Exam 5: Cost Behavior and Cost-Volume-Profit Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

Watson Company has monthly fixed costs of $83,000 and a 40% contribution margin ratio. If the company has set a target monthly income of $15,000, what dollar amount of sales must be made to produce the target income?

(Multiple Choice)

4.8/5  (39)

(39)

A cost-volume-profit (CVP) chart is a graph that plots number of units produced on the horizontal axis and dollars of costs and sales on the vertical axis.

(True/False)

4.9/5  (40)

(40)

The dollar amount of sales needed to achieve a target income is computed by dividing the sum of fixed costs plus the target pretax income by the contribution margin ratio.

(True/False)

4.9/5  (36)

(36)

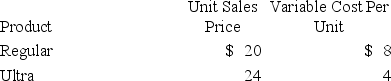

A firm sells two products, Regular and Ultra. For every unit of Regular sold, two units of Ultra are sold. The firm's total fixed costs are $1,612,000. Selling prices and cost information for both products follow. What is the firm's break-even point in units of Regular and Ultra?

(Multiple Choice)

4.9/5  (41)

(41)

A break-even point can be calculated either in units or in dollars of sales.

(True/False)

4.8/5  (38)

(38)

Forrester Company is considering buying new equipment that would increase monthly fixed costs from $120,000 to $150,000 and would decrease the current variable costs of $70 by $10 per unit. The selling price of $100 is not expected to change. Forrester's current break-even sales are $400,000 and current break-even units are 4,000. If Forrester purchases this new equipment, the revised break-even point in dollars would be:

(Multiple Choice)

5.0/5  (37)

(37)

A company manufactures and sells searchlights. Each searchlight sells for $345. The variable cost per unit is $198, and the company's total fixed costs are $635,000. Predicted sales are 15,000 units. What is the contribution margin per unit?

(Short Answer)

4.9/5  (41)

(41)

Wang Co. manufactures and sells a single product that sells for $450 per unit; variable costs are $270 per unit. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Management targets an annual pre-tax income of $1,125,000. Compute the dollar sales to earn the target pre-tax net income.

(Multiple Choice)

4.7/5  (35)

(35)

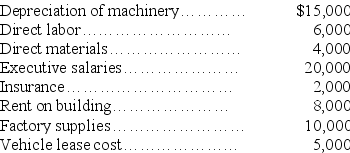

Dodge Industries incurs the following costs during the current year:

Sales for the year were $80,000 and Dodge determined that only the direct production costs and factory supplies are to be classified as variable costs; all other costs are classified as fixed costs. Dodge sold 400 units.

(a) Calculate the unit contribution margin and the contribution margin ratio for Dodge

Industries.

(b) Dodge Industries is considering plans that would increase the contribution margin ratio for next year. Should it pursue these plans? Explain.

Sales for the year were $80,000 and Dodge determined that only the direct production costs and factory supplies are to be classified as variable costs; all other costs are classified as fixed costs. Dodge sold 400 units.

(a) Calculate the unit contribution margin and the contribution margin ratio for Dodge

Industries.

(b) Dodge Industries is considering plans that would increase the contribution margin ratio for next year. Should it pursue these plans? Explain.

(Essay)

5.0/5  (34)

(34)

Variable costs per unit increase proportionately with increases in volume of activity.

(True/False)

4.9/5  (33)

(33)

Crookshank Manufacturing has total fixed costs of $460,000. A unit of product sells for $20 and variable costs per unit are $11.

Prepare a contribution margin income statement showing predicted net income (loss) if Crookshank sells 100,000 units for the year ended December 31.

(Essay)

4.9/5  (38)

(38)

The excess of expected sales over the sales level at the break-even point is known as the:

(Multiple Choice)

4.8/5  (41)

(41)

Cost-volume-profit analysis is used to predict future costs to be incurred, volumes of activity, sales to be made, and profit to be earned.

(True/False)

4.9/5  (38)

(38)

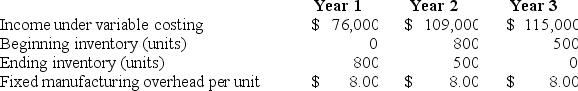

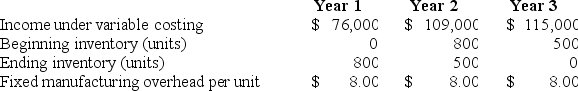

A manufacturer reports the following information below for its first three years in operation.  Income for year 2 using absorption costing is:

Income for year 2 using absorption costing is:

(Multiple Choice)

4.7/5  (35)

(35)

A manufacturer reports the following costs to produce 10,000 units in its first year of operations: Direct materials, $10 per unit, Direct labor, $6 per unit, Variable overhead, $70,000, and Fixed overhead, $120,000. The total product cost per unit under absorption costing is:

(Multiple Choice)

4.8/5  (37)

(37)

A manufacturer reports the following information below for its first three years in operation.  Income for year 1 using absorption costing is:

Income for year 1 using absorption costing is:

(Multiple Choice)

5.0/5  (43)

(43)

What is a scatter diagram? How is a scatter diagram used to estimate cost behavior?

(Essay)

4.7/5  (31)

(31)

A company's product sells at $12 per unit and has a $5 per unit variable cost. The company's total fixed costs are $98,000. The break-even point in units is:

(Multiple Choice)

4.8/5  (41)

(41)

Showing 41 - 60 of 248

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)