Exam 27: Activity-Based Costing C

Exam 1: Accounting in Business241 Questions

Exam 2: Analyzing and Recording Transactions188 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements213 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Cash and Internal Controls193 Questions

Exam 9: Accounting for Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles216 Questions

Exam 11: Current Liabilities and Payroll Accounting194 Questions

Exam 12: Accounting for Partnerships133 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities199 Questions

Exam 15: Investments and International Operations175 Questions

Exam 16: Reporting the Statement of Cash Flows178 Questions

Exam 17: Analysis of Financial Statements178 Questions

Exam 18: Managerial Accounting Concepts and Principles203 Questions

Exam 19: Job Order Costing160 Questions

Exam 20: Process Costing156 Questions

Exam 21: Cost-Volume-Profit Analysis180 Questions

Exam 22: Master Budgets and Planning153 Questions

Exam 23: Flexible Budgets and Standard Costs168 Questions

Exam 24: Performance Measurement and Responsibility Accounting163 Questions

Exam 25: Capital Budgeting and Managerial Decisions131 Questions

Exam 26: Time Value of Money B60 Questions

Exam 27: Activity-Based Costing C37 Questions

Select questions type

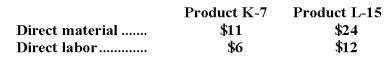

Cosgrove Company manufactures two products,Product K-7 and Product L-15.Product L-15 is of fairly recent origin,having been developed as an attempt to enter a market closely related to that of Product K-7.Product L-15 is the more complex of the two products,requiring 2.0 hours of direct labor time per unit to manufacture compared to 1.0 hour of direct labor time for Product K-7.Product L-15 is produced on an automated production line.

Overhead currently is applied to the products on the basis of direct labor-hours.The company estimated it would incur $510,000 in manufacturing overhead costs and produce 10,000 units of Product L-15 and 40,000 units of Product K- 7 during the current year.

Unit costs for materials and labor are:

Required:

a.Compute the predetermined overhead rate under the current method,and determine the unit product cost of each product for the current year.

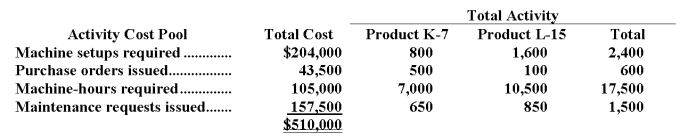

b.The company is considering the use of activity-based costing as an alternative to its traditional costing method for manufacturing overhead.Data relating to the company's activity cost pools for the current year are given below:

Required:

a.Compute the predetermined overhead rate under the current method,and determine the unit product cost of each product for the current year.

b.The company is considering the use of activity-based costing as an alternative to its traditional costing method for manufacturing overhead.Data relating to the company's activity cost pools for the current year are given below:

Using the data above,determine the unit product cost of each product for the current year.

c.What items of overhead cost make Product L-15 so costly to produce according to the activity-based costing system?

What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15?

Using the data above,determine the unit product cost of each product for the current year.

c.What items of overhead cost make Product L-15 so costly to produce according to the activity-based costing system?

What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15?

(Essay)

4.7/5  (40)

(40)

A system of assigning costs to departments and products on the basis of a variety of activities instead of only one allocation base is called:

(Multiple Choice)

4.9/5  (30)

(30)

In activity-based costing,there are a number of activity cost pools,each of which is allocated to products and other costing objects using its own unique measure of activity.

(True/False)

4.9/5  (37)

(37)

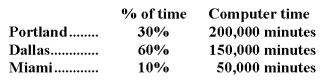

Reach Consulting Corporation has its headquarters in Chicago and operates from three branch offices in Portland,Dallas,and Miami.Two of the company's activity cost pools are General Service and Research Service.These costs are allocated to the three branch offices using an activity-based costing system.Information for next year follows:  Estimated branch data for next year is as follows:

Estimated branch data for next year is as follows:

How much of the headquarters cost allocation should Dallas expect to receive next year?

How much of the headquarters cost allocation should Dallas expect to receive next year?

(Multiple Choice)

4.9/5  (25)

(25)

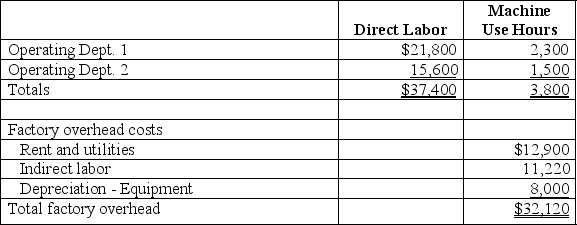

The following is taken from Ames Company's internal records of its factory with two operating departments.The cost driver for indirect labor is direct labor costs,and the cost driver for the remaining items is number of hours of machine use.Compute the total amount of overhead allocated to Dept.1 using activity-based costing.

(Multiple Choice)

4.8/5  (36)

(36)

A _________________ is a factor that causes the cost of an activity to go up and down.

(Short Answer)

5.0/5  (38)

(38)

An activity __________________ is a temporary account accumulating the costs a company incurs to support an identified set of activities.

(Short Answer)

4.9/5  (32)

(32)

In activity-based costing,some manufacturing costs may be excluded from product costs.

(True/False)

4.8/5  (32)

(32)

Activity-based costing can be especially effective in situations where many different products are manufactured in the same department or departments.

(True/False)

4.8/5  (40)

(40)

Which of the following is not a limitation of activity-based costing?

(Multiple Choice)

4.8/5  (36)

(36)

Activity-based costing is a costing method that is designed to provide managers with product cost information for external financial reports.

(True/False)

4.9/5  (35)

(35)

Activity cost pools are an important part of the allocation of overhead costs using activity-based costing.

(True/False)

4.9/5  (36)

(36)

An activity-based costing system usually involves a fewer number of allocations compared with a traditional cost allocation system.

(True/False)

4.9/5  (36)

(36)

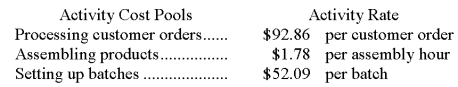

Activity rates from Quattrone Corporation's activity-based costing system are listed below.The company uses the activity rates to assign overhead costs to products:  Last year,Product F76D involved 2 customer orders,434 assembly hours,and 20 batches.How much overhead cost would be assigned to Product F76D using the activity-based costing system?

Last year,Product F76D involved 2 customer orders,434 assembly hours,and 20 batches.How much overhead cost would be assigned to Product F76D using the activity-based costing system?

(Multiple Choice)

4.8/5  (28)

(28)

Showing 21 - 37 of 37

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)