Exam 5: Cost Behavior and Cost-Volume-Profit Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

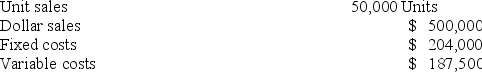

Use the following information to determine the margin of safety in dollars:

(Multiple Choice)

4.8/5  (27)

(27)

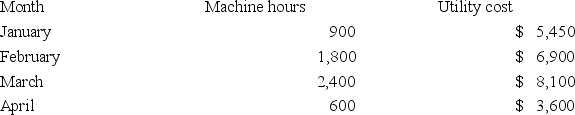

The following information is available for a company's utility cost for operating its machines over the last four months.  Using the high-low method, the estimated total fixed cost for utilities is:

Using the high-low method, the estimated total fixed cost for utilities is:

(Multiple Choice)

4.7/5  (34)

(34)

Wang Co. manufactures and sells a single product that sells for $450 per unit; variable costs are $270 per unit. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Compute the contribution margin ratio.

(Multiple Choice)

4.9/5  (38)

(38)

One aid in measuring cost behavior involves creating a display of the data about past costs in graphical form. Such a visual display is called a ________.

(Short Answer)

4.7/5  (35)

(35)

Kent Co. manufactures a product that sells for $50.00 and has variable costs of $24.00 per unit. Fixed costs are $260,000. Kent can buy a new production machine that will increase fixed costs by $11,400 per year, but will decrease variable costs by $3.50 per unit. Compute the revised break-even point in units if the new machine is purchased.

(Multiple Choice)

4.9/5  (33)

(33)

The contribution margin ratio is the percent of each sales dollar that remains after deducting the unit variable cost.

(True/False)

4.7/5  (40)

(40)

The margin of safety is the amount that sales can drop before the company incurs a loss.

(True/False)

4.7/5  (42)

(42)

Degree of operating leverage (DOL) is defined as total contribution margin in dollars divided by pretax income.

(True/False)

4.7/5  (40)

(40)

A firm expects to sell 25,000 units of its product at $11 per unit and to incur variable costs per unit of $6. Total fixed costs are $70,000. The total contribution margin is:

(Multiple Choice)

4.7/5  (40)

(40)

A company has fixed costs of $90,000. Its contribution margin ratio is 30% and the product sells for $75 per unit. What is the company's break-even point in dollar sales?

(Multiple Choice)

4.9/5  (31)

(31)

A product has a contribution margin per unit of $17 and sells at $25 per unit. If the break-even point is 82,000 units, calculate (a) the variable costs per unit and (b) the total fixed costs.

(Essay)

4.8/5  (38)

(38)

Alvarez Company's break-even point in units is 1,000. The sales price per unit is $10 and variable cost per unit is $7. If the company sells 2,500 units, what will net income be?

(Multiple Choice)

4.7/5  (41)

(41)

Leeks Company's product has a contribution margin per unit of $11.25 and a contribution margin ratio of 22.5%. What is the selling price of the product?

(Multiple Choice)

4.8/5  (35)

(35)

Kent Co. manufactures a product that sells for $50.00. Fixed costs are $260,000 and variable costs are $24.00 per unit. Kent can buy a new production machine that will increase fixed costs by $11,400 per year, but will decrease variable costs by $3.50 per unit. What effect would the purchase of the new machine have on Kent's break-even point in units?

(Multiple Choice)

4.9/5  (36)

(36)

During its most recent fiscal year, Dover, Inc. had total sales of $3,200,000. Contribution margin amounted to $1,500,000 and pretax income was $400,000. What amount should have been reported as variable costs in the company's contribution margin income statement for the year?

(Multiple Choice)

4.8/5  (39)

(39)

Dubashi Windows manufactures two standard size windows, J and R, in the ratio of 5:3. J has a selling price of $150 per unit and R has a selling price of $200 per unit. The variable cost of J is $75.00 and the variable cost of R is $90.00. Fixed costs are $352,500. Compute the (a) contribution margin per composite unit, (b) break-even point in composite units, (c) number of units of each product that will be sold at the break-even point.

(Essay)

4.9/5  (45)

(45)

The unit contribution margin divided by the selling price per unit is the ________.

(Short Answer)

4.7/5  (34)

(34)

During March, a firm expects its total sales to be $160,000, its total variable costs to be $95,000, and its total fixed costs to be $25,000. The contribution margin for March is:

(Multiple Choice)

4.8/5  (31)

(31)

Showing 221 - 240 of 248

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)