Exam 6: Variable Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

When setting long-term sales prices for products, the sales price must cover all costs, including fixed costs.

(True/False)

4.9/5  (37)

(37)

Materials Corporation sold 12,000 units of its product at a price of $67 per unit. Total variable cost per unit is $54.94, consisting of $45.05 in variable production cost and $9.89 in variable selling and administrative cost. Compute the total contribution margin.

(Essay)

4.8/5  (35)

(35)

Sea Company reports the following information regarding its production costs:  Compute the product cost per unit under absorption costing.

Compute the product cost per unit under absorption costing.

(Multiple Choice)

4.7/5  (37)

(37)

Kluber, Inc. had net income of $900,000 based on variable costing. Beginning and ending inventories were 55,000 units and 52,000 units, respectively. Assume the fixed overhead per unit was $1.25 for both the beginning and ending inventory. What is net income under absorption costing?

(Multiple Choice)

5.0/5  (28)

(28)

Under variable costing, product costs consist of direct labor, direct materials, and variable overhead.

(True/False)

4.8/5  (40)

(40)

Digby Company manufactured and sold 37,000 units of its product at a price of $93 per unit. Total variable cost per unit is $60, consisting of $58 in variable production cost and $2 in variable selling and administrative cost. Fixed costs of manufacturing are $350,000.

a. Compute the manufacturing margin for the company under variable costing.

b. Compute the contribution margin based on this data.

c. Compute the gross margin under absorption costing.

(Essay)

4.7/5  (35)

(35)

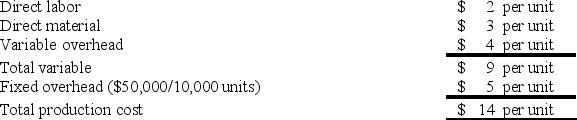

Assume a company had the following production costs:

Under absorption costing, the total product cost per unit when 4,000 units are produced would be $22.50.

Under absorption costing, the total product cost per unit when 4,000 units are produced would be $22.50.

(True/False)

4.9/5  (44)

(44)

Given the following data, total product cost per unit under absorption costing is $11.40.

(True/False)

4.8/5  (44)

(44)

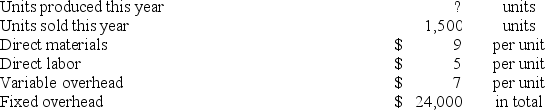

[The following information applies to the questions displayed below.]

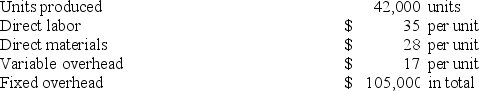

Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year.

![[The following information applies to the questions displayed below.] Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. -Given Advanced Company's data, compute cost of finished goods in inventory under absorption costing.](https://storage.examlex.com/TB6948/11eaadfd_cd2d_c039_95d8_c9dc524c1f09_TB6948_00_TB6948_00_TB6948_00_TB6948_00_TB6948_00_TB6948_00.jpg) -Given Advanced Company's data, compute cost of finished goods in inventory under absorption costing.

-Given Advanced Company's data, compute cost of finished goods in inventory under absorption costing.

(Multiple Choice)

4.9/5  (32)

(32)

A company is currently operating at 65% capacity producing 12,000 units. Cost information relating to this current production is shown in the following table:

Per Unit Sales price \ 6.00 Direct material \ 2.30 Direct labor \ 0.87 Variable overhead \ 0.91 Fixed overhead \ 0.70 The company has been approached by a customer with a request for a special order for 2,000 units. What is the minimum per unit sales price that management would accept for this order if the company wishes to increase current profits?

(Essay)

4.8/5  (49)

(49)

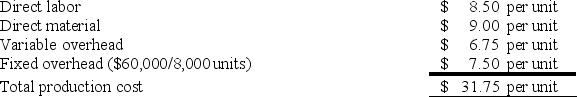

Under absorption costing, a company had the following unit costs when 8,000 units were produced.  Compute the total production cost per unit under variable costing if 25,000 units had been produced.

Compute the total production cost per unit under variable costing if 25,000 units had been produced.

(Multiple Choice)

4.8/5  (44)

(44)

Pact Company had net income of $972,000 based on variable costing. Beginning and ending inventories were 7,800 units and 5,200 units, respectively. Assume the fixed overhead per unit was $3.61 for both the beginning and ending inventory. What is net income under absorption costing?

(Multiple Choice)

4.9/5  (43)

(43)

Managers should accept special orders provided the special order price exceeds the product cost per unit under absorption costing.

(True/False)

4.7/5  (46)

(46)

Under variable costing, the product unit cost consists of ________, direct materials, and variable overhead.

(Short Answer)

4.9/5  (43)

(43)

________ is equal to Sales minus Variable manufacturing costs.

(Short Answer)

4.9/5  (38)

(38)

Under variable costing, fixed manufacturing overhead is expensed at the time the units are produced. Under absorption costing, fixed manufacturing overhead is expensed at the time the units are sold.

(True/False)

4.8/5  (34)

(34)

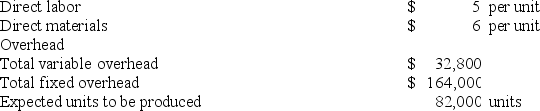

A company reports the following information for its first year of operations:  If the company's cost per unit of finished goods using absorption costing is $27, how many units were produced?

If the company's cost per unit of finished goods using absorption costing is $27, how many units were produced?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 181 - 200 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)