Exam 3: Adjusting the Accounts

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

At December 31, 2018, before any year-end adjustments, Murmur Company's Insurance Expense account had a balance of $2,450 and its Prepaid Insurance account had a balance of $3,800. It was determined that $2,800 of the Prepaid Insurance had expired. The adjusted balance for Insurance Expense for the year would be

(Multiple Choice)

4.8/5  (35)

(35)

Buena Vista Social Club accumulates the following adjustment data at December 31.

1. Revenue of $1,600 collected in advance has been recognized.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $500 has expired.

4. Supplies of $450 have been used.

5. Revenue recognized but unbilled total $750.

6. Utility expenses of $250 are unpaid.

7. Interest of $300 has accrued on a note payable.

Instructions

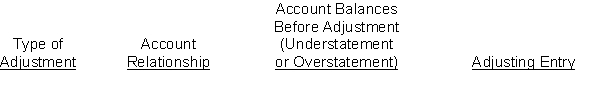

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (asset/liability, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $15,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

(Essay)

4.8/5  (37)

(37)

Compute the net income for 2018 based on the following amounts presented on the adjusted trial balance of D-Lay Company. Accumulated Depreciation - Equip. \ 20,000 Depreciation Expense 18,000 Salaries and Wages Expense 15,000 Service Revenue 40,000 Unearned Service Revenue 8,000

(Essay)

4.8/5  (34)

(34)

In developing an accounting information system, it is important to establish procedures whereby all transactions that affect the components of the accounting equation are recorded. Why then, is it often necessary to adjust the accounts before financial statements are prepared even in a properly designed accounting system? Identify the major types of adjustments that are frequently made and give a specific example of each.

(Essay)

4.9/5  (40)

(40)

The book value of a depreciable asset is always equal to its market value because depreciation is a valuation technique.

(True/False)

4.8/5  (36)

(36)

Pixies Inc. pays its rent of $54,000 annually on January 1. If the February 28 monthly adjusting entry for prepaid rent is omitted, which of the following will be true?

(Multiple Choice)

4.8/5  (24)

(24)

The difference between the cost of a depreciable asset and its related accumulated depreciation is referred to as the

(Multiple Choice)

4.9/5  (38)

(38)

Depreciation based on revaluation of land and buildings is permitted under

(Multiple Choice)

4.8/5  (43)

(43)

Adjusting entries are not necessary if the trial balance debit and credit column balances are equal.

(True/False)

4.9/5  (40)

(40)

Sebastian Belle has performed $2,000 of CPA services for a client but has not billed the client as of the end of the accounting period. What adjusting entry must Sebastian make?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following would not result in unearned revenue?

(Multiple Choice)

4.8/5  (40)

(40)

A business pays weekly salaries of $30,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on a Thursday is

(Multiple Choice)

4.8/5  (35)

(35)

In general, adjusting entries are required each time financial statements are prepared.

(True/False)

4.9/5  (40)

(40)

In general, the shorter the time period, the difficulty of making the proper adjustments to accounts

(Multiple Choice)

4.9/5  (33)

(33)

The adjusted trial balance of Old 97 Automotive Service Company on June 30, 2018 includes the following accounts: Supplies, $300; Accumulated Depreciation, $9,500; Salaries Payable, $1,550, Notes Payable $6,750; Service Revenue, $22,100; Salaries and Wages Expense, $8,750; Depreciation Expense, $3,250; Supplies Expense, $1,000; Rent Expense, $400; Utilities Expense, $350; and Interest Expense $250. Prepare an income statement for the month of June.

(Essay)

4.9/5  (36)

(36)

Financial statements can be prepared from the information provided by an adjusted trial balance.

(True/False)

4.9/5  (38)

(38)

At March 1, Psychocandy Inc. reported a balance in Supplies of $200. During March, the company purchased supplies for $750 and consumed supplies of $800. If no adjusting entry is made for supplies

(Multiple Choice)

4.8/5  (48)

(48)

Failure to prepare an adjusting entry at the end of a period to record an accrued revenue would cause

(Multiple Choice)

4.8/5  (34)

(34)

Showing 21 - 40 of 219

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)