Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

At a particular point in time, a taxpayer can have one or two principal residences for § 121 exclusion purposes.

(True/False)

4.9/5  (40)

(40)

Etta received nontaxable stock rights on October 3, 2012.She allocated $12,000 of the $30,000 basis for the associated stock to the stock rights.The stock rights are exercised on November 8, 2012.The exercise price for the stock is $42,000.What is Etta's basis for the acquired stock?

(Multiple Choice)

4.8/5  (34)

(34)

The basis of property received by gift is always a carryover basis.

(True/False)

4.7/5  (32)

(32)

Noelle owns an automobile which she uses for personal use.Her adjusted basis is $45,000 (i.e., the original cost).The car is worth $22,000.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (44)

(44)

The basis of property acquired in a bargain purchase is the cost of the asset. The bargain amount (fair market value - cost) is recognized when the asset is sold.

(True/False)

5.0/5  (33)

(33)

Monroe's delivery truck is damaged in an accident.Monroe's adjusted basis for the delivery truck prior to the accident is $20,000.If Monroe receives insurance proceeds of $21,000 and recognizes a casualty gain of $1,000, his adjusted basis for the delivery truck after the accident is $21,000.

(True/False)

4.8/5  (37)

(37)

Stuart owns land with an adjusted basis of $190,000 and a fair market value of $500,000.If the property is going to be given to Stuart's nephew, Alex, it is preferable for the transfer to be by inheritance rather than by gift.

(True/False)

4.8/5  (35)

(35)

The nonrecognition treatment on realized gains of an indirect involuntary conversion of a factory building under § 1033 is elective, while a like-kind exchange of computers under § 1031 is mandatory.

(True/False)

4.8/5  (36)

(36)

Pam exchanges a rental building, which has an adjusted basis of $520,000, for investment land which has a fair market value of $700,000.In addition, Pam receives $100,000 in cash.What is the recognized gain or loss and the basis of the investment land?

(Multiple Choice)

4.9/5  (33)

(33)

A taxpayer who sells his or her principal residence at a realized loss can elect to recognize the loss even if a qualified residence is acquired during the statutory time period.

(True/False)

4.8/5  (32)

(32)

In order to qualify for like-kind exchange treatment under § 1031, which of the following requirements must be satisfied?

(Multiple Choice)

4.9/5  (36)

(36)

If Wal-Mart stock increases in value during the tax year by $4,500, the amount realized is a positive $4,500.

(True/False)

4.9/5  (31)

(31)

Broker's commissions, legal fees, and points paid by the seller reduce the seller's amount realized.

(True/False)

4.8/5  (39)

(39)

Taxpayer owns a home in Atlanta.His company transfers him to Chicago on January 2, 2012, and he sells the Atlanta house in early February.He purchases a residence in Chicago on February 3, 2012.On December 15, 2012, taxpayer's company transfers him to Los Angeles.In January 2013, he sells the Chicago residence and purchases a residence in Los Angeles.Because multiple sales have occurred within a two-year period, § 121 treatment does not apply to the sale of the second home.

(True/False)

4.8/5  (39)

(39)

The holding period of replacement property where the election to postpone gain is made includes the holding period of the involuntarily converted property.

(True/False)

4.9/5  (38)

(38)

The basis of personal use property converted to business use is:

(Multiple Choice)

4.9/5  (38)

(38)

Alvin is employed by an automobile dealership as its manager.As such, he purchased an SUV for $32,000 (fair market value is $48,000).No other employees are permitted a discount.What is Alvin's basis in the SUV?

(Multiple Choice)

4.8/5  (39)

(39)

Section 1033 (nonrecognition of gain from an involuntary conversion) applies to both gains and losses.

(True/False)

4.7/5  (43)

(43)

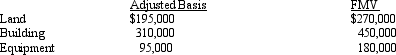

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 181 - 200 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)