5. Failure to record accrued wages.

_____ 6. Failure to record the recognized portion of unearned revenues.

(Essay)

4.9/5  (37)

(37)

Prepare adjusting entries for the following transactions. Omit explanations.

1. Depreciation on equipment is $900 for the accounting period.

2. There was no beginning balance of supplies and purchased $500 of supplies during the period. At the end of the period $150 of supplies were on hand.

3. Prepaid rent had a $1,000 normal balance prior to adjustment. By year end $400 was unexpired.

(Essay)

4.9/5  (36)

(36)

Live Wire Hot Rod Shop follows the revenue recognition principle. Live Wire services a car on July 31. The customer picks up the vehicle on August 1 and mails the payment to Live Wire on August 5. Live Wire receives the check in the mail on August 6. When should Live Wire show that the revenue was recognized?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is in accordance with generally accepted accounting principles?

(Multiple Choice)

4.8/5  (41)

(41)

The balance in the Prepaid Rent account before adjustment at the end of the year is $21,000, which represents three months' rent paid on December 1. The adjusting entry required on December 31 is to

(Multiple Choice)

4.9/5  (32)

(32)

Pavement Company purchased a truck from Bee Thousand Corp. by issuing a 6-month, 8% note payable for $90,000 on November 1. On December 31, the accrued expense adjusting entry is a. No entry is required.

b.

Interest Expense 7,200 Interest Payable 7,200

c.

Interest Expense 3,600 Interest Payable 3,600

d.

Interest Expense 1,200 Interest Payable 1,200

(Short Answer)

4.8/5  (36)

(36)

The balances of the Depreciation Expense and the Accumulated Depreciation accounts should always be the same.

(True/False)

4.7/5  (38)

(38)

Accounting time periods that are one year in length are referred to as interim periods.

(True/False)

4.7/5  (36)

(36)

As prepaid expenses expire with the passage of time, the correct adjusting entry will be a

(Multiple Choice)

4.7/5  (37)

(37)

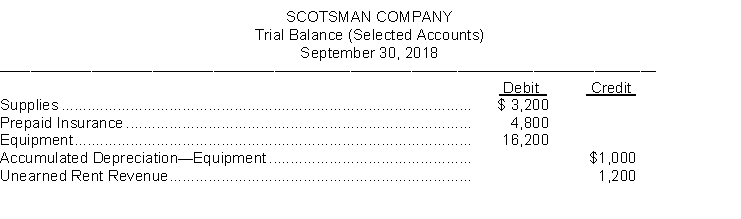

Scotsman Company prepares monthly financial statements. Below are listed some selected accounts and their balances in the September 30 trial balance before any adjustments have been made for the month of September.  (Note: Debit column does not equal credit column because this is a partial listing of selected account balances)

An analysis of the account balances by the company's accountant provided the following additional information:

1. A physical count of supplies revealed $1,000 on hand on September 30.

2. A two-year life insurance policy was purchased on June 1 for $4,800.

3. Equipment depreciated $3,000 per year.

4. The amount of rent received in advance that remains unearned at September 30 is $500.

Instructions

Using the above additional information, prepare the adjusting entries that should be made by Scotsman Company on September 30.

(Note: Debit column does not equal credit column because this is a partial listing of selected account balances)

An analysis of the account balances by the company's accountant provided the following additional information:

1. A physical count of supplies revealed $1,000 on hand on September 30.

2. A two-year life insurance policy was purchased on June 1 for $4,800.

3. Equipment depreciated $3,000 per year.

4. The amount of rent received in advance that remains unearned at September 30 is $500.

Instructions

Using the above additional information, prepare the adjusting entries that should be made by Scotsman Company on September 30.

(Essay)

4.9/5  (34)

(34)

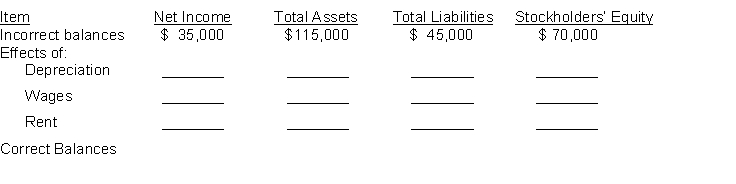

On December 31, 2018, Fashion Nugget Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $35,000. The balance sheet showed total assets, $115,000; total liabilities, $45,000; and stockholders' equity, $70,000.

The data for the three adjusting entries were:

(1) Depreciation of $10,000 was not recorded on equipment.

(2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded. The next payroll will be in January.

(3) Rent of $12,000 was paid for two months in advance on December 1. The entire amount was debited to Rent Expense when paid.

Instructions

Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses):

(Essay)

4.8/5  (34)

(34)

Showing 181 - 200 of 219

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)