Exam 19: Job Order Cost Accounting

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

When a job is finished, its job cost sheet is completed and moved from the jobs in process file to the ____________________ file.

Free

(Essay)

4.8/5  (35)

(35)

Correct Answer:

Finished job

_____________________, or customized production, produces products in response to customer orders.

Free

(Essay)

4.7/5  (38)

(38)

Correct Answer:

Job order manufacturing

Overapplied overhead is the amount by which actual overhead cost exceeds the overhead applied to products during the period.

Free

(True/False)

4.8/5  (44)

(44)

Correct Answer:

False

PRO, Inc. had the following activities during its most recent period of operations:

(a) Purchased raw materials on account for $140,000 (both direct and indirect materials are recorded in the Raw Materials Inventory account).

(b) Issued raw materials to production of $130,000 (80% direct and 20% indirect).

(c) Incurred and paid factory labor costs of $250,000 cash; allocated the factory labor costs to production (70% direct and 30% indirect).

(d) Incurred factory utilities costs of $20,000; this amount is still payable.

(e) Applied overhead at 80% of direct labor costs.

(f) Recorded factory depreciation, $22,000.

(Essay)

4.8/5  (37)

(37)

Austin Company uses a job order cost accounting system. The company's executives estimated that direct labor would be $2,000,000 (200,000 hours at $10/hour) and that factory overhead would be $1,500,000 for the current period. At the end of the period, the records show that there had been 180,000 hours of direct labor and $1,200,000 of actual overhead costs. Using direct labor hours as a base, what was the predetermined overhead allocation rate?

(Multiple Choice)

4.9/5  (33)

(33)

Whittier Manufacturing uses a job order cost accounting system that charges overhead to jobs on the basis of direct labor cost. Whittier used the following cost predictions: overhead costs $1,285,750, and direct labor costs of $695,000. At year-end, the company's records show that actual overhead costs for the year are $1,278,800, and actual direct labor costs are $692,000.

a. Determine the predetermined overhead rate for the year.

b. Compute the amount of overapplied or underapplied overhead.

c. Prepare the adjusting entry to allocate the over- or underapplied overhead assuming the amount if immaterial.

(Essay)

4.9/5  (35)

(35)

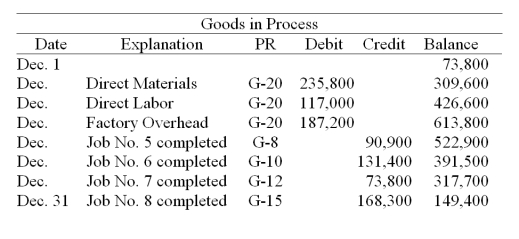

A company uses a job order cost accounting system and applies overhead on the basis of direct labor cost. A summary of the company's Goods in Process Inventory account for December appears below.

Fill in the blanks for the following:

(1) The total cost of the direct materials, direct labor, and factory overhead applied in the December 31 goods in process inventory is $_______________________.

(2) The company's overhead application rate is ____________________%

(3) Job No. 6 had $26,550 of direct labor cost. Therefore, the job must have had $__________ of direct materials cost.

(4) Job No. 8 had $73,998 of direct materials cost. Therefore, the job must have had $__________ of factory overhead cost.

(Essay)

4.8/5  (26)

(26)

Cost accounting systems accumulate costs and then assign them to products or services.

(True/False)

4.8/5  (28)

(28)

A company's predetermined overhead allocation rate is 130% based on direct labor cost. How much overhead would be allocated to Job No. 105 if it required total direct labor costs of $60,000?

(Essay)

4.8/5  (39)

(39)

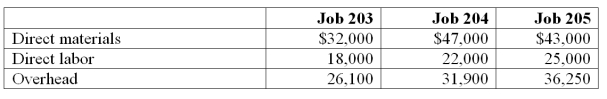

At the end of June, the job cost sheets for Monson Manufacturing show the following total costs accumulated on three custom jobs.

Job 203 was started in production in May and the following costs were assigned to it in May: direct materials, $12,000; direct labor, $6,000; and overhead $8,700. Jobs 204 and 205 are started in June. Overhead cost is applied with a predetermined rate based on direct labor cost. Jobs 203 and 204 are finished in June, and Job 205 will be finished in July. No raw materials are used indirectly in June. Using this information, answer the following questions assuming the company's predetermined overhead rate did not change.

(Essay)

4.9/5  (28)

(28)

If a company applies overhead to production with a predetermined rate, a credit balance in the Factory Overhead account at the end of the period means that:

(Multiple Choice)

4.8/5  (39)

(39)

If overhead applied is less than actual overhead incurred, it is:

(Multiple Choice)

4.9/5  (28)

(28)

A job cost sheet is useful for developing financial accounting numbers but does not contain information that is useful for managing the production process.

(True/False)

4.9/5  (39)

(39)

BVD Company uses a job order cost accounting system and last period incurred $80,000 of overhead and $100,000 of direct labor. BVD estimates that its overhead next period will be $75,000. It also expects to incur $100,000 of direct labor. If BVD bases applied overhead on direct labor cost, their overhead application rate for the next period should be:

(Multiple Choice)

4.8/5  (28)

(28)

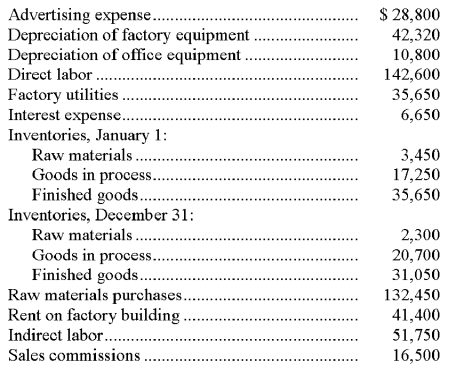

The following calendar year information about the Tahoma Corporation is available on December 31:

The company applies overhead on the basis of 125% of direct labor costs. Calculate the amount of over- or underapplied overhead.

(Essay)

4.8/5  (38)

(38)

Erlander Company uses a job order cost accounting system. On November 1, $15,000 of direct materials and $3,500 of indirect materials were requisitioned for production. Prepare the general journal entry to record this requisition.

(Essay)

4.8/5  (36)

(36)

Deltan Corp. allocates overhead to production on the basis of direct labor costs. Deltan's total estimated overhead is $450,000 and estimated direct labor is $180,000. Determine the amount of overhead to be allocated to finished goods inventory if there is $20,000 of total direct labor cost in the jobs in the finished goods inventory.

(Multiple Choice)

4.9/5  (32)

(32)

Showing 1 - 20 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)