Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

Explain whether shareholders are exempted from gain/loss recognition in nontaxable corporate reorganization or the gain/loss recognition is merely postponed.If postponed, what is the vehicle for ensuring the postponed gain/loss will be recognized in the future?

(Essay)

4.8/5  (38)

(38)

A subsidiary corporation is liquidated at a time when it is indebted to its parent corporation. The subsidiary corporation distributes property to the parent corporation in satisfaction of the indebtedness. If the liquidation is governed by § 332, neither the subsidiary nor the parent recognize gain or loss on the transfer of property in satisfaction of indebtedness.

(True/False)

4.8/5  (38)

(38)

In the current year, Dove Corporation (E & P of $1 million) distributes all of its property in a complete liquidation. Alexandra, a shareholder, receives land having a fair market value of $100,000. Dove Corporation had purchased the land as an investment three years ago for $75,000, and the land was distributed subject to a $70,000 liability. Alexandra took the land subject to the $70,000 liability. What is Alexandra's basis in the land?

(Multiple Choice)

4.9/5  (30)

(30)

Corporate reorganizations can meet the requirements to qualify as like-kind exchanges if there is no boot involved.

(True/False)

4.8/5  (42)

(42)

The built-in loss limitation in a complete liquidation does not apply to losses attributable to a decline in a property's fair market value after its transfer to the corporation.

(True/False)

4.8/5  (43)

(43)

Legal dissolution under state law is required for a liquidation to be complete for tax purposes.

(True/False)

4.9/5  (32)

(32)

For purposes of the § 338 election, a corporation must acquire, in a taxable transaction, at least 80% of the stock (voting power and value) of another corporation within an 12-month period.

(True/False)

4.9/5  (35)

(35)

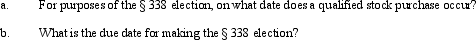

On March 16, 2011, Blue Corporation purchased 10% of the Gold Corporation stock outstanding.Blue Corporation purchased an additional 40% of the stock in Gold on October 24, 2011, and an additional 25% on April 4, 2012.On July 23, 2012, Blue Corporation purchased the remaining 25% of Gold Corporation stock outstanding.

(Essay)

4.9/5  (33)

(33)

Korat Corporation and Snow Corporation enter into an acquisitive "Type D" reorganization.Xin currently holds a 20-year, $10,000 Snow bond paying 4% interest.There are 8 years until the bond matures.In exchange for his Snow bond, Xin receives an 8 year $16,000 Korat bond paying 2.5% interest.Xin thinks this is fair because he will still receive $400 of interest each year and both bonds mature on the same date.How does Xin treat this transaction on his tax return?

(Multiple Choice)

4.7/5  (34)

(34)

On April 7, 2011, Crow Corporation acquired land in a transaction that qualified under § 351.The land had a basis of $400,000 to the contributing shareholder and a fair market value of $310,000.Assume that the shareholder also transferred equipment (basis of $100,000, fair market value of $200,000) in the same § 351 exchange.Crow Corporation adopted a plan of liquidation on October 5, 2012.On December 7, 2012, Crow Corporation distributes the land to Ali, a shareholder who owns 20% of the stock in Crow Corporation.The land's fair market value was $230,000 on the date of the distribution to Ali.Crow Corporation acquired the land to use as security for a loan it had hoped to obtain from a local bank.In negotiating with the bank for a loan, the bank required the additional capital investment as a condition of its making a loan to Crow Corporation.How much loss can Crow Corporation recognize on the distribution of the land?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 70 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)