Exam 11: Flexible Budgeting and Analysis of Overhead Costs

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment62 Questions

Exam 2: Basic Cost Management Concepts85 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment80 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems84 Questions

Exam 5: Activity-Based Costing and Management85 Questions

Exam 6: Activity Analysis, Cost Behavior, and Cost Estimation93 Questions

Exam 7: Cost-Volume-Profit Analysis89 Questions

Exam 8: Variable Costing and the Costs of Quality and Sustainability64 Questions

Exam 9: Financial Planning and Analysis: the Master Budget95 Questions

Exam 10: Standard Costing and Analysis of Direct Costs80 Questions

Exam 11: Flexible Budgeting and Analysis of Overhead Costs91 Questions

Exam 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard72 Questions

Exam 13: Investment Centers and Transfer Pricing95 Questions

Exam 14: Decision Making: Relevant Costs and Benefits90 Questions

Exam 15: Target Costing and Cost Analysis for Pricing Decisions99 Questions

Exam 16: Capital Expenditure Decisions104 Questions

Exam 17: Allocation of Support Activity Costs and Joint Costs81 Questions

Exam 18: The Sarbanes-Oxley Act, Internal Controls, and Management Accounting14 Questions

Exam 19: Compound Interest and the Concept of Present Value24 Questions

Exam 20: Inventory Management14 Questions

Select questions type

Draco, Inc. has the following overhead standards:

Variable overhead: 4 hours at $8 per hour

Fixed overhead: 4 hours at $10 per hour

The standards were based on a planned activity of 20,000 machine hours when 5,000 units were scheduled for production. Actual data follow.

Variable overhead incurred: $167,750

Fixed overhead incurred: $210,000

Machine hours worked: 19,800

Actual units produced: 5,100

Draco's variable-overhead efficiency variance is:

(Multiple Choice)

4.9/5  (36)

(36)

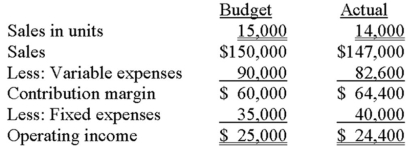

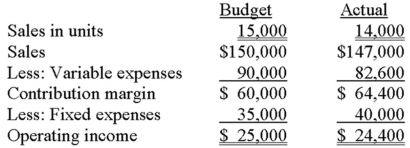

Master Products has the following information for the year just ended:  The company's sales-volume variance is:

The company's sales-volume variance is:

(Multiple Choice)

4.9/5  (34)

(34)

Atlanta Enterprises incurred $828,000 of fixed overhead during the period. During that same period, the company applied $845,000 of fixed overhead to production and reported an unfavorable budget variance of $41,000. How much was Atlanta's budgeted fixed overhead?

(Multiple Choice)

4.8/5  (31)

(31)

Abbott has a standard variable overhead rate of $4.50 per machine hour, and each unit produced has a standard time allowed of three hours. The company's static budget was based on 46,000 units. Actual results for the year follow.

Actual units produced: 42,000

Actual machine hours worked: 120,000

Actual variable overhead incurred: $520,000

Abbott's variable-overhead spending variance is:

(Multiple Choice)

4.8/5  (40)

(40)

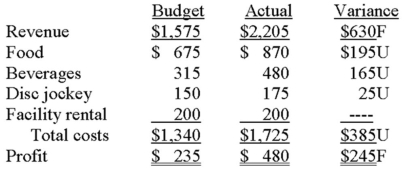

The Marketing Club at Southern University recently held an end-of-year dinner and swim party, which the treasurer declared to be a financial success. "Attendance was an all-time high, 60 members, and the results were much better than expected." The treasurer presented the following performance report at the executive board's June meeting:  The budget was based on the assumptions that follow.

• Forty-five members would attend at a fixed ticket price of $35.

• Food and beverage costs were anticipated to be $15 and $7 per attendee, respectively.

• A disc jockey was hired via a written contract at $50 per hour.

Required:

A. Briefly evaluate the meaningfulness of the treasurer's performance report.

B. Prepare a performance report by using flexible budgeting and determine whether the end-of-year party was as successful as originally reported.

C. Based on your answer in requirement "B," present a possible explanation for the variances in revenue, food costs, beverage costs, and the disc jockey.

The budget was based on the assumptions that follow.

• Forty-five members would attend at a fixed ticket price of $35.

• Food and beverage costs were anticipated to be $15 and $7 per attendee, respectively.

• A disc jockey was hired via a written contract at $50 per hour.

Required:

A. Briefly evaluate the meaningfulness of the treasurer's performance report.

B. Prepare a performance report by using flexible budgeting and determine whether the end-of-year party was as successful as originally reported.

C. Based on your answer in requirement "B," present a possible explanation for the variances in revenue, food costs, beverage costs, and the disc jockey.

(Essay)

5.0/5  (30)

(30)

Hot Stuff operates a delivery service for local restaurants, delivering call-in, to-go meals for restaurant customers. Variable overhead costs are applied at the budgeted rate of $3 per driving hour. The typical roundtrip takes a driver 45 minutes to complete. Actual results for March follow.

Number of roundtrips run: 1,560

Hours of delivery time: 1,250

Variable overhead cost incurred: $3,450

Hot Stuff uses flexible budgets and variance analysis to monitor performance.

Required:

A. Prepare a flexible-budget performance report that shows (1) actual variable overhead, (2) the amount of variable overhead that should have been incurred for the number of roundtrips taken, and (3) the variance between these amounts.

B. Compute the company's variable-overhead spending and efficiency variances.

C. Compare the variances that you computed in requirements "A" and "B," and comment on your findings.

(Essay)

4.7/5  (39)

(39)

Midwestern University operates a motor pool for the convenience of its faculty and staff. The following budget was prepared for an upcoming period: Gasoline and oil \ 40,000 Minor repairs 6,000 Insurance 20,000 Office help 24,000 Depreciation 30,000 Total

The budget was based on the assumptions of 20 vehicles, with each vehicle being driven 8,000 miles. Midwestern acquired two additional vehicles early in the period under study. Actual miles driven during the period totaled 180,000.

Discussions with the motor pool manager revealed that pool costs are variable and fixed in nature. The manager believed that miles driven was the most appropriate cost driver for studying gasoline and oil expense. In contrast, the number of vehicles in the pool was the best base to use when studying minor repairs, insurance, and depreciation. Office help is a fixed cost.

Required:

A. Contrast a static budget with a flexible budget.

B. Suppose that the university's budget officer desired to prepare a report that compared budgeted and actual costs. Should the report be based on a static budget or a flexible budget? Why?

C. On the basis of the information presented, determine the budgeted amounts for the five preceding costs that would be used in a flexible budget.

(Essay)

4.8/5  (32)

(32)

Master Products has the following information for the year just ended:  The company's sales-price variance is:

The company's sales-price variance is:

(Multiple Choice)

5.0/5  (38)

(38)

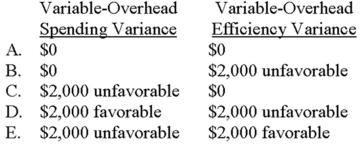

The variable-overhead spending and efficiency variances are:

(Multiple Choice)

4.7/5  (47)

(47)

Hanks Company uses a standard cost system and applies manufacturing overhead to products on the basis of machine hours. The following information is available for the year just ended:

Standard variable-overhead rate per machine hour: $2.50

Standard fixed-overhead rate per machine hour: $5.00

Planned activity during the period: 30,000 machine hours

Actual production: 10,700 finished units

Production standard: Three machine hours per unit

Actual variable overhead: $86,200

Actual total overhead: $225,500

Actual machine hours worked: 35,100

Required:

A. Calculate the budgeted fixed overhead for the year.

B. Did Hanks spend more or less than anticipated for fixed overhead? How much?

C. Was variable overhead under- or overapplied during the year? By how much?

D. Was Hanks efficient in its use of machine hours? Briefly explain.

E. Would the company's efficiency or inefficiency in the use of machine hours have any effect on Hanks' overhead variances? If "yes," which one(s)?

(Essay)

4.8/5  (26)

(26)

Smithville uses labor hours to apply variable overhead to production. If the company's workers were very inefficient during the period, which of the following statements would be true about the variable-overhead efficiency variance?

(Multiple Choice)

4.9/5  (41)

(41)

Flexible budgets reflect a company's anticipated costs based on variations in activity levels.

(True/False)

4.8/5  (36)

(36)

Benson Company, which uses a standard cost system, budgeted $600,000 of fixed overhead when 40,000 machine hours were anticipated. Other data for the period were:

Actual units produced: 10,000

Standard production time per unit: 3.9 machine hours

Fixed overhead incurred: $620,000

Actual machine hours worked: 42,000

Benson's fixed-overhead budget variance is:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following should have the strongest cause and effect relationship with overhead costs?

(Multiple Choice)

4.9/5  (39)

(39)

Del's Diner anticipated that 84,000 process hours would be worked during an upcoming accounting period when, in fact, 90,000 hours were actually worked. One of the company's cost functions is expressed as follows:

Y = $16PH + $640,000 where PH is defined as process hours

What is Del's flexible budget (Y) for the preceding cost function?

(Multiple Choice)

4.8/5  (37)

(37)

With respect to overhead, what is the difference between normal costing and standard costing?

(Multiple Choice)

4.8/5  (26)

(26)

Gridiron Merchandising anticipated selling 27,000 units of a major product and paying sales commissions of $6 per unit. Actual sales and sales commissions totaled 27,500 units and $171,400, respectively. If the company used a flexible budget for performance evaluations, Gridiron would report a cost variance of:

(Multiple Choice)

4.9/5  (31)

(31)

Darling Company, which applies overhead to production on the basis of machine hours, reported the following data for the period just ended:

Actual units produced: 12,000

Actual fixed overhead incurred: $730,000

Actual machine hours worked: 60,000

Budgeted fixed overhead: $720,000

Planned level of machine-hour activity: 50,000

If Darling estimates four hours to manufacture a completed unit, the company's standard fixed overhead rate per machine hour would be:

(Multiple Choice)

4.9/5  (31)

(31)

Showing 61 - 80 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)