Exam 14: Using Derivatives to Manage Foreign Currency Exposures

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

Adjustments to FX forwards at intervening financial reporting dates are ____________________________________ FX gains and losses.

(Short Answer)

4.9/5  (48)

(48)

Hedging an investment in a foreign subsidiary is a _______________________ hedge.

(Short Answer)

5.0/5  (38)

(38)

_____ Concerning FX forwards, which of the following statements is true?

(Multiple Choice)

4.8/5  (38)

(38)

Derivative financial instruments are contracts that create rights but not obligations.

(True/False)

4.8/5  (40)

(40)

_____ Which of the following is not a unique characteristic of forward-based derivative financial instruments?

(Multiple Choice)

4.7/5  (38)

(38)

Hedging a forecasted transaction is generally a __________________________ hedge.

(Short Answer)

4.9/5  (43)

(43)

In a cash flow hedge, the concern is that an adverse cash flow result will occur on a forecasted transaction.

(True/False)

4.9/5  (25)

(25)

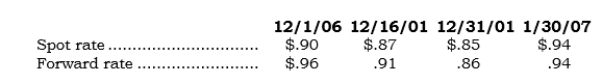

On 12/1/06, Purorc ordered machinery (under a noncancelable purchase order) from a Dutch vendor. The contract price was 1,000,000 euros. Concurrently, Purorc entered into a 60-day FX forward to buy 1,000,000 euros at the forward rate of $.96. Purorc took delivery of the machinery on 12/16/06 and paid the vendor on 1/30/07 via a bank wire transfer. Direct exchange rates for euros are as follows:

Required:

a. Prepare a partial balance sheet for Purorc at 12/31/06. (Be sure to include the machine as a fixed asset.)

b. Prepare a partial income statement for Purorc for 2006.

Required:

a. Prepare a partial balance sheet for Purorc at 12/31/06. (Be sure to include the machine as a fixed asset.)

b. Prepare a partial income statement for Purorc for 2006.

(Essay)

4.9/5  (40)

(40)

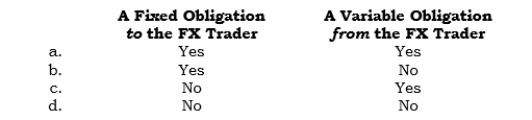

_____ A domestic company wishes to hedge an FX receivable arising from an exporting transaction denominated in a foreign currency using an FX forward. Concerning only the hedging transaction, the domestic company will have which of the following accounts if the company (contrary to actual practice) chooses to record the contractual obligations in the general ledger at the inception of the FX forward?

(Multiple Choice)

4.7/5  (36)

(36)

Hedging a firm commitment is generally a __________________________ hedge.

(Short Answer)

4.9/5  (44)

(44)

_____ In a derivative, "off-balance-sheet risk" is a component of which of the following risks?

(Multiple Choice)

4.9/5  (34)

(34)

An option to buy is a(n) _____________________________________. An option to sell is a(n) ____________________________________.

(Short Answer)

4.9/5  (33)

(33)

FX gains and losses on fair value hedges are reported in ______________________ when they arise.

(Short Answer)

4.9/5  (33)

(33)

_____ FX gains and losses on cash flow hedges are reported in earnings when

(Multiple Choice)

4.8/5  (36)

(36)

_____ In an FX forward entered into for hedging an exposed receivable, the exporter (from a dollar perspective) has

(Short Answer)

4.9/5  (40)

(40)

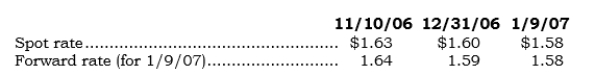

_____ On 11/10/06, Selmax entered into a 60-day FX forward involving 100,000 British pounds to hedge a firm sales commitment. Selmax shipped the inventory on l/9/07. Direct exchange rates on the respective dates are as follows:

What is the FX gain or loss to be reported in earnings for 2006 on the FX forward?

What is the FX gain or loss to be reported in earnings for 2006 on the FX forward?

(Multiple Choice)

4.9/5  (38)

(38)

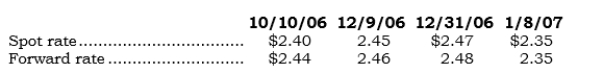

_____ On 10/10/06, Selcor entered into a noncancellable sales agreement with a foreign customer to sell a custom-made machine. Selcor delivered the machine on 12/9/06 (60 days later). The sales price was 100,000 LCUs, which Selcor received on 1/8/07 (30 days after delivery). Direct exchange rates on the respective dates are as follows:

Also on 10/10/06, Selcor entered into a 90-day FX forward to sell 100,000 LCUs. What should be the recorded sales price of the equipment?

Also on 10/10/06, Selcor entered into a 90-day FX forward to sell 100,000 LCUs. What should be the recorded sales price of the equipment?

(Multiple Choice)

4.8/5  (34)

(34)

_____ On 1/1/06, Callex purchased a 1-year at-the-money FX call option from an FX trader involving 2,000,000 French euros at a cost of $16,000. The exercise price was $.25. The option was obtained to hedge Callex's budgeted 2006 import purchases from French vendors. Actual purchases from French vendors for the first three months of 2006 were 500,000 euros. At 3/31/06, the direct spot rate was $.292 and the option's market value was $96,000. What amount is reported in Other Comprehensive Income at 3/31/06 assuming that Callex has resold 50% of the inventory received in the first quarter?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 101 - 120 of 256

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)