Exam 5: Introduction to Corporations

Exam 1: Long-Lived Assets263 Questions

Exam 2: Current Liabilities and Payroll191 Questions

Exam 3: Financial Reporting Concepts138 Questions

Exam 4: Accounting for Partnerships171 Questions

Exam 5: Introduction to Corporations210 Questions

Exam 6: Corporations: Additional Topics and IFRS42 Questions

Exam 7: Non-Current Liabilities39 Questions

Exam 8: Investments273 Questions

Exam 9: The Cash Flow Statement169 Questions

Exam 10: Financial Statement Analysis172 Questions

Exam 11: Understanding Interest, Annuities, and Bond Valuation188 Questions

Select questions type

Which group of users is responsible for selecting the company's operating policies and selecting officers such as the CEO?

(Multiple Choice)

4.8/5  (41)

(41)

Acts of the shareholders who are NOT official agents of a corporation can legally bind a corporation.

(True/False)

4.8/5  (47)

(47)

Which of the following statements concerning taxation is accurate?

(Multiple Choice)

4.9/5  (42)

(42)

On January 1, 2021, Urban Faith Limited had 200,000 common shares issued at an average cost of $ 25 per share. During the year, the following transactions occurred:

May 1 Issued 20,000 common shares for $ 470,000.

Jun 1 Declared a cash dividend of $ 3.50 per share to shareholders of record on June 15.

Jun 25 Issued 10,000 common shares for $ 260,000.

Jun 30 Paid the cash dividend declared on June 1.

Profit for 2021 amounted to $ 885,000.

Instructions

Prepare journal entries to record the above transactions assuming Urban Faith has a December 31 year end. Be sure to prepare the appropriate closing entries at December 31, 2021.

(Essay)

4.9/5  (32)

(32)

Cordoza Corporation had profit of $ 400,000 in 2021. Total shareholders' equity was $ 1,400,000 at December 31, 2019; $ 1,500,000 at December 31, 2020; and $ 1,600,000 at December 31, 2021.

Instructions

Calculate return on equity for 2021 and explain what it means.

(Essay)

4.7/5  (45)

(45)

Organization costs are normally capitalized by public companies.

(True/False)

4.8/5  (41)

(41)

Accounting entries are required for dividends on which of the following two dates?

(Multiple Choice)

4.8/5  (36)

(36)

Journal entries are made on the date of declaration and on the date of record date.

(True/False)

5.0/5  (45)

(45)

The two ways that a corporation can be classified by ownership are

(Multiple Choice)

4.8/5  (33)

(33)

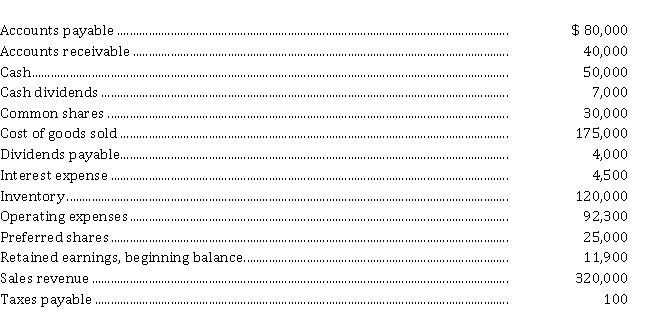

The trial balance of Terris Inc. for the year ended September 30, 2021, prior to recording of tax expenses, but after all other adjustments, is as follows. All accounts are their normal balance (debit or credit). Terris has a tax rate of 30%.  Instructions

Prepare the income statement and statement of retained earnings for Terris Inc. for the year ended September 30, 2021.

Instructions

Prepare the income statement and statement of retained earnings for Terris Inc. for the year ended September 30, 2021.

(Essay)

4.8/5  (39)

(39)

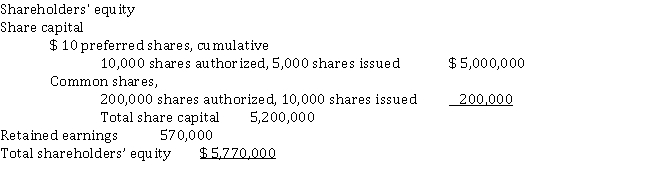

Norton Corporation has the following shareholders equity on September 30, 2021:  On September 15, 2021, Norton Corporation declared a $ 170,000 dividend to be paid on October 15 to shareholders of record on September 30. Assuming that the preferred dividends have NOT been paid since 2019 the amount of dividends per common share for 2021 would be

On September 15, 2021, Norton Corporation declared a $ 170,000 dividend to be paid on October 15 to shareholders of record on September 30. Assuming that the preferred dividends have NOT been paid since 2019 the amount of dividends per common share for 2021 would be

(Multiple Choice)

4.8/5  (39)

(39)

The articles of incorporation can contain all of the following EXCEPT

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is NOT a component of the statement of retained earnings?

(Multiple Choice)

4.7/5  (46)

(46)

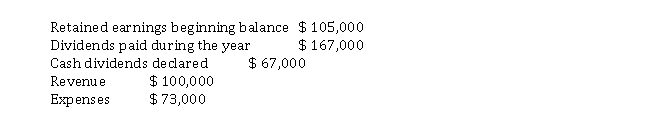

The following information is available for Mobily Corporation.  What is the ending retained earnings balance?

What is the ending retained earnings balance?

(Multiple Choice)

4.9/5  (40)

(40)

Sonoma Lakes Ltd. (SLL) has the following authorized share capital:

Unlimited Common voting shares

500,000 Class A, $ 5 cumulative preferred shares

500,000 Class B, $ 10 noncumulative preferred shares

During 2021, SLL had the following share transactions for cash:

Jan 1 Issued 50,000 common shares for $ 100,000.

Mar 12 Issued 1,000 Class A preferred shares for $ 60,000.

Apr 30 Issued 20,000 common shares for $ 2.50 per share.

Jun 20 Issued 3,000 Class B preferred shares for $ 70 per share.

SLL did not declare any dividends during 2021. On December 31, 2022 a dividend of $ 3 per share was declared on preferred shares issued.

Instructions

a) Journalize the share transactions.

b) Calculate the number of common shares issued at December 31, 2021.

c) Calculate the amount of the December 31, 2022 total dividend declared and the amount of dividends in arrears after declaring the December 31, 2022 dividend.

(Essay)

4.9/5  (41)

(41)

If a corporation has only one class of shares, they are referred to as

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 60 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)