Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

Indigo has a basis of $1 million in the stock of Owl Corporation, a subsidiary in which it owns 100% of all classes of stock. Indigo purchased the stock in Owl 10 years ago. In the current year, Indigo liquidates Owl and acquires assets worth $1.2 million. At the time of its liquidation, Owl Corporation had a basis of $800,000 in the assets and E & P of $500,000.Which of the following statements is correct with respect to the liquidation?

(Multiple Choice)

4.8/5  (40)

(40)

The determination of whether a shareholder's gain qualifies for stock redemption treatment in a corporate reorganization is based on the reduction in the percentage of the stock held in the target corporation when compared to the percentage held in the acquiring corporation.

(True/False)

4.8/5  (42)

(42)

Noncorporate shareholders may elect out of § 368 and recognize losses when property subject to a liability is distributed to them in a corporate reorganization.

(True/False)

4.8/5  (35)

(35)

Magenta Corporation acquired land in a § 351 exchange one year ago.The land had a basis of $320,000 and a fair market value of $350,000 on the date of the transfer.Magenta Corporation has two shareholders, Mark (70%) and Megan (30%), who are brother and sister.Magenta Corporation adopts a plan of liquidation in the current year.On this date, the land has decreased in value to $250,000.Magenta Corporation sells the land for $250,000 and distributes the proceeds pro rata to Mark and Megan.What amount of loss may Magenta Corporation recognize on the sale of the land?

(Multiple Choice)

4.8/5  (32)

(32)

For corporate restructurings, meeting the § 368 reorganization "Type" requirements is all that needs to be considered when planning the structure of the transaction.

(True/False)

4.9/5  (42)

(42)

Compare the sale of a corporation's assets with a sale of its stock from the perspective of the seller.

(Essay)

4.9/5  (42)

(42)

Lyon has 100,000 shares outstanding that are worth $10 per share.It uses 32% of its stock plus $80,000 to

(Essay)

4.8/5  (54)

(54)

Which of the following statements is true concerning all types of tax-free corporate reorganizations?

(Multiple Choice)

4.7/5  (30)

(30)

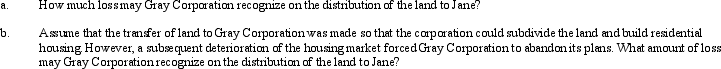

Mary and Jane, unrelated taxpayers, own Gray Corporation's stock equally.One year before the complete liquidation of Gray, Mary transfers land (basis of $420,000, fair market value of $350,000) to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000.In liquidation, Gray distributes the land to Jane.At the time of the liquidation, the land is worth $290,000.

(Essay)

4.7/5  (33)

(33)

The Federal income tax treatment of a corporate restructuring is an extension of allowing entities to form without taxation.

(True/False)

4.9/5  (29)

(29)

Yoko purchased 10% of Toyger Corporation's stock six years ago for $70,000.In a transaction qualifying as a "Type C" reorganization, Yoko received $50,000 cash and 8% of Angora Corporation's stock (valued at $100,000) in exchange for her Toyger stock.Prior to the reorganization, Toyger had $200,000 accumulated earnings and profits and Angora had $300,000.How does Yoko treat the exchange for tax purposes?

(Multiple Choice)

4.9/5  (46)

(46)

In corporate reorganizations, an acquiring corporation using property other than stock as consideration may recognize gains but not losses on the transaction.

(True/False)

4.8/5  (39)

(39)

Corporate shareholders would prefer to have a gain on a reorganization treated as a dividend rather than as a capital gain, because of the dividends received deduction.

(True/False)

4.9/5  (34)

(34)

Bobcat Corporation redeems all of Zeb's 4,000 shares and distributes to him 2,000 shares of Van Corporation stock plus $50,000 cash.Zeb's basis in his 20% interest in Bobcat is $100,000 and the stock's value is $250,000.At the time Bobcat is acquired by Van, the accumulated earnings and profits of Bobcat are $200,000 and Van's are $75,000.How does Zeb treat this transaction for tax purposes?

(Multiple Choice)

5.0/5  (39)

(39)

Sparrow Corporation purchased 90% of the stock of Warbler Corporation eight years ago for $1 million. In the current year, Sparrow liquidates Warbler and acquires assets with a basis to Warbler of $850,000 (fair market value of $1.2 million). Sparrow will have a basis in the assets of $850,000 (Warbler's basis in the assets), and a recognized loss of $150,000 ($1 million basis in Warbler stock - $850,000 carryover basis in assets).

(True/False)

4.8/5  (42)

(42)

In 1916, the Supreme Court decided that corporate reorganizations were substantially continuations of the prior entities and thus should not be subject to taxation.

(True/False)

4.8/5  (37)

(37)

As a general rule, a liquidating corporation recognizes gains but not losses on the distribution of property in complete liquidation.

(True/False)

4.7/5  (32)

(32)

What will cause the corporations involved in a § 368 reorganization to recognize gain or loss? What will cause shareholders of the companies involved in the corporate reorganization to recognize gain or loss? If gain is recognized by shareholders, what are the different tax character possibilities?

(Essay)

4.7/5  (33)

(33)

Showing 41 - 60 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)