Exam 14: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics439 Questions

Exam 2: Thinking Like an Economist615 Questions

Exam 3: Interdependence and the Gains From Trade527 Questions

Exam 4: The Market Forces of Supply and Demand697 Questions

Exam 5: Measuring a Nations Income518 Questions

Exam 6: Measuring the Cost of Living543 Questions

Exam 7: Production and Growth507 Questions

Exam 8: Saving, Investment, and the Financial System565 Questions

Exam 9: The Basic Tools of Finance510 Questions

Exam 10: Unemployment and Its Natural Rate698 Questions

Exam 11: The Monetary System517 Questions

Exam 12: Money Growth and Inflation484 Questions

Exam 13: Open-Economy Macroeconomics: Basic Concepts520 Questions

Exam 14: A Macroeconomic Theory of the Open Economy478 Questions

Exam 15: Aggregate Demand and Aggregate Supply563 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand510 Questions

Exam 17: The Short-Run Tradeoff Between Inflation and Unemployment516 Questions

Exam 18: Six Debates Over Macroeconomic Policy372 Questions

Select questions type

If after a country experiences capital flight, people become more confident about the safety of its assets, then in that country

(Multiple Choice)

4.9/5  (37)

(37)

If the demand for net exports rises, which of the following happens in the open-economy macroeconomic model?

(Multiple Choice)

4.8/5  (45)

(45)

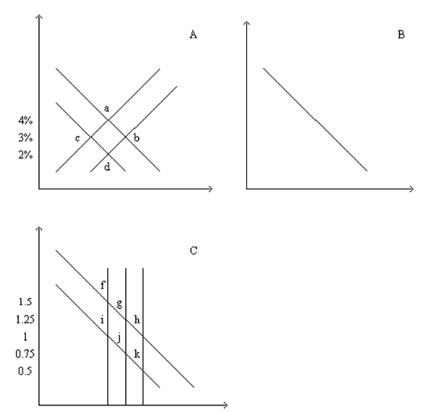

Figure 32-5

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.  -Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

-Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

(Multiple Choice)

4.8/5  (27)

(27)

Over the past two decades the U.S. has persistently had trade deficits.

(True/False)

4.8/5  (42)

(42)

In an open economy, the demand for loanable funds comes from

(Multiple Choice)

4.8/5  (34)

(34)

Suppose that U.S. savers decide that holding Brazilian assets has become riskier. What happens to U.S. net capital outflow? What happens to the U.S. real interest rate?

(Essay)

4.8/5  (31)

(31)

If the U.S. government imposes a quota on imports of jet planes, then

(Multiple Choice)

4.7/5  (31)

(31)

An increase in the U.S. government budget deficit shifts the

(Multiple Choice)

4.9/5  (37)

(37)

In the open-economy macroeconomic model, the supply of loanable funds comes from

(Multiple Choice)

4.9/5  (35)

(35)

Depositors Move Funds out of Greek Banks.

In 2011 Greek citizens were concerned about the size of government debt. Fearful that the government might be unable to fulfill its promise to insure depositors in Greek banks against losses created by bank failures, depositors moved funds out of Greek banks.

-Refer to Depositors Move Funds Out of Greek Banks. Because of depositors reactions what happened to net capital outflow?

(Short Answer)

4.7/5  (37)

(37)

Other things the same, a higher real interest rate raises the quantity of

(Multiple Choice)

4.9/5  (28)

(28)

If at a given exchange rate U.S. citizens wanted to buy more foreign bonds

(Multiple Choice)

4.8/5  (36)

(36)

The slope of the supply of loanable funds is based on an increase in

(Multiple Choice)

4.9/5  (29)

(29)

In the market for foreign-currency exchange, the source of the supply of dollars is _________. The supply curve is _________ because _____________.

(Essay)

4.7/5  (31)

(31)

Which of the following would make both the equilibrium real interest rate and the equilibrium quantity of loanable funds increase?

(Multiple Choice)

4.9/5  (32)

(32)

A country has domestic investment of $200 billion. Its citizens purchase $600 of foreign assets and foreign citizens purchase $300 of its assets. What is national saving?

(Multiple Choice)

4.8/5  (45)

(45)

Showing 241 - 260 of 478

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)