Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Ashley and Matthew are husband and wife and both are practicing CPAs. On a joint return, Ashley gets to deduct her professional dues but Matthew does not. Explain.

(Essay)

4.9/5  (38)

(38)

A taxpayer who maintains an office in the home to conduct his only business will not have nondeductible commuting expense.

(True/False)

4.8/5  (37)

(37)

Frank, a recently retired FBI agent, pays job search expenses to obtain a position with a city police department. Frank's job search expenses do qualify as deductions.

(True/False)

4.8/5  (49)

(49)

During the year, Sophie went from Omaha to Lima (Peru) on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's unreimbursed expenses are:

Sophie's deductible expenses are:

Sophie's deductible expenses are:

(Multiple Choice)

4.8/5  (36)

(36)

Regarding tax favored retirement plans for employees and self-employed persons, comment on the following:

a.The exclusion versus deduction approaches as to contributions by participants.

b.Tax-free accumulation of earnings.

c.The deferral of income tax consequences.

d.Employee versus self-employed status.

(Essay)

4.9/5  (43)

(43)

Once the actual cost method is used, a taxpayer cannot change to the automatic mileage method in a later year.

(True/False)

4.8/5  (33)

(33)

Paul is employed as an auditor by a CPA firm. On most days, he commutes by auto from his home to the office. During one month, however, he has an extensive audit assignment closer to home. For this engagement, Paul drives directly from home to the client's premises and back. Mileage information is summarized below:

If Paul spends 20 days on the audit, what is his deductible mileage?

(Short Answer)

4.8/5  (40)

(40)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Club dues deductible

(Short Answer)

4.8/5  (37)

(37)

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue uses her own helpers.

(Short Answer)

4.8/5  (37)

(37)

After graduating from college with a degree in chemistry, Alberto obtains a job as a chemist with DuPont. Alberto's job search expenses qualify as deductions.

(True/False)

4.8/5  (39)

(39)

The § 222 deduction for tuition and related expenses is available:

(Multiple Choice)

4.8/5  (33)

(33)

How are combined business/pleasure trips treated for travel within the United States as opposed to foreign travel?

(Essay)

4.9/5  (37)

(37)

Faith just graduated from college and she needs advice on the tax treatment of the costs she incurs in connection with her first job (a sales person for a pharmaceutical company). Specifically, she wants to know about the following items:

a.Job search costs.

b.Business wardrobe cost.

c.Moving expenses.

d.Deduction for office in the home.

(Essay)

4.7/5  (45)

(45)

As to meeting the time test for purposes of deducting moving expenses, which of the following statements is correct?

(Multiple Choice)

4.7/5  (35)

(35)

Lily went from her office in Portland to Lisbon, Portugal on business. While there, she spent part of the time on vacation. How much of the air fare of $5,000 can she deduct based on the following assumptions:

a.Lily was gone five days (i.e., three business and two personal).

b.Lily was gone five weeks (i.e., four business and one personal).

c.Lily was gone five weeks (i.e., three business and two personal).

(Essay)

4.8/5  (34)

(34)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Deemed substantiation

(Short Answer)

4.9/5  (42)

(42)

Which of the following expenses, if any, qualify as deductible?

(Multiple Choice)

4.9/5  (47)

(47)

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue files a Form 2106 with her Form 1040.

(Short Answer)

5.0/5  (30)

(30)

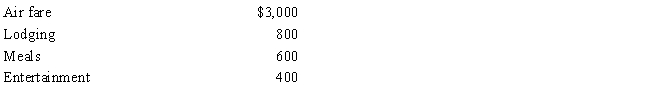

Noah moved from Delaware to Arizona to accept a better job. He incurred the following unreimbursed moving expenses:

What is Noah's moving expense deduction?

What is Noah's moving expense deduction?

(Essay)

4.9/5  (32)

(32)

In the case of an office in the home deduction, the exclusive business use test does not apply when the home is used as a daycare center.

(True/False)

4.9/5  (48)

(48)

Showing 61 - 80 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)