Exam 13: Differential Analysis: the Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

Kinsley Corporation manufactures numerous products, one of which is called Kappa-03. The company has provided the following data about this product:  Management is considering increasing the price of Kappa-03 by 7%, from $36.00 to $38.52. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 50,000 units to 45,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Kappa-03 earn at a price of $38.52 if this sales forecast is correct?

Management is considering increasing the price of Kappa-03 by 7%, from $36.00 to $38.52. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 50,000 units to 45,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Kappa-03 earn at a price of $38.52 if this sales forecast is correct?

(Multiple Choice)

4.9/5  (37)

(37)

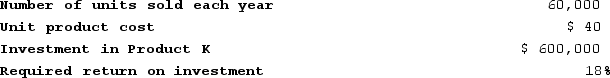

Seamons Corporation has the following information available on Product K:  The company uses the absorption costing approach to cost-plus pricing described in the text and a 40% markup. Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

The company uses the absorption costing approach to cost-plus pricing described in the text and a 40% markup. Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

(Multiple Choice)

4.8/5  (39)

(39)

Ecob Corporation uses the absorption costing approach to cost-plus pricing as described in the text to set prices for its products. Based on budgeted sales of 19,000 units next year, the unit product cost of a particular product is $16.00. The company's selling and administrative expenses for this product are budgeted to be $250,800 in total for the year. The company has invested $440,000 in this product and expects a return on investment of 14%.The selling price based on the absorption costing approach for this product would be closest to:

(Multiple Choice)

4.8/5  (30)

(30)

An avoidable fixed production cost incurred before the split-off point in a joint process is relevant in a sell or process further decision.

(True/False)

4.8/5  (29)

(29)

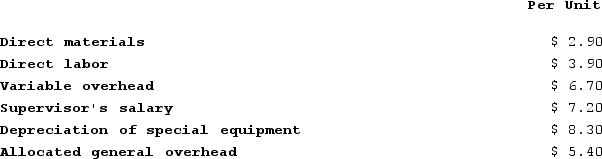

Part U67 is used in one of Broce Corporation's products. The company's Accounting Department reports the following costs of producing the 16,000 units of the part that are needed every year.

An outside supplier has offered to make the part and sell it to the company for $28.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $22,000 of these allocated general overhead costs would be avoided.

Required:

a. Prepare a report that shows the financial impact of buying part U67 from the supplier rather than continuing to make it inside the company.

b. Which alternative should the company choose?

An outside supplier has offered to make the part and sell it to the company for $28.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $22,000 of these allocated general overhead costs would be avoided.

Required:

a. Prepare a report that shows the financial impact of buying part U67 from the supplier rather than continuing to make it inside the company.

b. Which alternative should the company choose?

(Essay)

4.8/5  (42)

(42)

Weitman Corporation manufactures numerous products, one of which is called Epsilon-50. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

(Multiple Choice)

4.9/5  (38)

(38)

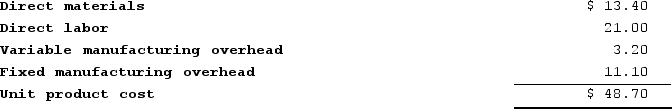

Foto Company makes 12,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

(Essay)

4.8/5  (37)

(37)

The Tolar Corporation has 500 obsolete desk calculators that are carried in inventory at a total cost of $720,000. If these calculators are upgraded at a total cost of $190,000, they can be sold for a total of $250,000. As an alternative, the calculators can be sold in their present condition for $50,000.Assume that Tolar decides to upgrade the calculators. At what selling price per unit would the company be as well off as if it just sold the calculators in their present condition?

(Multiple Choice)

4.7/5  (35)

(35)

Boggess Corporation manufactures numerous products, one of which is called Alpha-41. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. How many units of product Alpha-41 would Boggess need to sell at a price of $94.60 to earn the same net operating income that it currently earns at a price of $86.00? (Round your answer up to the nearest whole number.)

Assume that the total traceable fixed expense does not change. How many units of product Alpha-41 would Boggess need to sell at a price of $94.60 to earn the same net operating income that it currently earns at a price of $86.00? (Round your answer up to the nearest whole number.)

(Multiple Choice)

4.9/5  (39)

(39)

Ludy Mechanical Corporation has developed a new industrial grinder-model YS-48-that has been designed to outperform a competitor's best-selling industrial grinder. Model YS-48 has a useful life of 100,000 hours of service and its operating cost is $0.90 per hour. In contrast, the competitor's product has a useful life of 20,000 hours of service and has operating costs that average $1.50 per hour. The competitor's industrial grinder sells for $169,000. Ludy has not yet established a selling price for model YS-48.From a value-based pricing standpoint what is the differentiation value offered by YS-48 relative to the competitor's offering for each 100,000 hours of service?

(Multiple Choice)

4.9/5  (37)

(37)

The management of Rademacher Corporation is considering introducing a new product--a compact lawn blower. At a selling price of $27 per unit, management projects sales of 30,450 units. The lawn blower would require an investment of $203,000. The desired return on investment is 12%.The target cost per lawn blower is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

Target costing involves adding a target profit per unit to actual unit cost to determine the selling price.

(True/False)

4.8/5  (36)

(36)

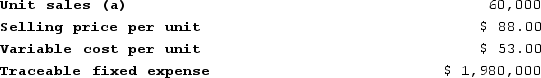

Eastwood Corporation manufactures numerous products, one of which is called Beta96. The company has provided the following data about this product:  Management is considering decreasing the price of Beta96 by 8%, from $88.00 to $80.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta96 earn at a price of $80.96 if this sales forecast is correct?

Management is considering decreasing the price of Beta96 by 8%, from $88.00 to $80.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta96 earn at a price of $80.96 if this sales forecast is correct?

(Multiple Choice)

4.9/5  (36)

(36)

A study has been conducted to determine if one of the departments in Carry Corporation should be discontinued. The contribution margin in the department is $80,000 per year. Fixed expenses charged to the department are $95,000 per year. It is estimated that $50,000 of these fixed expenses could be eliminated if the department is discontinued. These data indicate that if the department is discontinued, the yearly financial advantage (disadvantage) for the company would be:

(Multiple Choice)

4.9/5  (41)

(41)

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.How much of the unit product cost of $54.90 is relevant in the decision of whether to make or buy the part? (Round your intermediate calculations to 2 decimal places.)

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.How much of the unit product cost of $54.90 is relevant in the decision of whether to make or buy the part? (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (42)

(42)

In a sell or process further decision, consider the following costs:A variable production cost incurred prior to split-off.A variable production cost incurred after split-off.An avoidable fixed production cost incurred after split-off.Which of the above costs is (are) not relevant in a decision regarding whether the product should be processed further?

(Multiple Choice)

4.8/5  (34)

(34)

The management of Furrow Corporation is considering dropping product L07E. Data from the company's budget for the upcoming year appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $186,000 of the fixed manufacturing expenses and $106,000 of the fixed selling and administrative expenses are avoidable if product L07E is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $186,000 of the fixed manufacturing expenses and $106,000 of the fixed selling and administrative expenses are avoidable if product L07E is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

(Multiple Choice)

4.8/5  (42)

(42)

Companies that use value-based pricing establish selling prices based on the economic value of the benefits that their products and services provide to customers.

(True/False)

4.8/5  (38)

(38)

Hennig Plastics Equipment Corporation has developed a new injection mold-model XP-30-that has been designed to outperform a competitor's best-selling injection mold. Model XP-30 has a useful life of 70,000 hours of service and its operating cost is $0.80 per hour. In contrast, the competitor's product has a useful life of 35,000 hours of service and has operating costs that average $1.10 per hour. The competitor's injection mold sells for $151,000. Hennig has not yet established a selling price for model XP-30. From a value-based pricing standpoint what is XP-30's economic value to the customer over its 70,000 hour useful life?

(Multiple Choice)

4.7/5  (35)

(35)

Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $18, computed as follows:  An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 201 - 220 of 432

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)