Exam 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate

Exam 1: The Scope and Method of Economics65 Questions

Exam 2: The Economic Problem: Scarcity and Choice107 Questions

Exam 3: Demand, Supply, and Market Equilibrium86 Questions

Exam 4: Demand and Supply Applications37 Questions

Exam 5: Introduction to Macroeconomics64 Questions

Exam 6: Measuring National Output and National Income84 Questions

Exam 7: Unemployment, Inflation, and Long-Run Growth81 Questions

Exam 8: Aggregate Expenditure and Equilibrium Output58 Questions

Exam 9: The Government and Fiscal Policy71 Questions

Exam 10: The Money Supply and the Federal Reserve System96 Questions

Exam 11: Money Demand and the Equilibrium Interest Rate96 Questions

Exam 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate100 Questions

Exam 13: Policy Effects and Costs Shocks in the Asad Model89 Questions

Exam 14: The Labor Market in the Macroeconomy111 Questions

Exam 15: Financial Crises, Stabilization, and Deficits102 Questions

Exam 16: Household and Firm Behavior in the Macroeconomy: a Further Look92 Questions

Exam 17: Long-Run Growth59 Questions

Exam 18: Alternative Views in Macroeconomics88 Questions

Exam 19: International Trade, Comparative Advantage, and Protectionism63 Questions

Exam 20: Open-Economy Macroeconomics: the Balance of Payments and Exchange Rates105 Questions

Exam 21: Economic Growth in Developing and Transitional Economies48 Questions

Select questions type

Discuss the impact of an increase in the money supply upon the goods and money markets. What most importantly determines the effectiveness of monetary policy?

(Essay)

4.9/5  (38)

(38)

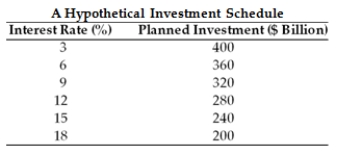

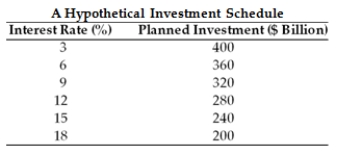

Table 27.1

-Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 5 and the initial interest rate is 12%. Where will the interest rate have to move to in order to cause equilibrium output to fall by 400 billion?

Table 27.1

-Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 5 and the initial interest rate is 12%. Where will the interest rate have to move to in order to cause equilibrium output to fall by 400 billion?

(Essay)

4.8/5  (26)

(26)

Would each of the following cause planned investment to increase or decrease?

(a) Owners of firms become more optimistic about their future sales.

(b) The degree of utilization of a firm's capital stock is very low.

(c) The cost of capital relative to the cost of labor increases.

(Essay)

4.8/5  (26)

(26)

Briefly explain what type of policy mix existed in the United States in 1980-82. What effect did this policy mix have on the interest rate and investment?

(Essay)

4.8/5  (30)

(30)

Explain the consumption link as it relates to the shape of the aggregate demand curve.

(Essay)

5.0/5  (37)

(37)

Explain the chain of events that results from an expansionary monetary policy. Explain your answer in terms of its impact on money supply, aggregate output, the demand for money, the interest rate and planned investment. Be sure to include any feedback effects in your answer.

(Essay)

4.8/5  (31)

(31)

Scenario 1

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

-Using Scenario 1, if the interest rate were 10%, calculate the level of investment.

(Essay)

4.8/5  (31)

(31)

Graphically illustrate and explain the effects of a reduction in the money supply on the equilibrium interest rate, investment, and equilibrium output. Clearly label all curves and the initial and final equilibria.

(Essay)

4.9/5  (29)

(29)

Table 27.1

-Use the Table 27.1 to answer the following question.. Suppose the expenditure multiplier is 3. What impact on equilibrium output will there be by an increase in the interest rate from 6% to 9%, ceteris paribus?

Table 27.1

-Use the Table 27.1 to answer the following question.. Suppose the expenditure multiplier is 3. What impact on equilibrium output will there be by an increase in the interest rate from 6% to 9%, ceteris paribus?

(Essay)

4.8/5  (35)

(35)

How can monetary policy be used to reduce the impact of the crowding-out effect?

(Essay)

4.9/5  (27)

(27)

Using short-hand symbols, explain the effects of a contractionary fiscal policy.

(Essay)

4.9/5  (25)

(25)

Show the impact on the IS curve of an increase in government spending. Make sure to draw in the LM curve as well and illustrate the impact on the equilibrium interest rate and the aggregate output level.

(Essay)

4.8/5  (33)

(33)

Explain what is meant by the "mix of macroeconomic policy" and explain how it can affect the level and composition of output (i.e., GDP).

(Essay)

4.7/5  (34)

(34)

Summarize the effects of a contractionary fiscal policy where the changes in government spending (G) and/or taxes (T) are changes upon output and income (Y), the demand for money (Md), the rate of interest (r), and investment spending (I).

(Essay)

4.9/5  (45)

(45)

Summarize the effects of a contractionary monetary policy where the changes in the money supply (Ms) impacts the rate of interest (r), investment spending (I), output and income (Y), and the demand for money (Md).

(Essay)

4.9/5  (27)

(27)

Showing 21 - 40 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)