Exam 13: Differential Analysis: the Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

Boggess Corporation manufactures numerous products, one of which is called Alpha41. The company has provided the following data about this product:  Management is considering increasing the price of Alpha41 by 10%, from $86.00 to $94.60. The company's marketing managers estimate that this price hike would decrease unit sales by 20%, from 120,000 units to 96,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Alpha41 earn at a price of $94.60 if this sales forecast is correct?

Management is considering increasing the price of Alpha41 by 10%, from $86.00 to $94.60. The company's marketing managers estimate that this price hike would decrease unit sales by 20%, from 120,000 units to 96,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Alpha41 earn at a price of $94.60 if this sales forecast is correct?

(Multiple Choice)

4.9/5  (31)

(31)

One way to increase the effective utilization of a bottleneck is to reduce the number of defective units.

(True/False)

4.9/5  (36)

(36)

Wermers Industries Incorporated has developed a new drill press, model LS-88, that is designed to offer superior performance to a comparable drill press sold by Wermers's main competitor. The competing drill press sells for $31,000 and needs to be replaced after 1,000 hours of use. It also requires $6,000 of preventive maintenance during its useful life. ModelLS-88's performance capabilities are similar to the competing product with two important exceptions-it needs to be replaced only after 2,000 hours of use and it requires $7,000 of preventive maintenance during its useful life.From a value-based pricing standpoint what range of possible prices should Wermers consider when setting a price for model LS-88?

(Multiple Choice)

4.9/5  (31)

(31)

The Anaconda Mining Company currently is operating at less than 50 percent of practical capacity. The management of the company expects sales to drop below the present level of 15,000 tons of ore per month very soon. The selling price per ton of ore is $2 and the variable cost per ton is $1. Fixed costs per month total $15,000.

Management is concerned that a further drop in sales volume will generate a loss and, accordingly, is considering the temporary suspension of operations until demand in the metals markets returns to normal levels and prices rebound. Management has implemented a cost reduction program over the past year that has been successful in reducing costs. Nevertheless, suspension of operations appears to be the only viable alternative. Management estimates that suspension of operations would reduce fixed costs from $15,000 to $5,000 per month.

Required:

a. Why does management estimate that fixed costs will persist at $5,000 per month even though the mine is temporarily closed?

b. At what sales volume should management suspend operations at the mine?

(Essay)

4.8/5  (35)

(35)

Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 51,000 units per month is as follows:  The normal selling price of the product is $108.10 per unit.An order has been received from an overseas customer for 3,100 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $2.30 less per unit on this order than on normal sales.Direct labor is a variable cost in this company.Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1,250 units for regular customers. The minimum acceptable price per unit for the special order is closest to: (Round your intermediate calculations to 2 decimal places.)

The normal selling price of the product is $108.10 per unit.An order has been received from an overseas customer for 3,100 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $2.30 less per unit on this order than on normal sales.Direct labor is a variable cost in this company.Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1,250 units for regular customers. The minimum acceptable price per unit for the special order is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (41)

(41)

When a company has a production constraint, total contribution margin will be maximized by emphasizing the products with the highest contribution margin per unit of the constrained resource.

(True/False)

4.7/5  (42)

(42)

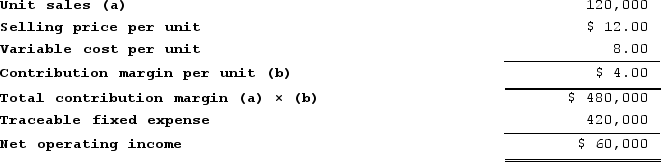

Starowicz Corporation manufactures numerous products, one of which is called Beta10. The company has provided the following data about this product:  Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

(Multiple Choice)

4.9/5  (34)

(34)

Morr Logistic Solutions Corporation has developed a new forklift-model QY-49-that has been designed to out perform a competitor's best-selling forklift. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $3.70 per hour, and sells for $109,000. In contrast, model QY-49 has a useful life of 40,000 hours of service and its operating cost is $2.10 per hour. Morr has not yet established a selling price for model QY-49.From a value-based pricing standpoint what is QY-49's economic value to the customer over its 40,000 hour useful life?

(Multiple Choice)

4.9/5  (29)

(29)

Diedrich Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.The company has invested $420,000 in this product and expects a return on investment of 12%.Direct labor is a variable cost in this company.The selling price based on the absorption costing approach is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.The company has invested $420,000 in this product and expects a return on investment of 12%.Direct labor is a variable cost in this company.The selling price based on the absorption costing approach is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

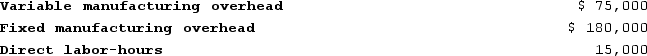

Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $17 per direct labor-hour, which was calculated using the following budgeted data:

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

(Essay)

4.9/5  (38)

(38)

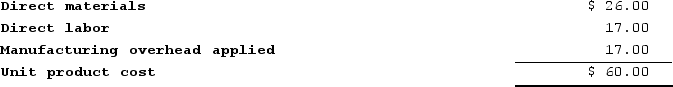

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The absorption costing unit product cost is:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The absorption costing unit product cost is:

(Multiple Choice)

4.9/5  (28)

(28)

The management of Giammarino Corporation is considering introducing a new product--a compact barbecue. At a selling price of $82 per unit, management projects sales of 10,000 units. Launching the barbecue as a new product would require an investment of $70,000. The desired return on investment is 18%. The target cost per barbecue is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

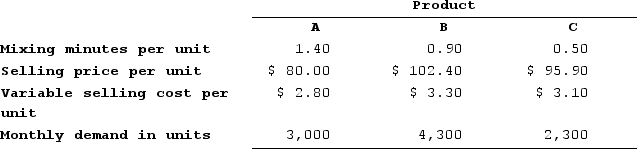

Glover Company makes three products in a single facility. These products have the following unit product costs:

Additional data concerning these products are listed below.

Additional data concerning these products are listed below.

The mixing machines are potentially the constraint in the production facility. A total of 9,120 minutes are available per month on these machines.Direct labor is a variable cost in this company.Required:a. How many minutes of mixing machine time would be required to satisfy demand for all three products?b. How much of each product should be produced to maximize net operating income? (Round final answers to the nearest whole unit.)c. Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company has made the best use of the existing mixing machine capacity? (Round your intermediate calculations and final answer to 2 decimal places.)

The mixing machines are potentially the constraint in the production facility. A total of 9,120 minutes are available per month on these machines.Direct labor is a variable cost in this company.Required:a. How many minutes of mixing machine time would be required to satisfy demand for all three products?b. How much of each product should be produced to maximize net operating income? (Round final answers to the nearest whole unit.)c. Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company has made the best use of the existing mixing machine capacity? (Round your intermediate calculations and final answer to 2 decimal places.)

(Essay)

4.8/5  (41)

(41)

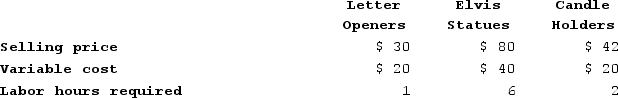

The Wester Corporation produces three products with the following costs and selling prices:  The company has insufficient capacity to fulfill all of the demand for these three products.If machine hours are the constraint, then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

The company has insufficient capacity to fulfill all of the demand for these three products.If machine hours are the constraint, then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

(Multiple Choice)

4.7/5  (36)

(36)

Wood Carving Corporation manufactures three products. Because of a recent lack of skilled wood carvers, the corporation has had a shortage of available labor hours. The following per unit data relates to the three products of the corporation:  Assume that Wood Carving only has 1,800 labor hours available next month. Also assume that Wood Carving can only sell 800 units of each product in a given month. What is the maximum amount of contribution margin that Wood Carving can generate next month given this labor hour shortage?

Assume that Wood Carving only has 1,800 labor hours available next month. Also assume that Wood Carving can only sell 800 units of each product in a given month. What is the maximum amount of contribution margin that Wood Carving can generate next month given this labor hour shortage?

(Multiple Choice)

4.9/5  (37)

(37)

The variable costs of a product are relevant in a decision concerning whether to eliminate the product.

(True/False)

4.7/5  (35)

(35)

Two products, QI and VH, emerge from a joint process. Product QI has been allocated $9,600 of the total joint costs of $12,000. A total of 9,000 units of product QI are produced from the joint process. Product QI can be sold at the split-off point for $13 per unit, or it can be processed further for an additional total cost of $54,000 and then sold for $18 per unit. If product QI is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

(Multiple Choice)

4.9/5  (37)

(37)

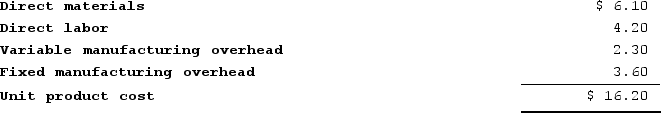

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each. Product A90's unit product cost is $16.20, determined as follows:  Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

(Multiple Choice)

4.8/5  (37)

(37)

Blauvelt Electronics Corporation has developed a new instrument-model GZ-29-that has been designed to outperform a competitor's best-selling instrument. Model GZ-29 has a useful life of 30,000 hours of service and its operating cost is $3.20 per hour. In contrast, the competitor's product has a useful life of 10,000 hours of service and has operating costs that average $5.60 per hour. The competitor's instrument sells for $149,000. Blauvelt has not yet established a selling price for model GZ-29.From a value-based pricing standpoint what is the reference value that Blauvelt should consider when pricing model GZ-29?

(Multiple Choice)

5.0/5  (43)

(43)

Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $44 to buy from farmers and $15 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $20 or processed further for $19 to make the end product industrial fiber that is sold for $52. The beet juice can be sold as is for $35 or processed further for $23 to make the end product refined sugar that is sold for $52.What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 381 - 400 of 432

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)