Exam 14: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics439 Questions

Exam 2: Thinking Like an Economist615 Questions

Exam 3: Interdependence and the Gains From Trade527 Questions

Exam 4: The Market Forces of Supply and Demand697 Questions

Exam 5: Measuring a Nations Income518 Questions

Exam 6: Measuring the Cost of Living543 Questions

Exam 7: Production and Growth507 Questions

Exam 8: Saving, Investment, and the Financial System565 Questions

Exam 9: The Basic Tools of Finance510 Questions

Exam 10: Unemployment and Its Natural Rate698 Questions

Exam 11: The Monetary System517 Questions

Exam 12: Money Growth and Inflation484 Questions

Exam 13: Open-Economy Macroeconomics: Basic Concepts520 Questions

Exam 14: A Macroeconomic Theory of the Open Economy478 Questions

Exam 15: Aggregate Demand and Aggregate Supply563 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand510 Questions

Exam 17: The Short-Run Tradeoff Between Inflation and Unemployment516 Questions

Exam 18: Six Debates Over Macroeconomic Policy372 Questions

Select questions type

In the open-economy macroeconomic model, the supply of dollars in the market for foreign-currency exchange comes from

(Multiple Choice)

4.8/5  (32)

(32)

When a country suffers from capital flight, the demand for loanable funds in that country shifts

(Multiple Choice)

4.9/5  (40)

(40)

In 2009 Greece's budget deficit rose and people became worried about the ability of the Greek government to make payments on its debt. Which of the these events reduces a country's real exchange rate?

(Multiple Choice)

4.8/5  (36)

(36)

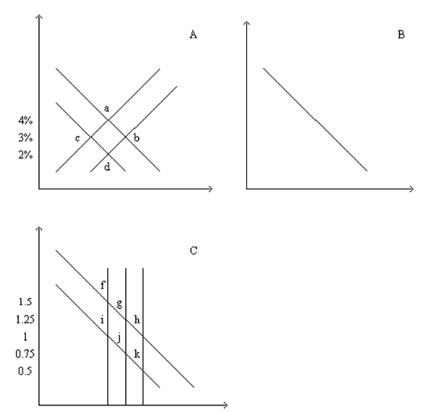

Figure 32-5

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.  -Refer to Figure 32-5. In the market for foreign-currency exchange, the effects of an increase in the budget surplus can be illustrated as a move from j to

-Refer to Figure 32-5. In the market for foreign-currency exchange, the effects of an increase in the budget surplus can be illustrated as a move from j to

(Multiple Choice)

4.8/5  (31)

(31)

Budget in Recession

During a recession government revenues from the income tax fall and government transfers rise as the reduction in income and the rise in unemployment raise the number of people who qualify for benefits.

-Refer to Budget in Recession. What does this change in the budget deficit do to the equilibrium values of the interest rate and the quantity of loanable funds?

(Essay)

4.8/5  (34)

(34)

Political events convince people that the assets of country x are now riskier. As a result of this change which curves in the open-economy macroeconomic model shift and which direction do they shift for country x?

(Essay)

4.8/5  (31)

(31)

Explain how the relation between the real exchange rate and net exports explains the downward slope of the demand for foreign-currency exchange curve.

(Essay)

4.9/5  (28)

(28)

In an open economy, the source of the demand for loanable funds is

(Multiple Choice)

4.9/5  (34)

(34)

What happens to net capital outflow as the real interest rate falls? Explain your answer.

(Essay)

4.8/5  (35)

(35)

If the risk of buying U.S. assets rises because it is discovered that lending institutions had not carefully evaluated borrowers prior to lending them funds, then

(Multiple Choice)

4.9/5  (41)

(41)

If a country makes political reforms so that people now believe this country's assets are less risky, what happens to its interest rate, its exchange rate, and its net exports?

(Essay)

4.8/5  (43)

(43)

The variable that links the market for loanable funds and the market for foreign-currency exchange is

(Multiple Choice)

4.9/5  (33)

(33)

Other things the same, if the U.S. interest rate rises, what happens to the net capital outflow of other countries?

(Essay)

4.8/5  (37)

(37)

A country has output of $900 billion, consumption of $600 billion, government expenditures of $150 billion and investment of $120 billion. What is its supply of loanable funds?

(Multiple Choice)

4.7/5  (37)

(37)

If the demand for dollars in the market for foreign-currency exchange shifts left, then the exchange rate

(Multiple Choice)

4.8/5  (37)

(37)

Other things the same, if foreigners desire to purchase more U.S. bonds, then the demand for loanable funds shifts left.

(True/False)

4.7/5  (34)

(34)

Showing 221 - 240 of 478

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)