Exam 14: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics439 Questions

Exam 2: Thinking Like an Economist615 Questions

Exam 3: Interdependence and the Gains From Trade527 Questions

Exam 4: The Market Forces of Supply and Demand697 Questions

Exam 5: Measuring a Nations Income518 Questions

Exam 6: Measuring the Cost of Living543 Questions

Exam 7: Production and Growth507 Questions

Exam 8: Saving, Investment, and the Financial System565 Questions

Exam 9: The Basic Tools of Finance510 Questions

Exam 10: Unemployment and Its Natural Rate698 Questions

Exam 11: The Monetary System517 Questions

Exam 12: Money Growth and Inflation484 Questions

Exam 13: Open-Economy Macroeconomics: Basic Concepts520 Questions

Exam 14: A Macroeconomic Theory of the Open Economy478 Questions

Exam 15: Aggregate Demand and Aggregate Supply563 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand510 Questions

Exam 17: The Short-Run Tradeoff Between Inflation and Unemployment516 Questions

Exam 18: Six Debates Over Macroeconomic Policy372 Questions

Select questions type

What happens to each of the following if the supply of loanable funds shifts left?

a. the interest rate

b. net capital outflow

c. the exchange rate

(Essay)

4.8/5  (35)

(35)

An increase in the budget deficit causes net capital outflow to

(Multiple Choice)

4.9/5  (36)

(36)

In the open-economy macroeconomic model, if there is currently a surplus in the foreign exchange market, the quantity of desired net exports will increase as the market moves to equilibrium.

(True/False)

4.9/5  (36)

(36)

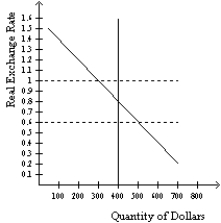

Figure 32-2  -Refer to Figure 32-2. What are the equilibrium values of the real exchange rate and net exports?

-Refer to Figure 32-2. What are the equilibrium values of the real exchange rate and net exports?

(Multiple Choice)

4.9/5  (37)

(37)

If the demand for dollars in the market for foreign-currency exchange shifts right, then the exchange rate

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following will not change the U.S. real interest rate?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is the most likely response to a decrease in the U.S. real interest rate?

(Multiple Choice)

4.8/5  (33)

(33)

In 2002, the United States placed higher tariffs on imports of steel. According to the open-economy macroeconomic model this policy should have

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following would shift the demand for dollars in the market for foreign currency exchange to the right?

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following would not be a consequence of an increase in the U.S. government budget deficit?

(Multiple Choice)

4.9/5  (32)

(32)

If there is a surplus of loanable funds, the quantity demanded is

(Multiple Choice)

4.7/5  (36)

(36)

Which of the following will decrease U.S. net capital outflow?

(Multiple Choice)

4.8/5  (28)

(28)

A country has national saving of $80 billion, government expenditures of $40 billion, domestic investment of $50 billion, and net capital outflow of $30 billion. What is its supply of loanable funds?

(Multiple Choice)

4.8/5  (37)

(37)

When Mexico suffered from capital flight in 1994, Mexico's net exports

(Multiple Choice)

4.8/5  (31)

(31)

When the real exchange rate for the dollar depreciates, U.S. goods become

(Multiple Choice)

4.7/5  (36)

(36)

In the open-economy macroeconomic model, a higher U.S. real exchange rate makes

(Multiple Choice)

4.8/5  (33)

(33)

A firm produces construction equipment, some of which it exports. Which of the following effects of an increase in the government budget deficit would likely reduce the quantity of equipment it sells?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following can explain a decrease in the U.S. real exchange rate?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following is consistent with moving from a surplus to equilibrium in the market for foreign-currency exchange?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 281 - 300 of 478

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)