Exam 13: Comparative Forms of Doing Business

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

Aubrey has been operating his business as a C corporation for the past 5 years. The corporation pays him a reasonable salary. The profits of the corporation, after paying Federal income tax, are distributed to him each year as a dividend. He is considering electing S status for his corporation in order to avoid double taxation. What factors should he consider assuming after-tax earnings will continue to be distributed to him?

(Essay)

4.9/5  (31)

(31)

An S corporation has a lesser degree of limited liability than a C corporation.

(True/False)

4.8/5  (36)

(36)

Barb and Chuck each own one-half the stock of Wren, Inc., an S corporation. Each shareholder has a stock basis of $125,000. Wren has no accumulated E & P. Wren's taxable income for the current year is $90,000, and it distributes $60,000 to each shareholder. Barb's stock basis at the end of the year is:

(Multiple Choice)

4.9/5  (34)

(34)

A C corporation offers greater flexibility in terms of the types of owners and capital structure than an S corporation.

(True/False)

4.8/5  (38)

(38)

List some techniques which can be used to avoid and/or reduce double taxation for a C corporation.

(Essay)

4.8/5  (34)

(34)

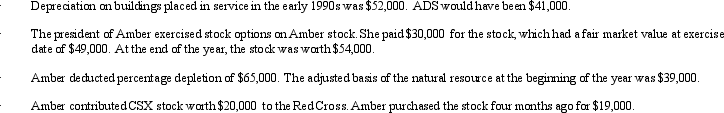

Amber, Inc., has taxable income of $212,000. In addition, Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

(Multiple Choice)

4.9/5  (41)

(41)

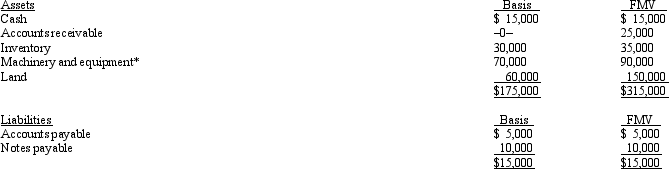

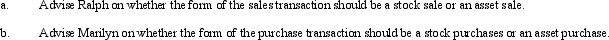

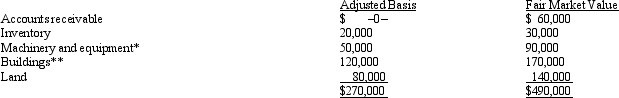

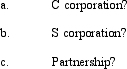

Ralph owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Ralph founded Silver 12 years ago. The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser, Marilyn, have agreed to a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser, Marilyn, have agreed to a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

(Essay)

4.9/5  (42)

(42)

Tonya contributes $150,000 to Swan, Inc., for 80% of the stock. In addition, she loans Swan $600,000. The maturity date on the loan is 5 years and the interest rate is 6%, the same as the Federal rate. Which of the following statements are correct?

(Multiple Choice)

4.8/5  (35)

(35)

Only C corporations are subject to the accumulated earnings tax (i.e., S corporations are not).

(True/False)

4.8/5  (36)

(36)

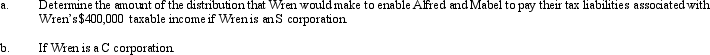

Wren, Inc. is owned by Alfred (30%) and Mabel (70%). Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%. Wren's taxable income for 2011 is $400,000.

(Essay)

4.7/5  (34)

(34)

Carol is a 60% owner of a business entity and has an adjusted basis in such interest of $60,000. For the current tax year, the entity has profits of $50,000. If the entity is a C corporation, the corporate profits have no effect on Carol's basis in her stock. However, if the entity is an S corporation, Carol's basis increases to $90,000 [$60,000 + (60% ´ $50,000)].

(True/False)

4.8/5  (45)

(45)

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

(Multiple Choice)

4.8/5  (32)

(32)

Barb and Chuck each own one-half of the stock of Wren, Inc., a C corporation. Each shareholder has a stock basis of $125,000. Wren has accumulated E & P of $200,000. Wren's taxable income for the current year is $90,000, and it distributes $60,000 to each shareholder. Barb's stock basis at the end of the year is:

(Multiple Choice)

4.8/5  (31)

(31)

Lime, Inc., has taxable income of $330,000. If Lime is a C corporation, its tax liability must be either $111,950 [($50,000 ´ 15%) + ($25,000 ´ 25%) + ($25,000 ´ 34%) + ($230,000 ´ 39%)] or $115,500.

(True/False)

4.9/5  (34)

(34)

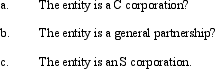

A business entity has appreciated land (basis of $50,000 and fair market value of $75,000) which it is going to distribute to Craig, one of its owners. The entity has earned substantial profits during its 15 years of operations and has reinvested most of them in the business. What are the tax consequences of the distribution to the business entity and to Craig if the business entity is a(n):

(Essay)

4.8/5  (36)

(36)

Actual dividends paid to shareholders result in double taxation. Likewise, deemed dividends (e.g., free use of corporate assets by a shareholder) result in double taxation.

(True/False)

4.9/5  (43)

(43)

Terry has a 20% ownership interest in a business for which his basis is $100,000. During the year, the entity earns profits of $90,000 and makes cash distributions to the owners of $50,000. How do these transactions affect Terry's basis if:

(Essay)

4.8/5  (42)

(42)

In its first year of operations, a corporation projects losses of $200,000. Since losses are involved, the corporation definitely should elect S corporation status.

(True/False)

4.8/5  (33)

(33)

Showing 21 - 40 of 143

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)