Exam 2: Analyzing and Recording Transactions

Exam 1: Accounting in Business241 Questions

Exam 2: Analyzing and Recording Transactions188 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements213 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Cash and Internal Controls193 Questions

Exam 9: Accounting for Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles216 Questions

Exam 11: Current Liabilities and Payroll Accounting194 Questions

Exam 12: Accounting for Partnerships133 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities199 Questions

Exam 15: Investments and International Operations175 Questions

Exam 16: Reporting the Statement of Cash Flows178 Questions

Exam 17: Analysis of Financial Statements178 Questions

Exam 18: Managerial Accounting Concepts and Principles203 Questions

Exam 19: Job Order Costing160 Questions

Exam 20: Process Costing156 Questions

Exam 21: Cost-Volume-Profit Analysis180 Questions

Exam 22: Master Budgets and Planning153 Questions

Exam 23: Flexible Budgets and Standard Costs168 Questions

Exam 24: Performance Measurement and Responsibility Accounting163 Questions

Exam 25: Capital Budgeting and Managerial Decisions131 Questions

Exam 26: Time Value of Money B60 Questions

Exam 27: Activity-Based Costing C37 Questions

Select questions type

A company had total assets of $350,000 and total liabilities of $101,500 and total equity of $248,500.Calculate its debt ratio.

(Essay)

4.9/5  (35)

(35)

A ____________ gives a complete record of each transaction in one place,and shows debits and credits for each transaction.

(Short Answer)

4.9/5  (40)

(40)

Asset accounts normally have credit balances and revenue accounts normally have debit balances.

(True/False)

4.7/5  (43)

(43)

Hal Smith opened Smith's Repairs on March 1 of the current year.During March,the following transactions occurred and were recorded in the company's books:

1)Smith invested $25,000 cash in the business.

2)Smith contributed $100,000 of equipment to the business.

3)The company paid $2,000 cash to rent office space for the month.

4)The company received $16,000 cash for repair services provided during March.

5)The company paid $6,200 for salaries for the month.

6)The company provided $3,000 of services to customers on account.

7)The company paid cash of $500 for monthly utilities.

8)The company received $3,100 cash in advance of providing repair services to a customer.

9)Smith withdrew $5,000 for his personal use from the company.

Based on this information,net income for March would be:

(Multiple Choice)

4.8/5  (35)

(35)

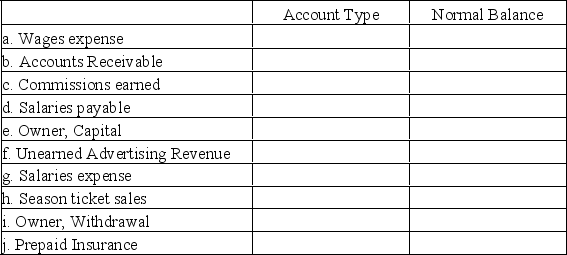

For each of the following (1)identify the type of account as an asset,liability,equity,revenue,or expense,and (2)identify the normal balance of the account.

(Essay)

4.9/5  (40)

(40)

If a company purchases land paying cash,the journal entry to record this transaction will include a debit to Cash.

(True/False)

4.9/5  (36)

(36)

A $15 credit to Sales was posted as a $150 credit.By what amount is Sales in error?

(Multiple Choice)

4.7/5  (30)

(30)

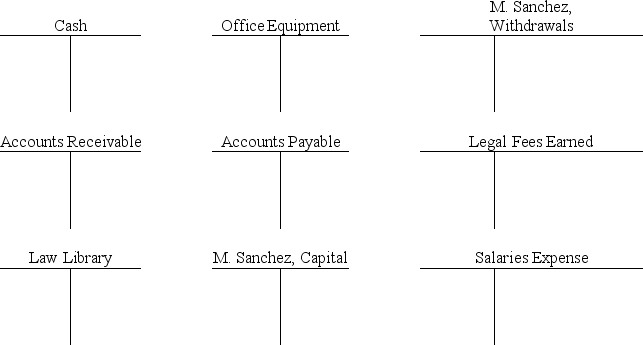

Maria Sanchez began business as Sanchez Law Firm on November 1.Record the following November transactions by making entries directly to the T-accounts provided.Then,prepare a trial balance,as of November 30.

a)Sanchez invested $15,000 cash and a law library valued at $6,000.

b)Purchased $7,500 of office equipment from Johnson Bros.on credit.

c)Completed legal work for a client and received $1,500 cash in full payment.

d)Paid Johnson Bros.$3,500 cash in partial settlement of the amount owed.

e)Completed $4,000 of legal work for a client on credit.

f)Sanchez withdrew $2,000 cash for personal use.

g)Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h)Paid $2,500 cash for the legal secretary's salary.

(Essay)

4.8/5  (42)

(42)

The following transactions occurred during July:

1)Received $900 cash for services provided to a customer during July.

2)Received $2,200 cash investment from Barbara Hanson,the owner of the business.

3)Received $750 from a customer in partial payment of his account receivable which arose from sales in June.

4)Provided services to a customer on credit,$375.

5)Borrowed $6,000 from the bank by signing a promissory note.

6)Received $1,250 cash from a customer for services to be rendered next year.

What was the amount of revenue for July?

(Multiple Choice)

4.8/5  (36)

(36)

Dolly Barton began Barton Office Services in October and during that month completed these transactions:

a.Invested $10,000 cash,and $15,000 of computer equipment.

b.Paid $500 cash for an insurance premium covering the next 12 months.

c.Completed a word processing assignment for a customer and collected $1,000 cash.

d.Paid $200 cash for office supplies.

e.Paid $2,000 for October's rent.

Prepare journal entries to record the above transactions.Explanations are unnecessary.

(Essay)

4.9/5  (38)

(38)

Indicate whether a debit or credit entry would be made to record the following changes in each account.

a.To decrease Cash

b.To increase Owner,Capital

c.To decrease Accounts Payable.

d.To increase Salaries Expense.

e.To decrease Supplies.

f.To increase Revenue.

g.To decrease Accounts Receivable.

h.To increase Owner,Withdrawals.

(Essay)

4.9/5  (33)

(33)

Preparation of a trial balance is the first step in the analyzing and recording process.

(True/False)

4.7/5  (40)

(40)

The journal is known as the book of final entry because financial statements are prepared from it.

(True/False)

4.8/5  (37)

(37)

A formal promise to pay (in the form of a promissory note)a future amount is a(n):

(Multiple Choice)

5.0/5  (34)

(34)

The credit purchase of a delivery truck for $4,700 was posted to Delivery Trucks as a $4,700 debit and to Accounts Payable as a $4,700 debit.What effect would this error have on the trial balance?

(Multiple Choice)

4.8/5  (35)

(35)

Andrea Conaway opened Wonderland Photography on January 1 of the current year.During January,the following transactions occurred and were recorded in the company's books:

1)Conaway invested $13,500 cash in the business.

2)Conaway contributed $20,000 of photography equipment to the business.

3)The company paid $2,100 cash for an insurance policy covering the next 24 months.

4)The company received $5,700 cash for services provided during January.

5)The company purchased $6,200 of office equipment on credit.

6)The company provided $2,750 of services to customers on account.

7)The company paid cash of $1,500 for monthly rent.

8)The company paid $3,100 on the office equipment purchased in transaction #5 above.

9)Paid $275 cash for January utilities.

Based on this information,the balance in the cash account at the end of January would be:

(Multiple Choice)

4.8/5  (42)

(42)

The trial balance can serve as a replacement for the balance sheet,since debits must equal with credits.

(True/False)

4.8/5  (35)

(35)

Showing 61 - 80 of 188

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)