Exam 17: Corporations: Introduction and Operating Rules

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Income that is included in net income per books but not included in taxable income is an addition item on Schedule M-1.

(True/False)

4.7/5  (39)

(39)

Azul Corporation,a personal service corporation,had $300,000 of active income,$40,000 of portfolio income,and a $190,000 passive loss during the year.How much is Azul's taxable income?

(Multiple Choice)

4.9/5  (48)

(48)

As a general rule,a personal service corporation (PSC)must use a fiscal year as its accounting period.

(True/False)

4.9/5  (43)

(43)

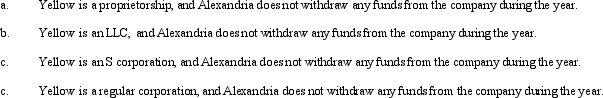

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

(Essay)

4.8/5  (35)

(35)

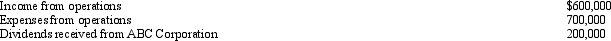

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

(Essay)

4.8/5  (35)

(35)

Schedule M-1 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

(True/False)

4.8/5  (39)

(39)

Starling Corporation,a closely held personal service corporation,has $150,000 of active income,$60,000 of portfolio income,and a $165,000 passive loss during the year.How much of the passive loss can Starling deduct in the current year?

(Multiple Choice)

4.7/5  (35)

(35)

Macayo,Inc. ,received $800,000 life insurance proceeds on the death of its president.The $800,000 will be a subtraction item on Macayo's Schedule M-1.

(True/False)

4.8/5  (36)

(36)

In the current year,Plum Corporation,a computer manufacturer,donated 100 laptop computers to a local school district (a qualified educational organization).The computers were constructed by Plum earlier this year,and the school district allocated the computers among its various schools where they will be used for educational purposes.Plum's basis in the computers is $70,000,and their fair market value is $250,000.What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)?

(Multiple Choice)

4.8/5  (43)

(43)

C corporations can elect fiscal years that are different from those of their shareholders,but personal service corporations (PSCs)are subject to substantial restrictions in the choice of a fiscal year.Why are the fiscal year choices of PSCs limited?

(Essay)

4.8/5  (41)

(41)

Which of the following statements is correct regarding the taxation of C corporations?

(Multiple Choice)

4.9/5  (33)

(33)

Peach Corporation had $210,000 of active income,$45,000 of portfolio income,and a $230,000 passive loss during the year.If Peach is a closely held C corporation that is not a PSC,it can deduct $210,000 of the passive loss in the year.

(True/False)

4.9/5  (33)

(33)

Unlike individual taxpayers,corporate taxpayers do not receive a preferential tax rate with respect to long-term capital gains.

(True/False)

4.8/5  (39)

(39)

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income.Which of the following items is an addition on Schedule M-1?

(Multiple Choice)

4.9/5  (36)

(36)

A corporation with $10 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

(True/False)

4.9/5  (33)

(33)

On April 8,2010,Oriole Corporation donated a painting worth $75,000 to the Texas Art Museum,a qualified public charity.The museum included the painting in its permanent collection.Oriole Corporation purchased the painting 5 years ago for $25,000.Oriole's charitable contribution deduction is $25,000 (ignoring the taxable income limitation).

(True/False)

4.9/5  (41)

(41)

Ted is the sole shareholder of a C corporation,and Sue owns a sole proprietorship.Both businesses were started in 2010,and each business sustained a $5,000 net capital loss for the year.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (38)

(38)

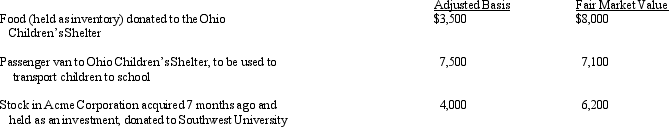

Grocer Services Corporation (a calendar year taxpayer),a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

(Multiple Choice)

4.8/5  (43)

(43)

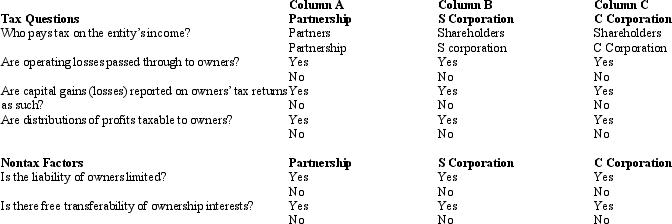

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

(Essay)

4.8/5  (35)

(35)

Nicole owns and operates a sole proprietorship.She is considering incorporating the business as a C corporation and has asked you to explain how a corporate tax return differs from the return for a sole proprietorship.In addition,she has asked you to explain the nontax factors that she should consider in deciding whether to incorporate her business.

(Essay)

4.9/5  (32)

(32)

Showing 81 - 100 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)