Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

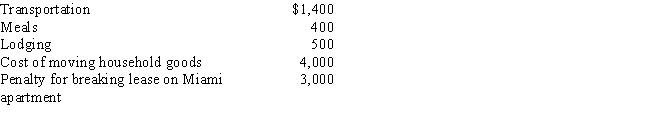

Due to a merger, Allison transfers from Miami to Chicago. Under a new job description, she is reclassified from employee to independent contractor status. Her moving expenses, which are not reimbursed, are as follows:

Allison's deductible moving expense is:

Allison's deductible moving expense is:

(Multiple Choice)

4.9/5  (38)

(38)

After she finishes working at her main job, Ann returns home, has dinner, then drives to her second job. Ann may deduct the mileage between her first and second job.

(True/False)

4.9/5  (39)

(39)

During 2017, Eva used her car as follows: 12,000 miles (business), 1,400 miles (commuting), and 4,000 miles (personal). In addition, she spent $440 for tolls (business) and $620 for parking (business). If Eva uses the automatic mileage method, what is the amount of her deduction?

(Essay)

4.8/5  (44)

(44)

In May 2017, after 11 months on a new job, Ken is fired after he assaults a customer. Ken must include in his gross income for 2017 any deduction for moving expenses he may have claimed on his 2016 tax return.

(True/False)

4.8/5  (32)

(32)

Logan, Caden, and Olivia are three unrelated parties who claim the standard deduction. All are married and attend Citron University and each pays tuition of $6,100. Of this payment, Logan can claim a deduction of $4,000; Caden a deduction of $2,000; and Olivia no deduction at all. Explain.

(Essay)

4.8/5  (39)

(39)

In choosing between the actual expense method and the automatic mileage method, a taxpayer should consider the cost of insurance on the automobile.

(True/False)

4.9/5  (36)

(36)

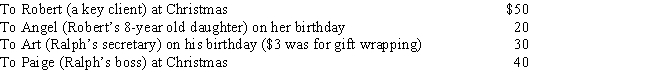

Ralph made the following business gifts during the year.

Presuming proper substantiation, Ralph's deduction is:

Presuming proper substantiation, Ralph's deduction is:

(Multiple Choice)

4.8/5  (31)

(31)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Must involve the same trade or business

b.Must be for the convenience of the employer

c.Meals while in route

d.Lodging while in route

e.Out-of-town job assignment lasts for more than one year

f.Can include actual cost of parking

g.Payment for services rendered based on tasks performed

h.Excludes use of MACRS depreciation

i.Taxpayer has tools and helper provided for him

j.Transportation must be allocated if taxpayer spends two weeks on business and one week sightseeing

k.Paralegal obtains a law degree

l.Correct match not provided

-Automatic mileage method

(Short Answer)

4.9/5  (25)

(25)

Under the regular (actual expense) method, the portion of the office in the home deduction that exceeds the income from the business can be carried over to future years.

(True/False)

4.8/5  (47)

(47)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Cutback adjustment applies

(Short Answer)

4.8/5  (32)

(32)

Elsie lives and works in Detroit. She is the regional sales manager for a national fast-food chain. Due to unusual developments, she is compelled to work six straight weeks in the Cleveland area. Instead of spending the weekend there, she flies home every Friday night and returns early Monday morning. The cost of coming home for the weekend approximates $600. Had she stayed in Cleveland, deductible meals and lodging would have been $700. How much, if any, may Elsie deduct as to each weekend?

(Essay)

4.8/5  (39)

(39)

In contrasting the reporting procedures of employees and self-employed persons regarding job-related transactions, which of the following items involve self-employed?

(Multiple Choice)

4.7/5  (37)

(37)

During the year, Walt travels from Seattle to Tokyo (Japan) on business. His time was spent as follows: 2 days travel (one day each way), 2 days business, and 2 days personal. His expenses for the trip were as follows (meals and lodging reflect only the business portion):

Presuming no reimbursement, Walt's deductible expenses are:

Presuming no reimbursement, Walt's deductible expenses are:

(Multiple Choice)

4.9/5  (34)

(34)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Must involve the same trade or business

b.Must be for the convenience of the employer

c.Meals while in route

d.Lodging while in route

e.Out-of-town job assignment lasts for more than one year

f.Can include actual cost of parking

g.Payment for services rendered based on tasks performed

h.Excludes use of MACRS depreciation

i.Taxpayer has tools and helper provided for him

j.Transportation must be allocated if taxpayer spends two weeks on business and one week sightseeing

k.Paralegal obtains a law degree

l.Correct match not provided

-Deduction by an employee of unreimbursed office-in-the-home expenses

(Short Answer)

5.0/5  (34)

(34)

Jacob is a landscape architect who works out of his home. He wonders whether or not he will have nondeductible commuting expenses when he drives to the locations of his clients. Please comment.

(Essay)

4.8/5  (29)

(29)

Marvin lives with his family in Alabama. He has two jobs: one in Alabama and one in North Carolina. Marvin's tax home is where he lives (Alabama).

(True/False)

4.9/5  (46)

(46)

Ethan, a bachelor with no immediate family, uses the Pine Shadows Country Club exclusively for his business entertaining. All of Ethan's annual dues for his club membership are deductible.

(True/False)

4.8/5  (38)

(38)

Mallard Corporation pays for a trip to Aruba for its two top salespersons. This expense is subject to the cutback adjustment.

(True/False)

4.9/5  (37)

(37)

Felicia, a recent college graduate, is employed as an accountant by an oil company. She would like to continue her education and obtain a law degree. Discuss Felicia's tax status if she attends a local law school on a:

a.Part-time basis.

b.Full-time basis.

(Essay)

4.8/5  (29)

(29)

Showing 21 - 40 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)