Exam 16: Statement of Cash Flows

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

Use the following information to calculate cash paid for wages and salaries:

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

B

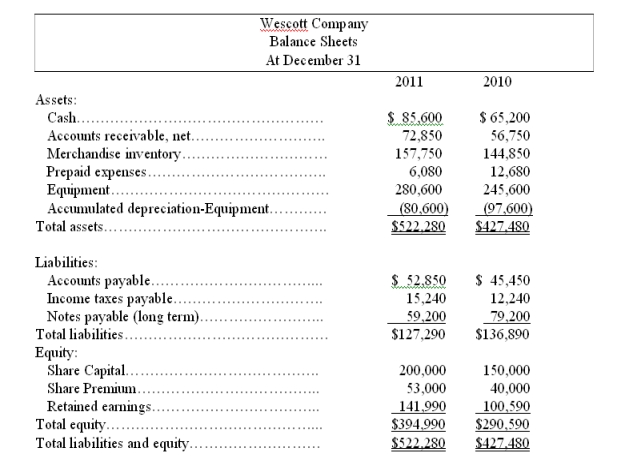

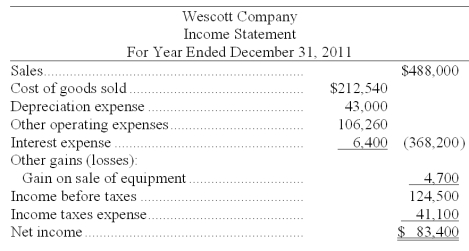

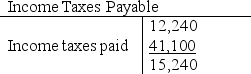

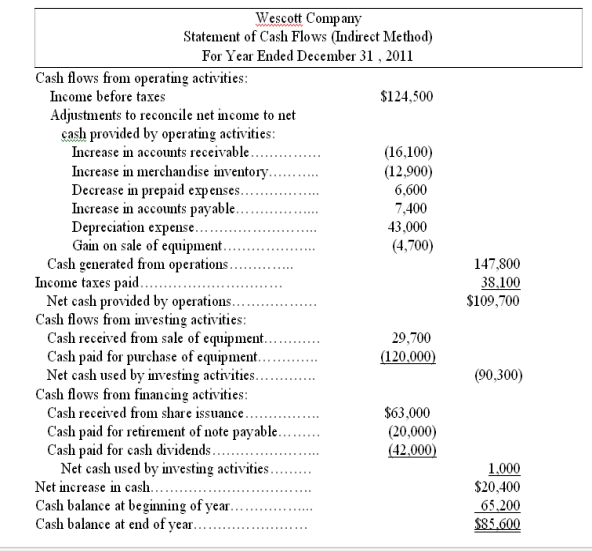

Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 2011 using the indirect method, and (2) compute the company's cash flow on total assets ratio for 2011.

Additional Information

a. A $20,000 note payable is retired at its carrying amount in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid. Cash dividends paid is to be classified under financing activities.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Additional Information

a. A $20,000 note payable is retired at its carrying amount in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid. Cash dividends paid is to be classified under financing activities.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Free

(Essay)

4.8/5  (25)

(25)

Correct Answer:

(1)

(2) $109,700/((522,280+427,480)/2) = 23.1%

(2) $109,700/((522,280+427,480)/2) = 23.1%

The direct method for the preparation of the operating activities section of the statement of cash flows:

Free

(Multiple Choice)

4.7/5  (42)

(42)

Correct Answer:

A

Becker Corporation paid cash dividends totaling $75,000 during its most recent fiscal year. How should this information be reported on Becker's statement of cash flows?

(Multiple Choice)

4.9/5  (33)

(33)

Investments that are readily convertible to a known amount of cash and are sufficiently close to their maturity so that the market value is unaffected by interest rate changes are ____________________________.

(Essay)

4.8/5  (35)

(35)

Use the following information to calculate cash received from dividends:

(Multiple Choice)

4.8/5  (26)

(26)

A company's transactions with its creditors to borrow money and/or to repay the principal amounts of both short- and long-term debt are reported as cash flows from:

(Multiple Choice)

4.8/5  (40)

(40)

The cash flow on total assets ratio reflects actual cash flows and is therefore affected by the accounting constraints of recognition and measurement for net income.

(True/False)

4.8/5  (32)

(32)

Mansell reported net income of $233.4 million, net cash provided by operating activities of $131.4 million, total cash flows of $187.7 million, and average total assets of $2,040.8 million at the end of the year. Calculate the cash flow on total assets ratio for Mansell.

(Essay)

4.9/5  (37)

(37)

A noncash investing transaction should be disclosed in either a footnote or at the bottom of the statement of cash flows.

(True/False)

4.8/5  (28)

(28)

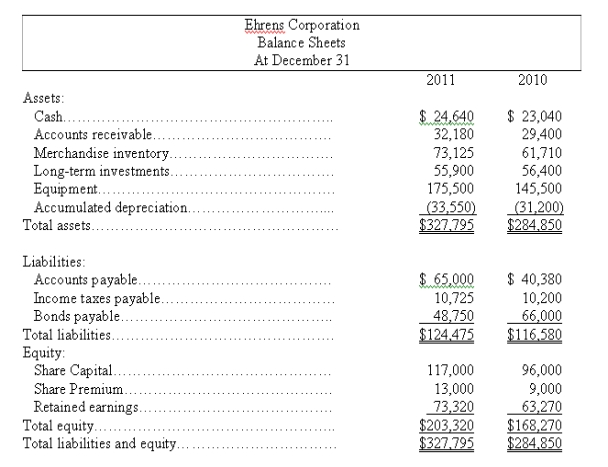

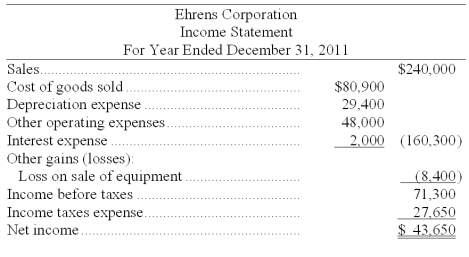

The following information is available for the Ehrens Corporation:

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid. Management wishes to classify this under financing activities.

(5) Additional shares were issued for cash.

Prepare a complete statement of cash flows for year 2011 using the indirect method.

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid. Management wishes to classify this under financing activities.

(5) Additional shares were issued for cash.

Prepare a complete statement of cash flows for year 2011 using the indirect method.

(Essay)

4.9/5  (35)

(35)

Activities that involve the production or purchase of merchandise and the sale of goods and services to customers, including expenditures related to administering the business, are classified as:

(Multiple Choice)

4.7/5  (37)

(37)

Internal users of the statement of cash flows often use cash flow information to plan day-to-day operating activities and make long-term investment and financing decisions.

(True/False)

4.8/5  (35)

(35)

Use the following information to calculate the net cash provided or used by financing activities for the Brooks Corporation:

(a) Net income, $10,000

(b) Sold ordinary shares for $4,000 cash

(c) Paid cash dividend of $3,000 (classify under financing activities)

(d) Paid bond payable, $8,000

(e) Purchased equipment for $12,000 cash

(Essay)

4.8/5  (41)

(41)

The primary purpose of the statement of cash flows is to report all major cash receipts (inflows) and cash payments (outflows) during a period.

(True/False)

4.8/5  (30)

(30)

A cash equivalent must be readily convertible to a known amount of cash, and must be sufficiently close to its maturity so its market value is unaffected by interest rate changes.

(True/False)

4.7/5  (37)

(37)

The indirect method for the preparation of the operating activities section of the statement of cash flows:

(Multiple Choice)

4.8/5  (35)

(35)

The appropriate section in the statement of cash flows for reporting the issuance of ordinary shares for cash is:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 1 - 20 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)