Exam 17: Advanced Issues in Revenue Recognition

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

What are the two methods that recognize revenue prior to the full completion of the earnings process and what two methods recognize revenue after the earnings process is complete and when realization occurs?

Methods that recognize revenue prior to the full completion of the earnings process.

1) percentage-of-completion

2) proportional performance method

(Essay)

4.9/5  (32)

(32)

A Provision for Loss on Contract is reported in the financial statements as a(n)

(Multiple Choice)

4.9/5  (38)

(38)

When is gross profit recognized under the installment method and the cost recovery method?

(Essay)

4.8/5  (36)

(36)

The Marco Company uses the percentage-of-completion method and the cost-to-cost method for its long-term construction contracts. On one such contract, Marco expects total revenues of $260,000 and total costs of $200,000. During the first year, Marco incurred costs of $50,000 and billed the customer $30,000 under the contract. At what net amount should Marco's Construction in Progress for this contract be reported at the end of the first year?

(Multiple Choice)

4.9/5  (36)

(36)

Inventory is reported at cost plus gross profit recognized to date under which of the following revenue recognition methods?

(Multiple Choice)

4.8/5  (39)

(39)

Forest Hill, Inc. repossessed an item it sold in 2014 with a gross profit of 40%. The fair value of the repossessed item was $140. The remaining receivable amounted to $400. What account had the smallest amount debited to it?

(Multiple Choice)

4.8/5  (35)

(35)

When merchandise previously sold under an installment contract is repossessed, it is recorded at

(Multiple Choice)

4.8/5  (33)

(33)

The Marathon Company uses the percentage-of-completion method to recognize profits on long-term contracts. At the end of the second year of the contract, a project was 70% complete and an overall loss of $100,000 was expected. A $25,000 profit had been recognized in the first year of the contract. The loss to be recognized in the second year is

(Multiple Choice)

4.7/5  (28)

(28)

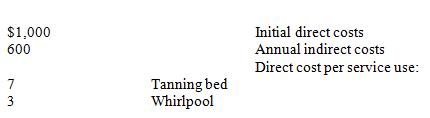

Hagerstown Tanning & Spa sold 300 contracts at $230 each. Each contract permitted the buyer to use a tanning bed 12 times and a whirlpool 16 times. Cost information follows:  In the first year, customers used the tanning bed 2,160 times and the whirlpool 900 times.

Required:

Compute the amount of revenue that should be recognized in the first year.

In the first year, customers used the tanning bed 2,160 times and the whirlpool 900 times.

Required:

Compute the amount of revenue that should be recognized in the first year.

(Essay)

5.0/5  (42)

(42)

If a company has an agreement to deliver software that does not require significant production, modification, or customization, it recognizes revenue when persuasive evidence of an agreement exists and

(Multiple Choice)

4.8/5  (36)

(36)

When a long-term service contract requires similar services to be performed in more than one act, revenue is recognized by the percentage-of-performance method.

(True/False)

5.0/5  (35)

(35)

An excess of Construction in Progress over Partial Billings for long-term contracts accounted for on the percentage-of-completion method should be shown as a

(Multiple Choice)

4.9/5  (38)

(38)

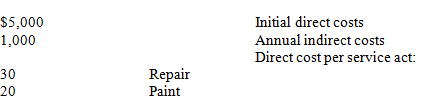

Exhibit 17-3 On January 1, 2014, Dundee Co. sold 100 contracts at $500 each. Each contract permitted the buyer to use a repair bay six times and a paint bay nine times.

Additional information:  In 2014, the repair bay was used 180 times and the paint bay was used 162 times.

-Refer to Exhibit 17-3. How much revenue should be recognized by Dundee in 2014?

In 2014, the repair bay was used 180 times and the paint bay was used 162 times.

-Refer to Exhibit 17-3. How much revenue should be recognized by Dundee in 2014?

(Multiple Choice)

4.7/5  (31)

(31)

A client in the retail industry has come to you for an explanation. The client's company offers installment sales contracts to some of its customers, and the client believes that the installment method of revenue recognition must be the only way to account for such contracts.

Required:

Explain the difference between installment sales contracts and the installment method of revenue recognition.

(Essay)

4.9/5  (37)

(37)

If a company had an agreement to deliver software that requires significant production, modification, or customization, which method of revenue recognition should it use?

(Multiple Choice)

4.7/5  (32)

(32)

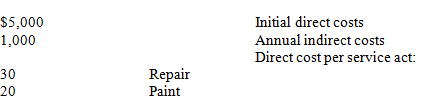

Exhibit 17-3 On January 1, 2014, Dundee Co. sold 100 contracts at $500 each. Each contract permitted the buyer to use a repair bay six times and a paint bay nine times.

Additional information:  In 2014, the repair bay was used 180 times and the paint bay was used 162 times.

-Refer to Exhibit 17-3. What net income (loss) should be recognized by Dundee in 2014?

In 2014, the repair bay was used 180 times and the paint bay was used 162 times.

-Refer to Exhibit 17-3. What net income (loss) should be recognized by Dundee in 2014?

(Multiple Choice)

4.9/5  (33)

(33)

If collectibility is reasonably certain or there is a reliable basis for estimating collectibility then the cost recovery method is appropriate.

(True/False)

4.9/5  (38)

(38)

Jones sells computer software to Wyatt that requires significant construction. When recognizing revenue, Jones

(Multiple Choice)

4.7/5  (36)

(36)

Exhibit 17-1 In 2014, Omega Construction began work on a contract with a price of $850,000 and estimated costs of $595,000. Data for each year of the contract are as follows:

- Refer to Exhibit 17-1. Under the percentage-of-completion method of revenue recognition, gross profit in 2014 would be

- Refer to Exhibit 17-1. Under the percentage-of-completion method of revenue recognition, gross profit in 2014 would be

(Multiple Choice)

4.8/5  (40)

(40)

Showing 41 - 60 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)