Exam 5: Cost Behavior and Cost-Volume-Profit Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

Barclay Bikes manufactures and sells three distinct styles of bicycles: the Youth model sells for $300 and has a unit contribution margin of $105; the Adult model sells for $850 and has a unit contribution margin of $450; and the Recreational model sells for $1,000 and has a unit contribution margin of $500. The company's sales mix includes: 5 Youth models; 9 Adult models; and 6 Recreational models. If the firm's annual fixed costs total $6,500,000, calculate the firm's contribution margin per composite unit.

(Multiple Choice)

4.7/5  (38)

(38)

Cost-volume-profit analysis is based on necessary assumptions. Which of the following is not one of these assumptions?

(Multiple Choice)

4.9/5  (40)

(40)

A product sells for $30 per unit and has variable costs of $18 per unit. The fixed costs are $720,000. If the variable costs per unit were to decrease to $15 per unit, fixed costs increase to $900,000, and the selling price does not change, break-even point in units would:

(Multiple Choice)

4.8/5  (35)

(35)

Fixed costs per unit decrease proportionately with increases in volume of activity.

(True/False)

5.0/5  (48)

(48)

A manufacturer reports the following costs to produce 10,000 units in its first year of operations: Direct materials, $10 per unit, Direct labor, $6 per unit, Variable overhead, $70,000, and Fixed overhead, $120,000. The total product cost per unit under variable costing is:

(Multiple Choice)

4.8/5  (41)

(41)

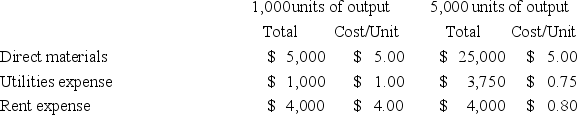

Select cost information for Seacrest Enterprises is as follows:  Based on this information:

Based on this information:

(Multiple Choice)

4.8/5  (44)

(44)

The following information describes a product expected to be produced and sold by Quark Corporation:

Selling price…………………………… $33 per unit

Variable costs………………………… $27 per unit

Total fixed costs……………………… $855,000 per year

Required:

(a) Calculate the contribution margin per unit.

(b) Calculate the break-even point in units.

(Essay)

4.9/5  (32)

(32)

Journey Company is considering the production and sale of a new product with the following sales and cost data: unit sales price $18; unit variable costs $8.50; and total fixed costs of $81,250. Determine the dollar sales needed to generate a pre-tax income of $44,000, rounded to the nearest whole dollar.

(Essay)

4.8/5  (40)

(40)

Which of the following is the correct interpretation of a degree of operating leverage of 5?

(Multiple Choice)

4.8/5  (34)

(34)

The proportion of sales volumes for various products in a multiproduct company is known as the sales mix.

(True/False)

4.8/5  (35)

(35)

A company has total fixed costs of $200,000. Its product sells for $25 per unit and variable costs amount to $15 per unit. The company has a target pre-tax income of $50,000. How many units must be sold to achieve this pre-tax target income?

(Essay)

4.9/5  (35)

(35)

Portal Manufacturing has total fixed costs of $520,000. A unit of product sells for $15 and variable costs per unit are $11.

a) Prepare a contribution margin income statement showing predicted net income (loss) if Portal sells 100,000 units for the year ended December 31.

b) At a minimum, how many units must Portal sell in order not to incur a loss?

(Essay)

4.8/5  (29)

(29)

The contribution margin per unit expressed as a percentage of the product's selling price is the:

(Multiple Choice)

4.8/5  (41)

(41)

Solving problems to determine the relationship of cost, volume, and profit often starts with measuring the ________ point. Further analysis emphasizing profitability may be accomplished by measuring the ________ and ________.

(Short Answer)

4.9/5  (42)

(42)

The method most likely to produce the most precise line of cost behavior and require the least amount of judgment is the scatter diagram.

(True/False)

4.8/5  (36)

(36)

Scatter diagrams plot volume (units) on the vertical axis and cost on the horizontal axis.

(True/False)

5.0/5  (44)

(44)

Mott Company's sales mix is 3 units of A, 2 units of B, and 1 unit of C. Selling prices for each product are $20, $30, and $40, respectively. Variable costs per unit are $12, $18, and $24, respectively. Fixed costs are $320,000. What is the break-even point in composite units?

(Multiple Choice)

4.8/5  (37)

(37)

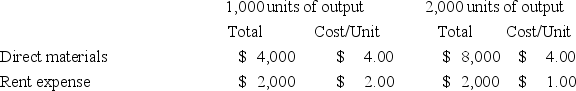

Select cost information for Klondike Corporation is as follows:  Based on this information:

Based on this information:

(Multiple Choice)

4.9/5  (45)

(45)

A company has a goal of earning $128,000 in pre-tax income. The contribution margin ratio is 30%. What dollar amount of sales must be achieved to reach the goal if fixed costs are $64,000?

(Essay)

5.0/5  (39)

(39)

Mullis Corp. manufactures DVDs that sell for $5.00. Fixed costs are $28,000 and variable costs are $3.60 per unit. Mullis can buy a newer production machine that will increase fixed costs by $8,000 per year, but will decrease variable costs by $0.40 per unit. What effect would the purchase of the new machine have on Mullis' break-even point in units?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 21 - 40 of 248

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)