Exam 5: Introduction to Corporations

Exam 1: Long-Lived Assets263 Questions

Exam 2: Current Liabilities and Payroll191 Questions

Exam 3: Financial Reporting Concepts138 Questions

Exam 4: Accounting for Partnerships171 Questions

Exam 5: Introduction to Corporations210 Questions

Exam 6: Corporations: Additional Topics and IFRS42 Questions

Exam 7: Non-Current Liabilities39 Questions

Exam 8: Investments273 Questions

Exam 9: The Cash Flow Statement169 Questions

Exam 10: Financial Statement Analysis172 Questions

Exam 11: Understanding Interest, Annuities, and Bond Valuation188 Questions

Select questions type

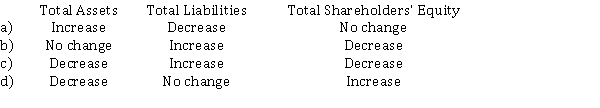

Indicate the respective effects of the declaration of a cash dividend on the following balance sheet sections:

(Short Answer)

4.8/5  (32)

(32)

No par value shares are shares that have NOT been assigned any specific value.

(True/False)

4.7/5  (47)

(47)

Authorized share capital is the amount of the shares that are issued to the shareholders.

(True/False)

4.8/5  (40)

(40)

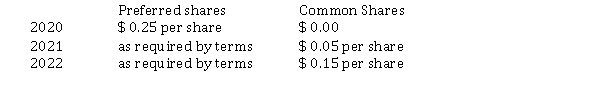

Trainor Corporation was organized on January 1, 2020. During its first year, the corporation issued 20,000 preferred shares with a $ 0.30 dividend entitlement and 200,000 common shares, both at $ 1 per share. At December 31, the corporation's year end, Trainor declared the following cash dividends:  Instructions

a) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is not cumulative.

b) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is cumulative.

b).

c) Journalize the declaration of the cash dividend at December 31, 2022 using the assumption of part

Instructions

a) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is not cumulative.

b) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is cumulative.

b).

c) Journalize the declaration of the cash dividend at December 31, 2022 using the assumption of part

(Essay)

4.8/5  (39)

(39)

A corporation is a legal entity that is combined with the owner's economic circumstances.

(True/False)

4.8/5  (30)

(30)

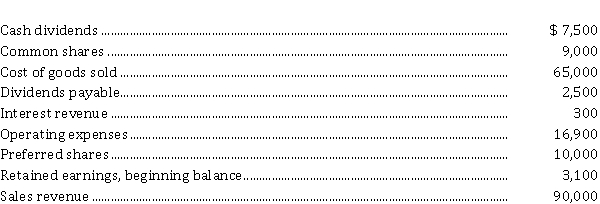

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2021, the company's year end. GlaxonSmith has a 15% tax rate.  Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2021.

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2021.

(Essay)

4.7/5  (36)

(36)

The date on which a cash dividend becomes a binding legal obligation is on the

(Multiple Choice)

4.7/5  (38)

(38)

During its first year of operations, Millwoods Enterprises Inc. had the following transactions related to its common shares:

Jan 5 Issued 5,000 common shares to Michelle Vogel for $ 1 each.

Mar 15 Issued 10,000 common shares in exchange for equipment transferred from Vogel. The equipment was valued at $ 40,000.

Apr 10 Issued 3,500 shares to a consulting firm for management consulting services as settlement of a $ 14,000 invoice.

Sep 30 Issued 4,000 common shares to Renee Vogel for $ 5 each.

Instructions

a) Journalize the share transactions.

b) Calculate the average cost of the common shares of Millwoods Enterprises Inc. at December 31.

(Essay)

4.9/5  (38)

(38)

Return on equity will assist a company to measure its cash flow.

(True/False)

4.9/5  (37)

(37)

The ways that a corporation can be classified by purpose are

(Multiple Choice)

4.8/5  (28)

(28)

Showing 201 - 210 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)