Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidationssubsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership115 Questions

Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 8: Translation of Foreign Currency Financial Statements97 Questions

Exam 9: Partnerships: Formation and Operation88 Questions

Exam 10: Partnerships: Termination and Liquidation69 Questions

Exam 11: Accounting for State and Local Governments Part 178 Questions

Exam 12: Accounting for State and Local Governments Part 251 Questions

Select questions type

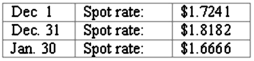

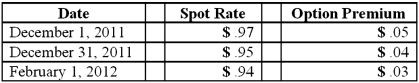

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:

What amount of foreign exchange gain or loss should be recorded on January 30?

What amount of foreign exchange gain or loss should be recorded on January 30?

(Multiple Choice)

4.8/5  (40)

(40)

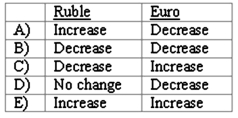

Frankfurter Company, a U.S. company, had a ruble receivable from exports to Russia and a euro payable resulting from imports from Italy. Frankfurter recorded foreign exchange loss related to both its ruble receivable and euro payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

(Multiple Choice)

4.9/5  (31)

(31)

What is the major assumption underlying the one-transaction perspective?

(Essay)

4.9/5  (43)

(43)

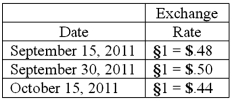

Old Colonial Corp. (a U.S. company) made a sale to a foreign customer on September 15, 2011, for 100,000 stickles. Payment was received on October 15, 2011. The following exchange rates applied:

Required:

Prepare all journal entries for Old Colonial Corp. in connection with this sale assuming that the company closes its books on September 30 to prepare interim financial statements.

Required:

Prepare all journal entries for Old Colonial Corp. in connection with this sale assuming that the company closes its books on September 30 to prepare interim financial statements.

(Essay)

4.7/5  (38)

(38)

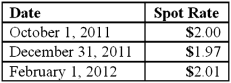

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the 2012 effect on net income as a result of these transactions?

What is the 2012 effect on net income as a result of these transactions?

(Multiple Choice)

5.0/5  (31)

(31)

A company has a discount on a forward contract for a foreign currency denominated asset. How is the discount recognized over the life of the contract under fair value hedge accounting?

(Multiple Choice)

4.9/5  (36)

(36)

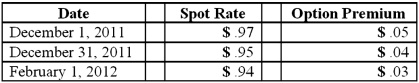

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the U.S. dollars received on February 1, 2012.

Compute the U.S. dollars received on February 1, 2012.

(Multiple Choice)

4.9/5  (38)

(38)

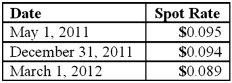

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the impact on Mosby's 2011 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the impact on Mosby's 2011 net income as a result of this fair value hedge of a firm commitment?

(Multiple Choice)

4.8/5  (42)

(42)

Mills Inc. had a receivable from a foreign customer that is due in the local currency of the customer (stickles). On December 31, 2010, this receivable for §200,000 was correctly included in Mills' balance sheet at $132,000. When the receivable was collected on February 15, 2011, the U.S. dollar equivalent was $144,000. In Mills' 2011 consolidated income statement, how much should have been reported as a foreign exchange gain?

(Multiple Choice)

4.9/5  (42)

(42)

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:

What amount of foreign exchange gain or loss should be recorded on December 31?

What amount of foreign exchange gain or loss should be recorded on December 31?

(Multiple Choice)

4.9/5  (39)

(39)

On April 1, Quality Corporation, a U.S. company, expects to sell merchandise to a French customer in three months, denominating the transaction in euros. On April 1, the spot rate is $1.41 per euro, and Quality enters into a three-month forward contract cash flow hedge to sell 400,000 euros at a rate of $1.36. At the end of three months, the spot rate is $1.37 per euro, and Quality delivers the merchandise, collecting 400,000 euros. What are the effects on net income from these transactions?

(Multiple Choice)

4.8/5  (30)

(30)

Which statement is true regarding a foreign currency option?

(Multiple Choice)

5.0/5  (41)

(41)

When a U.S. company purchases parts from a foreign company, which of the following will result in zero foreign exchange gain or loss?

(Multiple Choice)

4.9/5  (39)

(39)

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the fair value of the foreign currency option at February 1, 2012.

Compute the fair value of the foreign currency option at February 1, 2012.

(Multiple Choice)

4.8/5  (37)

(37)

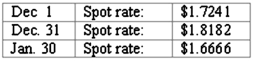

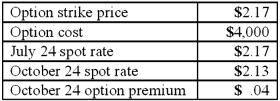

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

(Multiple Choice)

4.9/5  (32)

(32)

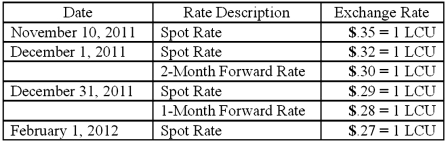

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2011 net income.

(C.) Compute the effect on 2012 net income.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2011 net income.

(C.) Compute the effect on 2012 net income.

(Essay)

4.9/5  (39)

(39)

Belsen purchased inventory on December 1, 2010. Payment of 200,000 stickles was to be made in sixty days. Also on December 1, Belsen signed a contract to purchase §200,000 in sixty days. The spot rate was §1 = .35714, and the 60-day forward rate was §1 = $.38462. On December 31, the spot rate was §1 = .34483 and the 30-day forward rate was §1 = .38168. Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

In the journal entry to record the establishment of a forward exchange contract, at what amount should the Forward Contract account be recorded on December 1?

(Multiple Choice)

4.8/5  (42)

(42)

All of the following data may be needed to determine the fair value of a forward contract at any point in time except

(Multiple Choice)

4.8/5  (34)

(34)

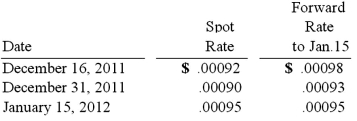

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied:

Assuming a forward contract was entered into, at what amount should the forward contract be recorded at December 31, 2011? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

Assuming a forward contract was entered into, at what amount should the forward contract be recorded at December 31, 2011? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

(Multiple Choice)

4.9/5  (39)

(39)

Alpha, Inc., a U.S. company, had a receivable from a customer that was denominated in Mexican pesos. On December 31, 2010, this receivable for 75,000 pesos was correctly included in Alpha's balance sheet at $8,000. The receivable was collected on March 2, 2011, when the U.S. equivalent was $6,900. How much foreign exchange gain or loss will Alpha record on the income statement for the year ended December 31, 2011?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 61 - 80 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)