Exam 23: Options, Caps, Floors, and Collars

Exam 1: Why Are Financial Institutions Special90 Questions

Exam 2: Deposit-Taking Institutions43 Questions

Exam 3: Finance Companies71 Questions

Exam 4: Securities, Brokerage, and Investment Banking91 Questions

Exam 5: Mutual Funds, Hedge Funds, and Pension Funds61 Questions

Exam 6: Insurance Companies80 Questions

Exam 7: Risks of Financial Institutions110 Questions

Exam 8: Interest Rate Risk I110 Questions

Exam 9: Interest Rate Risk II116 Questions

Exam 10: Credit Risk: Individual Loans112 Questions

Exam 11: Credit Risk: Loan Portfolio and Concentration Risk51 Questions

Exam 12: Liquidity Risk85 Questions

Exam 13: Foreign Exchange Risk87 Questions

Exam 14: Sovereign Risk89 Questions

Exam 15: Market Risk95 Questions

Exam 16: Off-Balance-Sheet Risk101 Questions

Exam 17: Technology and Other Operational Risks107 Questions

Exam 18: Liability and Liquidity Management38 Questions

Exam 19: Deposit Insurance and Other Liability Guarantees54 Questions

Exam 20: Capital Adequacy102 Questions

Exam 21: Product and Geographic Expansion114 Questions

Exam 22: Futures and Forwards234 Questions

Exam 23: Options, Caps, Floors, and Collars113 Questions

Exam 24: Swaps95 Questions

Exam 25: Loan Sales83 Questions

Exam 26: Securitization Index98 Questions

Select questions type

A naked option is an option written that has no identifiable underlying asset or liability position.

(True/False)

4.9/5  (31)

(31)

Regulators tend to discourage, and even prohibit in some cases, FIs from writing options because the upside potential is unlimited and the downside losses are potentially limited.

(True/False)

4.9/5  (35)

(35)

The premium on a credit spread call option is the maximum loss attainable to the buyer of the option in situations where the credit spread increases.

(True/False)

4.7/5  (31)

(31)

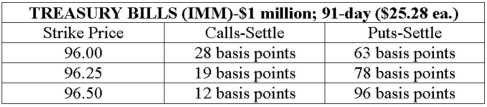

A bank with total assets of $271 million and equity of $31 million has a leverage adjusted duration gap of +0.21 years. Use the following quotation from the Wall Street Journal to construct an at-the-money futures option hedge of the bank's duration gap position.  If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

(Multiple Choice)

4.8/5  (43)

(43)

The payoff values on bond options are positively linked to the changes in interest rates.

(True/False)

4.9/5  (30)

(30)

A digital default option pays a stated amount in the event that a portion of the loan is not paid.

(True/False)

4.7/5  (30)

(30)

Simultaneously buying a bond and a put option on a bond produces the same payoff as buying a call option on a bond.

(True/False)

4.9/5  (42)

(42)

The payoffs on bond call options move symmetrically with changes in interest rates.

(True/False)

4.7/5  (38)

(38)

Options become more valuable as the variability of interest rates decreases.

(True/False)

4.8/5  (43)

(43)

The purchase often of a series of put options with multiple exercise dates results in a

(Multiple Choice)

4.8/5  (34)

(34)

Buying a cap is like buying insurance against a decrease in interest rates.

(True/False)

4.8/5  (36)

(36)

As interest rates increase, the writer of a bond call option stands to make

(Multiple Choice)

4.9/5  (33)

(33)

Allright Insurance has total assets of $140 million consisting of $50 million in 2-year, 6 percent Treasury notes and $90 million in 10-year, 7.2 percent fixed-rate Baa bonds. These assets are funded by $100 million 5-year, 5 percent fixed rate GICs and equity. Market interest rates are expected to increase 1 percent to 11 percent in the next year. If this occurs, what will be the effect on the market value of equity of Allright?

(Multiple Choice)

4.8/5  (38)

(38)

A contract that results in the delivery of a futures contract when exercised is a

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following holds true for the writer of a bond call option if interest rates decrease?

(Multiple Choice)

4.8/5  (26)

(26)

Assume a binomial pricing model where there is an equal probability of interest rates increasing or decreasing 1 percent per year. What should be the price of a three-year 6 percent cap if the current (spot) rates are also 6 percent? The face value is $5,000,000, and time periods are zero, one, and two.

(Multiple Choice)

4.7/5  (34)

(34)

Exercise of a put option on interest rate futures by the buyer of the option results in the buyer putting to the writer the bond futures contract at an exercise price higher than the currently trading bond future.

(True/False)

4.9/5  (32)

(32)

Showing 61 - 80 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)