Exam 6: Variable Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

Many companies link manager bonuses to income computed under absorption costing because this is how income is reported to shareholders.

(True/False)

4.8/5  (35)

(35)

When units produced exceed the units sold, income under absorption costing is higher than income under variable costing.

(True/False)

4.7/5  (41)

(41)

Brush Industries reports the following information for May:  Calculate the gross margin for May under absorption costing.

Calculate the gross margin for May under absorption costing.

(Multiple Choice)

4.9/5  (34)

(34)

Using absorption costing, which of the following manufacturing costs are assigned to products?

(Multiple Choice)

4.9/5  (46)

(46)

Which of the following would be reported on a variable costing income statement?

(Multiple Choice)

4.8/5  (41)

(41)

Wrap-It Company, a manufacturer of wrapping paper, began operations on June 1 of the current year. During this time, the company produced 370,000 units and sold 310,000 units at a sales price of $50 per unit. Cost information for this period is shown in the following table:

Production costs Direct materials \ 2.00 per unit Direct labor \ 80 per unit Variable overhead \ 814,000 in total Fixed overhead \ 481,000 in total Non production costs Variable selling and administrative \ 78,000 in total Fixed selling and administrative \ 210,000 in total a. Prepare Wrap-It's December 31st income statement for the current year under absorption costing.

b. Prepare Wrap-It's December 31st income statement for the current year under variable costing.

(Essay)

4.8/5  (36)

(36)

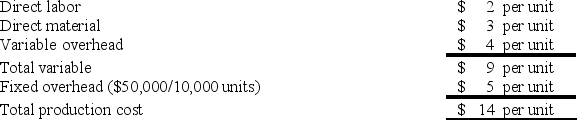

A company is currently operating at 75% capacity and producing 3,000 units. Current cost information relating to this production is shown in the table below:  The company has been approached by a customer with a request for a 200-unit special order. What is the minimum per unit sales price that management would accept for this order if the company wishes to increase current profits?

The company has been approached by a customer with a request for a 200-unit special order. What is the minimum per unit sales price that management would accept for this order if the company wishes to increase current profits?

(Multiple Choice)

4.9/5  (46)

(46)

When excess capacity exists, what is the minimum special order price a manager should accept to increase net income?

(Essay)

4.8/5  (30)

(30)

Blatt Company, a manufacturer of slippers, began operations on June 1 of the current year. During this time, the company produced 210,000 units and sold 185,000 units at a sales price of $40 per unit. Cost information for this period is shown in the following table:

Production costs Direct materials \ 5.00 per unit Direct labor \ 4.75 per unit Variable overhead \ 302,000 in total Fixed overhead \ 405,000 in total Non-production costs Variable selling and administrative \ 9,000 in total Fixed selling and administrative \ 25,000 in total a. Prepare Blatt's December 31st income statement for the current year under absorption costing.

b. Prepare Blatt's December 31st income statement for the current year under variable costing.

(Essay)

4.8/5  (39)

(39)

Castaway Company reports the following first year production cost information:

Units produced 53,000 units Units sold 51,000 units Direct labor \ 8 per unit Direct materials \ 4 per unit Variable overhead \ 41 per unit Fixed overhead \ 3,339,000 in total a. Compute production cost per unit under variable costing.

b. Compute production cost per unit under absorption costing.

c. Determine the cost of ending inventory using variable costing.

d. Determine the cost of ending inventory using absorption costing.

(Essay)

4.9/5  (37)

(37)

The key difference between variable costing and absorption costing is the treatment of ________ costs.

(Short Answer)

4.8/5  (45)

(45)

A company reports the following information regarding its production cost:

Units produced 14,000 units Direct labor \ 13 per unit Direct materials \ 3 per unit Variable overhead ? in total Fixed overhead \ 56,000 in total Required: Perform the following independent calculations.

a. Compute total variable overhead cost if the production cost per unit under variable costing is $73.

b. Compute total variable overhead cost if the production cost per unit under absorption costing is $73.

(Essay)

4.9/5  (36)

(36)

What costs are treated as product costs under the absorption costing method?

(Essay)

4.8/5  (36)

(36)

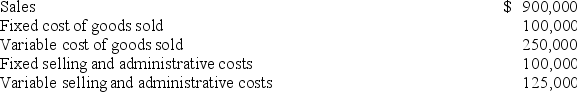

Maloney Co. provided the following information for the year 20X1:

There are no beginning inventories. Prepare an income statement using the variable costing format.

There are no beginning inventories. Prepare an income statement using the variable costing format.

(Essay)

4.8/5  (43)

(43)

Cost information from both absorption costing and variable costing can aid managers in pricing.

(True/False)

4.7/5  (38)

(38)

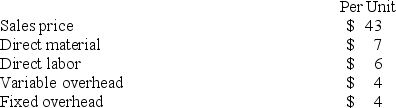

Under absorption costing, a company had the following unit costs when 10,000 units were produced:

The total product cost per unit under absorption costing if 25,000 units had been produced would be $11.

The total product cost per unit under absorption costing if 25,000 units had been produced would be $11.

(True/False)

4.7/5  (44)

(44)

On a contribution margin income statement, expenses are grouped according to ________.

(Short Answer)

4.9/5  (36)

(36)

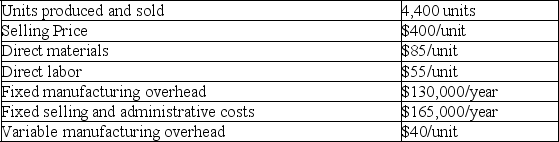

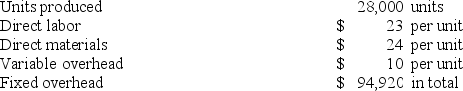

Shore Company reports the following information regarding its production cost.  Compute product cost per unit under absorption costing.

Compute product cost per unit under absorption costing.

(Multiple Choice)

4.8/5  (36)

(36)

[The following information applies to the questions displayed below.]

Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year.

![[The following information applies to the questions displayed below.] Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. -Given Advanced Company's data, compute cost per unit of finished goods under absorption costing.](https://storage.examlex.com/TB6948/11eaadfd_cd2d_c039_95d8_c9dc524c1f09_TB6948_00_TB6948_00_TB6948_00_TB6948_00_TB6948_00_TB6948_00.jpg) -Given Advanced Company's data, compute cost per unit of finished goods under absorption costing.

-Given Advanced Company's data, compute cost per unit of finished goods under absorption costing.

(Multiple Choice)

4.7/5  (35)

(35)

Showing 121 - 140 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)