Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

Under current U.S. GAAP, the temporal method and the monetary-nonmonetary method produce the same results.

(True/False)

4.8/5  (45)

(45)

A factor to be considered in determining a foreign unit's functional currency is whether inventory is purchased from the parent company versus unrelated vendors located in the United States.

(True/False)

4.7/5  (41)

(41)

When the temporal method is used, any exchange rate change adjustment to a parent's long-term intercompany receivable from (or payable to) its foreign subsidiary is reported currently in earnings-regardless of whether the amount is expected to be paid in the foreseeable future.

(True/False)

5.0/5  (43)

(43)

_____ Panex owns 100% of the outstanding common stock of Sanex, a foreign subsidiary located in a country having a 20% income tax rate and a 5% dividend withholding tax. For 2006, Sanex reported net income of $600,000 and paid dividends of $300,000. Concerning the 2006 undistributed earnings of $300,000, Panex's intent is to have Sanex (a) distribute $200,000 as dividends when cash becomes available and (b) reinvest $100,000 indefinitely (to be used for internal expansion). Assume a 40% U.S. income tax rate. How much income tax expense will be recorded on Sanex's books for 2006?

(Multiple Choice)

4.7/5  (35)

(35)

Under FAS 52, it may be necessary in some cases to use the remeasurement process and then the translation process for a specific foreign unit.

(True/False)

4.8/5  (37)

(37)

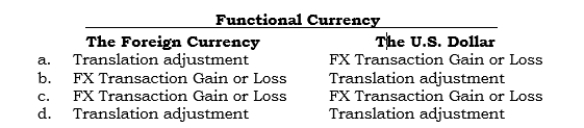

_____ What is the effect of an exchange rate change called in each of the following situations?

(Short Answer)

4.9/5  (40)

(40)

_____ For financial reporting purposes, parent companies must provide income taxes on their share of their foreign subsidiaries' earnings

(Multiple Choice)

4.8/5  (34)

(34)

A foreign subsidiary will not pay taxes to the U.S. government.

(True/False)

4.8/5  (43)

(43)

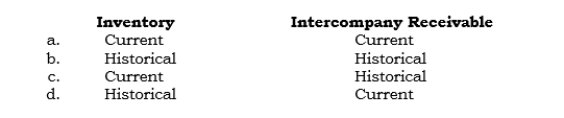

_____ Which exchange rates are used to express the following accounts in dollars under the temporal method of translation?

(Short Answer)

5.0/5  (36)

(36)

The disappearing plant problem does not occur under the PPP current-value approach.

(True/False)

4.8/5  (31)

(31)

Under the U.S. dollar unit of measure approach, monetary accounts are always translated at the current exchange rate.

(True/False)

4.9/5  (31)

(31)

The current-noncurrent method does not fit under the foreign currency unit of measure approach.

(True/False)

4.7/5  (42)

(42)

The temporal method is no more able to produce realistic results when high __________________ inflation is the dominant exchange rate change factor than the current rate method is able to produce reliable results when high _________________ inflation is the dominant exchange rate change factor.

(Short Answer)

4.8/5  (43)

(43)

_____ Pindax owns 100% of the outstanding common stock of Sindax, a foreign subsidiary located in a country having a 25% income tax rate and a 5% dividend withholding tax. For 2006, Sindax reported net income of $300,000 and paid dividends of $300,000. Pindax's income tax rate is 40%. How much should Pindax record on its books in 2006 for income tax expense pertaining to Sindax's 2006 earnings?

(Multiple Choice)

4.8/5  (31)

(31)

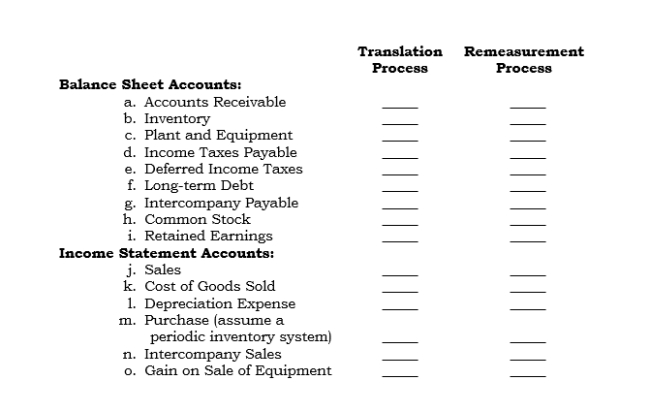

Indicate which of the following exchange rates would be used to translate or remeasure the accounts listed below.

Code

C = Current rate (at balance sheet date)

C-R = Current rate (when recognized in the income statement)

H = Historical rate

A = Average rate (for the year)

R = Reciprocal amount

O = Other (explain this one)

N/A = Not applicable

(Essay)

4.7/5  (28)

(28)

The accounting for the gain or loss on the hedging of a net investment position depends on whether the foreign currency or the U.S. dollar is the foreign unit's functional currency.

(True/False)

4.7/5  (40)

(40)

_____ On 1/1/06, a foreign unit of a domestic company acquired a parcel of land at a cost of 100,000 LCUs. During 2006, the inflation rate in the foreign country was 20%. The direct exchange rate was $.60 on 1/1/06 and $.52 on 12/31/06. At what amount would the land be expressed in dollars in the 12/31/06 translated balance sheet under the temporal method of translation?

(Multiple Choice)

4.8/5  (42)

(42)

If foreign inflation exceeds domestic inflation, the direct exchange rate should increase under PPP theory.

(True/False)

4.9/5  (36)

(36)

_____ Paltex's foreign subsidiary reported depreciation expense for 2007 of 250,000 LCUs (100,000 LCUs pertain to equipment acquired in 2007, when the exchange rate was $1 = 8 LCUs, and 150,000 LCUs pertain to equipment acquired in 2007, when the exchange rate was $1 = 6 LCUs). For 2007, the average exchange rate was $1 = 5 LCUs, and the year-end exchange rate was $1 = 4 LCUs. If the U.S. dollar is the functional currency, what amount should be reported for depreciation expense in dollars?

(Multiple Choice)

4.7/5  (34)

(34)

Under FAS 52, a highly inflationary economy is defined as one that has inflation of more than 100% annually.

(True/False)

4.9/5  (34)

(34)

Showing 161 - 180 of 231

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)