Exam 15: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

After personal property is fully depreciated for both regular income tax purposes and AMT purposes,the positive and negative adjustments that have been made for AMT purposes will net to zero.

(True/False)

4.9/5  (37)

(37)

Which of the following statements concerning capital gains and losses and the AMT is correct?

(Multiple Choice)

4.7/5  (44)

(44)

Assuming no phaseout,the AMT exemption amount for a married taxpayer filing separately for 2017 is more than the AMT exemption amount for C corporations.

(True/False)

4.9/5  (36)

(36)

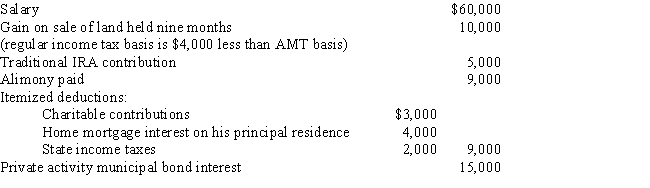

Gunter,who is divorced,reports the following items for 2017.Calculate Gunter's 2017 AMTI.

(Essay)

4.9/5  (29)

(29)

Income from some long-term contracts can be reported using the completed contract method for regular income tax purposes,but the percentage of completion method is required for AMT purposes for all long-term contracts.

(True/False)

4.8/5  (33)

(33)

A taxpayer has a passive activity loss for the current tax year for regular income tax purposes and for AMT purposes.Is it possible that the passive activity losses will be the same amount?

(Essay)

5.0/5  (37)

(37)

The AMT exemption for a corporation with $225,000 of AMTI is $18,750.

(True/False)

5.0/5  (36)

(36)

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2017,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2017,he paid the following amounts of interest.

What amount,if any,must Ted recognize as an AMT adjustment in 2017?

(Multiple Choice)

4.9/5  (29)

(29)

The required adjustment for AMT purposes for pollution control facilities placed in service this year is equal to the difference between the amortization deduction allowed for regular income tax purposes and the depreciation deduction computed under ADS.

(True/False)

4.9/5  (41)

(41)

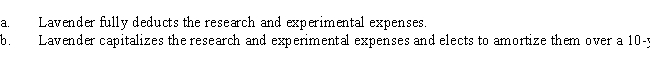

Lavender,Inc.,incurs research and experimental expenditures of $210,000 in 2017.Determine the amount of the AMT adjustment for 2017 and for 2018 if for regular income tax purposes,assuming in independent cases that:

(Essay)

4.9/5  (27)

(27)

How can an AMT adjustment be avoided by a taxpayer who incurs circulation expenditures in the current tax year?

(Essay)

4.7/5  (24)

(24)

Business tax credits reduce the AMT and the regular income tax in the same way.

(True/False)

4.9/5  (39)

(39)

Beige,Inc.,records AMTI of $200,000.Calculate the amount of the AMT exemption if:

a.Beige is a small corporation for AMT purposes.

b.Beige is not a small corporation for AMT purposes.

(Essay)

4.9/5  (28)

(28)

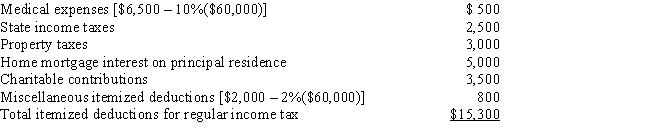

In calculating her 2017 taxable income,Rhonda,who is age 45,claims the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

(Essay)

4.7/5  (31)

(31)

Evan is a contractor who constructs both commercial and residential buildings.Even though some of the contracts could qualify for the use of the completed contract method,Evan decides to use the percentage of the completion method for all of his contracts.This increases Evan's AMT adjustment associated with long-term contracts for the current year.

(True/False)

4.8/5  (34)

(34)

Tad and Audria,who are married filing a joint return,have AMTI of $256,000 for 2017.Calculate their AMT exemption.

(Essay)

4.8/5  (46)

(46)

A taxpayer who expenses circulation expenditures in the year incurred for regular income tax purposes will have a positive AMT adjustment in the following year.

(True/False)

5.0/5  (40)

(40)

Frederick sells equipment whose adjusted basis for regular income tax purposes is $345,000 and for AMT purposes is $380,000.The sales proceeds are $850,000.Determine the effect on:

a.Taxable income.

b.AMTI.

(Essay)

4.9/5  (35)

(35)

Identify an AMT adjustment that applies for the individual taxpayer that does not apply for the corporate taxpayer and identify an AMT adjustment that applies for the corporate taxpayer that does not apply for the individual taxpayer.

(Essay)

4.9/5  (35)

(35)

In 2017,the amount of the deduction for medical expenses for regular tax purposes may be different than for AMT purposes if the taxpayer is at least age 65.

(True/False)

4.8/5  (27)

(27)

Showing 101 - 120 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)