Exam 20: Process Cost Accounting

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

In a process costing system, factory labor costs incurred in a reporting period are presented on the income statement as Factory Labor Expense.

Free

(True/False)

4.9/5  (34)

(34)

Correct Answer:

False

In process cost accounting, materials are always classified as indirect if they are not physically incorporated into the final product.

Free

(True/False)

4.9/5  (36)

(36)

Correct Answer:

False

One section of the process cost summary describes the equivalent units of production for the department during the reporting period and presents the calculations of the costs per equivalent unit.

Free

(True/False)

4.7/5  (40)

(40)

Correct Answer:

True

A process cost accounting system records all factory overhead costs directly in the Goods in Process Inventory accounts.

(True/False)

4.8/5  (33)

(33)

Browning Company had 8,700 units in beginning inventory with accumulated costs for direct materials of $17,900, $16,500 direct labor, and $13,200 of overhead. During July, the company completed and transferred 50,000 units to finished goods. Costs incurred in the current period included $45,000 of direct materials, $58,500 of direct labor, and $46,800 of factory overhead. Ending inventory consisted of 12,000 units which were 80% complete with respect to materials and 50% complete with respect to labor and overhead. Compute the value assigned to ending inventory based on the weighted average method of inventory costing.

(Essay)

4.8/5  (30)

(30)

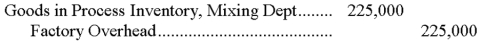

If the predetermined overhead allocation rate is 225% of direct labor cost, and the Mixing Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

(True/False)

4.7/5  (35)

(35)

In process costing, indirect materials are charged directly to Goods in Process Inventory.

(True/False)

4.9/5  (28)

(28)

What is meant by equivalent units of production, and why are they important when a process cost accounting system is used?

(Essay)

4.7/5  (39)

(39)

In a process cost accounting system, the purchase of raw materials is debited to the Raw Materials Inventory.

(True/False)

4.9/5  (47)

(47)

Which of the following products is least likely to be produced in a process manufacturing system?

(Multiple Choice)

4.8/5  (32)

(32)

Process manufacturing usually reflects a manufacturer that produces large quantities of identical products.

(True/False)

4.9/5  (35)

(35)

An equivalent unit of production is an estimate of efforts that is used to calculate the ______________ of each production component.

(Essay)

4.9/5  (29)

(29)

The use of process costing is of little benefit to a service type of operation.

(True/False)

4.8/5  (33)

(33)

The process cost summary presents calculations of the cost of units completed during the reporting period, but does not present any information about the ending goods in process inventory.

(True/False)

4.7/5  (33)

(33)

Aniston Enterprises manufactures stylish hats for sophisticated women. All materials are introduced at the beginning of the manufacturing process in the Cutting Department. Conversion costs are incurred uniformly throughout the manufacturing process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Information for the Cutting Department for the month of May follows. Goods in Process, May 1 (50,000 units, 100% complete for direct materials, 40% complete with respect to direct labor and overhead; includes $70,500 of direct material cost; $34,050 of conversion costs).

Goods in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs).

If Aniston Enterprises uses the FIFO method of process costing, compute the equivalent units for materials and conversion costs respectively for May.

(Multiple Choice)

4.9/5  (25)

(25)

Medina Corp. uses the weighted average method for inventory costs and had the following information available for the year. The number of units transferred to finished goods during the year is:

(Multiple Choice)

4.9/5  (32)

(32)

In a process cost accounting system, the purchase of raw materials is credited to the Raw Materials Inventory.

(True/False)

4.9/5  (36)

(36)

Embark produces mulch for landscaping use. The following information summarizes production operations for June. The journal entry to record June production activities for direct material usage is:

(Multiple Choice)

4.8/5  (28)

(28)

Prepare journal entries to record the following production activities for Sherman Manufacturing.

a. Incurred $105,100 of factory labor cost which is paid in cash.

b. Used $93,900 of direct labor in the production department.

c. Used $11,200 of indirect labor.

(Essay)

4.9/5  (30)

(30)

Showing 1 - 20 of 172

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)