Exam 5: Cost Behavior and Cost-Volume-Profit Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

A product is sold for $45 and has variable costs of $33 per unit. The total fixed costs for the firm are $180,600. If the firm desires to earn a pretax income of $77,400, how many units must be sold?

(Essay)

4.8/5  (33)

(33)

The high-low method is used to derive the variable cost per unit and total fixed costs using just the highest and lowest volume levels.

(True/False)

4.8/5  (32)

(32)

Isaacson Co. has total fixed costs of $240,000 and a contribution margin ratio of 40%. If rent expense increases by $5,000, how much will total sales revenue have to increase to cover this increase in costs?

(Essay)

4.8/5  (44)

(44)

Kent Co. manufactures a product that sells for $50.00. Fixed costs are $260,000 and variable costs are $24.00 per unit. Kent can buy a new production machine that will increase fixed costs by $11,400 per year, but will decrease variable costs by $3.50 per unit. Compute the revised break-even point in dollars with the purchase of the new machine.

(Multiple Choice)

4.9/5  (36)

(36)

Barclay Bikes manufactures and sells three distinct styles of bicycles: the Youth model sells for $300 and has a unit contribution margin of $105; the Adult model sells for $850 and has a unit contribution margin of $450; and the Recreational model sells for $1,000 and has a unit contribution margin of $500. The company's sales mix includes: 5 Youth models; 9 Adult models; and 6 Recreational models. If the firm's annual fixed costs total $6,500,000, calculate the firm's break-even point in total sales dollars.

(Multiple Choice)

4.7/5  (42)

(42)

Dividing a mixed cost into its separate fixed and variable cost components cannot be done in cost-volume-profit analysis.

(True/False)

4.8/5  (33)

(33)

Zola Co. has a contribution margin ratio of 40% and would like to determine whether an additional advertising expenditure of $4,000 would increase sales by $8,000. Calculate the increase or decrease in net income that would result from this change, and comment on whether Zola should purchase the additional advertising.

(Essay)

4.8/5  (29)

(29)

Forrester Company is considering buying new equipment that would increase monthly fixed costs from $120,000 to $150,000 and would decrease the current variable costs of $70 by $10 per unit. The selling price of $100 is not expected to change. Forrester's current break-even sales are $400,000 and current break-even units are 4,000. If Forrester purchases this new equipment, the revised contribution margin ratio would be:

(Multiple Choice)

4.8/5  (38)

(38)

During a recent fiscal year, Creek Company reported pretax income of $125,000, a contribution margin ratio of 25% and total contribution margin of $400,000. Total variable costs must have been:

(Multiple Choice)

4.8/5  (33)

(33)

The difference between the unit sales price and the unit variable cost of an item is defined as the ________.

(Short Answer)

4.7/5  (39)

(39)

Locus Company has total fixed costs of $112,000. Its product sells for $35 per unit and variable costs amount to $25 per unit. Next year Locus Company wishes to earn a pretax income that equals 10% of fixed costs. How many units must be sold to achieve this target income level?

(Multiple Choice)

4.8/5  (40)

(40)

Curvilinear costs increase as volume of activity increases, but at a nonconstant rate.

(True/False)

4.8/5  (30)

(30)

Barclay Bikes manufactures and sells three distinct styles of bicycles: the Youth model sells for $300 and has a unit contribution margin of $105; the Adult model sells for $850 and has a unit contribution margin of $450; and the Recreational model sells for $1,000 and has a unit contribution margin of $500. The company's sales mix includes: 5 Youth models; 9 Adult models; and 6 Recreational models. If the firm's annual fixed costs total $6,500,000, calculate the firm's selling price per composite unit.

(Multiple Choice)

4.9/5  (31)

(31)

Three methods to separate costs into fixed and variable are the ________, ________, and ________ methods.

(Short Answer)

4.9/5  (37)

(37)

On a typical cost-volume-profit chart, unit sales are shown on the horizontal axis and both dollars of sales and dollars of costs are represented on the vertical axis.

(True/False)

4.9/5  (35)

(35)

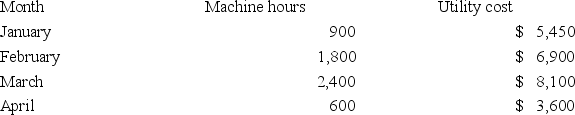

The following information is available for a company's utility cost for operating its machines over the last four months.  Using the high-low method, the estimated variable cost per machine hour for utilities is:

Using the high-low method, the estimated variable cost per machine hour for utilities is:

(Multiple Choice)

4.9/5  (35)

(35)

To calculate the break-even point in units, one must know unit fixed cost, unit variable cost, and sales price.

(True/False)

4.9/5  (36)

(36)

Wang Co. manufactures and sells a single product that sells for $450 per unit; variable costs are $270 per unit. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Compute the break-even point in dollars.

(Multiple Choice)

4.8/5  (35)

(35)

As production volume increases, fixed cost per unit of output remains constant.

(True/False)

4.8/5  (44)

(44)

Describe and compare the three cost estimation methods used to develop a cost equation.

(Essay)

4.8/5  (43)

(43)

Showing 101 - 120 of 248

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)