Exam 6: Capital Allocation to Risky Assets

Exam 1: The Investment Environment58 Questions

Exam 2: Asset Classes and Financial Instruments86 Questions

Exam 3: How Securities Are Traded69 Questions

Exam 4: Mutual Funds and Other Investment Companies72 Questions

Exam 5: Risk, Return, and the Historical Record85 Questions

Exam 6: Capital Allocation to Risky Assets70 Questions

Exam 7: Optimal Risky Portfolios80 Questions

Exam 8: Index Models87 Questions

Exam 9: The Capital Asset Pricing Model83 Questions

Exam 10: Arbitrage Pricing Theory and Multifactor Models of Risk and Return80 Questions

Exam 11: The Efficient Market Hypothesis71 Questions

Exam 12: Behavioral Finance and Technical Analysis54 Questions

Exam 13: Empirical Evidence on Security Returns56 Questions

Exam 14: Bond Prices and Yields129 Questions

Exam 15: The Term Structure of Interest Rates49 Questions

Exam 16: Managing Bond Portfolios84 Questions

Exam 17: Macroeconomic and Industry Analysis90 Questions

Exam 18: Equity Valuation Models130 Questions

Exam 19: Financial Statement Analysis91 Questions

Exam 20: Options Markets: Introduction108 Questions

Exam 21: Option Valuation90 Questions

Exam 22: Futures Markets91 Questions

Exam 23: Futures, Swaps, and Risk Management56 Questions

Exam 24: Portfolio Performance Evaluation83 Questions

Exam 25: International Diversification52 Questions

Exam 26: Hedge Funds49 Questions

Exam 27: The Theory of Active Portfolio Management50 Questions

Exam 28: Investment Policy and the Framework of the Cfa Institute83 Questions

Select questions type

According to the mean-variance criterion, which one of the following investments dominates all others

(Multiple Choice)

4.8/5  (36)

(36)

Treasury bills are commonly viewed as risk-free assets because

(Multiple Choice)

4.7/5  (46)

(46)

When an investment advisor attempts to determine an investor's risk tolerance, which factor would they be least likely to assess

(Multiple Choice)

4.8/5  (43)

(43)

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. A portfolio that has an expected outcome of $114 is formed by

(Multiple Choice)

4.9/5  (39)

(39)

In the mean-standard deviation graph, which one of the following statements is true regarding the indifference curve of a risk-averse investor

(Multiple Choice)

4.9/5  (42)

(42)

In the mean-standard deviation graph, the line that connects the risk-free rate and the optimal risky portfolio, P, is called

(Multiple Choice)

4.8/5  (42)

(42)

The capital market line I) is a special case of the capital allocation line.

II) represents the opportunity set of a passive investment strategy.

III) has the one-month T-Bill rate as its intercept.

IV) uses a broad index of common stocks as its risky portfolio.

(Multiple Choice)

4.9/5  (34)

(34)

The optimal proportion of the risky asset in the complete portfolio is given by the equation y* = [E(rP) - rf]/(.01A times the variance of P).For each of the variables on the right side of the equation, discuss the impact of the variable's effect on y* and why the nature of the relationship makes sense intuitively.Assume the investor is risk averse.

(Essay)

4.8/5  (39)

(39)

In a return-standard deviation space, which of the following statements is(are) true for risk-averse investors (The vertical and horizontal lines are referred to as the expected return-axis and the standard deviation-axis, respectively.)

I. An investor's own indifference curves might intersect.

II. Indifference curves have negative slopes.

III. In a set of indifference curves, the highest offers the greatest utility.

IV. Indifference curves of two investors might intersect.

(Multiple Choice)

4.9/5  (34)

(34)

Steve is more risk-averse than Edie.On a graph that shows Steve and Edie's indifference curves, which of the following is true Assume that the graph shows expected return on the vertical axis and standard deviation on the horizontal axis.

I. Steve and Edie's indifference curves might intersect.

II. Steve's indifference curves will have flatter slopes than Edie's.

III. Steve's indifference curves will have steeper slopes than Edie's.

IV. Steve and Edie's indifference curves will not intersect.

V. Steve's indifference curves will be downward sloping and Edie's will be upward sloping.

(Multiple Choice)

4.9/5  (48)

(48)

Assume an investor with the following utility function: U = E(r) - 3/2(s2). To maximize her expected utility, she would choose the asset with an expected rate of return of _______ and a standard deviation of ________, respectively.

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following statements regarding the capital allocation line (CAL) is false

(Multiple Choice)

4.9/5  (37)

(37)

Given the capital allocation line, an investor's optimal portfolio is the portfolio that

(Multiple Choice)

4.8/5  (34)

(34)

An investor invests 70% of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.04 and 30% in a T-bill that pays 5%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

(Multiple Choice)

4.8/5  (38)

(38)

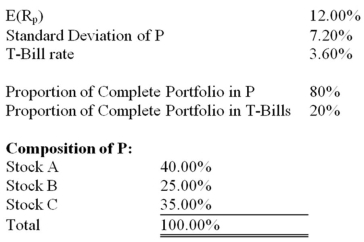

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the equation of Bo's capital allocation line

What is the equation of Bo's capital allocation line

(Multiple Choice)

4.9/5  (37)

(37)

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y.The weights of X and Y in P are 0.60 and 0.40, respectively.X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. If you want to form a portfolio with an expected rate of return of 0.11, what percentages of your money must you invest in the T-bill and P, respectively

(Multiple Choice)

4.9/5  (37)

(37)

Showing 21 - 40 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)